In his first fiscal year as CEO, Toyota Motor Corporation, led by Akio Toyoda, achieved record-breaking performance in production, sales, revenue, and profit.

However, as Toyota achieves its best performance ever, it seems that they plan to “hit the brakes”. They announced that Toyota will withdraw from the hot expansion and reinvest cash dividends in suppliers, dealers, employees, and a range of next-generation technologies from electric vehicles to software. Multiple performance records set, Toyota ends the year perfectly. In the just-ended previous fiscal year, Toyota set historical highs in global production, sales, revenue, operating profit, and net profit.

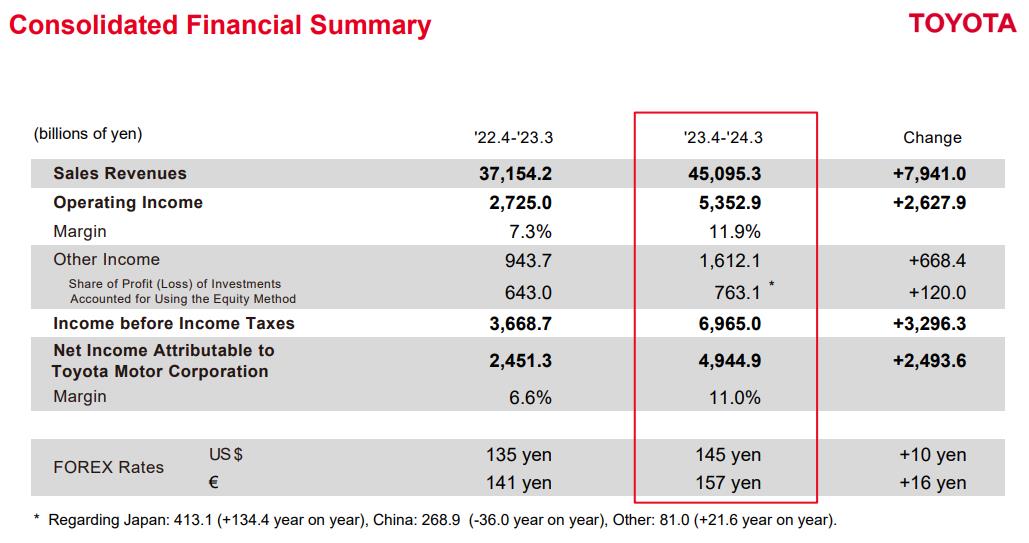

Thanks to the weakening of the yen and the accelerated demand for hybrid cars, Toyota’s revenue in the previous fiscal year increased by 21% to 45 trillion yen; net profit also more than doubled, setting a new record of 4.9 trillion yen. Operating profit nearly doubled, reaching 5.35 trillion yen, exceeding the latest expectations raised in February, surpassing 5 trillion yen. Specifically, strong demand for hybrid cars from consumers and price adjustments in North America and Europe increased Toyota’s operating profit by 2 trillion yen, while favorable exchange rates increased its operating profit by 685 billion yen. In the previous fiscal year, Toyota produced 11.2 million cars globally, a 4.5% increase year-on-year, maintaining year-on-year growth for the third consecutive year, setting a new production record. During the same period, Toyota’s global retail sales increased by a slight 5% year-on-year, reaching a record 11.1 million units, partly driven by the strong sales of hybrid cars.

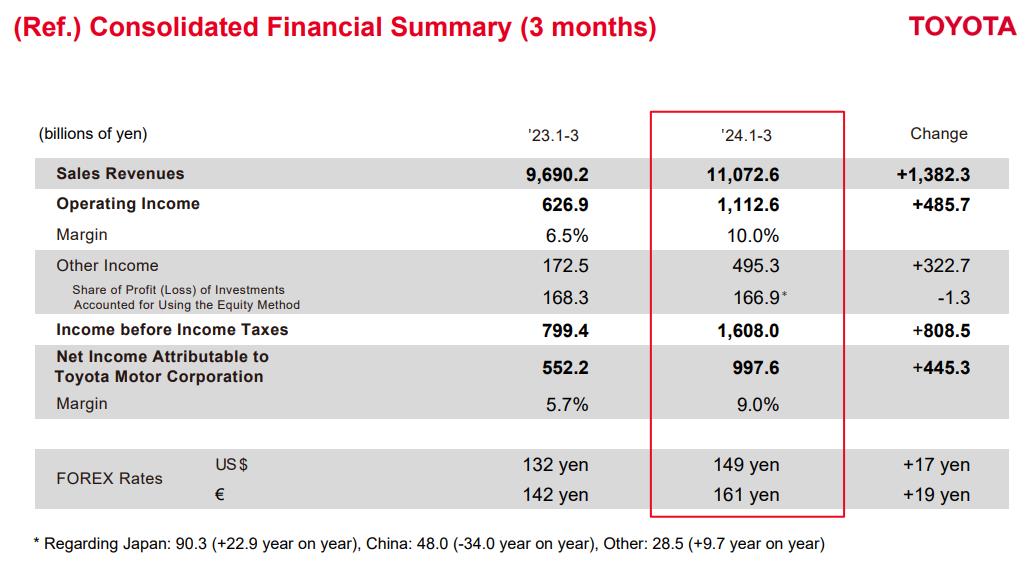

In the first quarter of this year, Toyota’s revenue increased by 14% year-on-year to 11.07 trillion yen; net profit nearly doubled, rising from 552.2 billion yen in the same period last year to 997.6 billion yen. Operating profit surged by 77% year-on-year to 1.11 trillion yen; operating profit margin rose from 6.5% in the same period last year to 10%. Favorable exchange rates boosted profits in yen terms, increasing Toyota’s operating profit by 305 billion yen. As global semiconductor shortages eased and consumers rushed to buy its iconic hybrid cars, Toyota accelerated the pace of production at its global factories to meet market demand, achieving record sales volume and outstanding performance. Despite announcing impressive financial results, Toyota plans to slow down its development pace, reward dealers and suppliers, focus on investing in “growth-oriented” technologies, and strive for sustainable growth in the future. Firstly, in terms of technology investment, Toyota plans to significantly increase investments in “growth-oriented” technologies such as electrification, hydrogen, software-defined cars, and artificial intelligence by 42% to 1.7 trillion yen, equivalent to a $3.3 billion increase from the previous fiscal year. Next, Toyota will invest a total of about 380 billion yen in human capital, including supporting suppliers, dealers, offices, and factories to improve wages and working conditions. Conservative or disappointed in Toyota’s future prospects. Earlier this year, Sato Tsuneharu proposed a plan to slow down development after achieving record sales, to regroup and maintain long-term profitability. He revealed this plan at a press conference. Regarding the 1.7 trillion yen investment in “growth” technology, Sato Tsuneharu said, “The value of mobility is continuing to evolve, not just for transporting people and goods, but also for data and energy transport.” Sanshiro Fukao, automotive analyst and senior researcher at Itochu Research Institute, also believes that Toyota and other Japanese automakers need to turn success into better products and more advanced technology, especially in the digital field to keep up with Chinese competitors. “The battlefield of the automotive industry seems to be rapidly shifting from electric vehicles to artificial intelligence,” Fukao said. If Japanese OEMs invest heavily in R&D or collaborate with AI developers, it could determine their survival in the automotive industry.

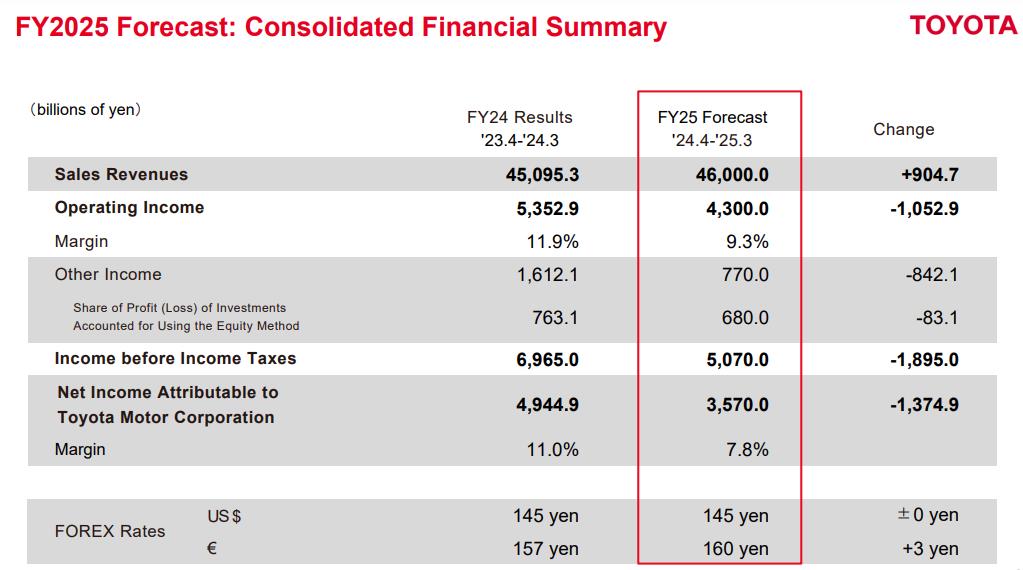

Toyota Motor Corporation hopes to optimize its workforce, suppliers, and dealers by investing approximately 380 billion yen in human capital. This support is aimed at achieving sustainable growth. The decision to provide this large sum of money is to support business partners in the face of economic pressures caused by inflation. CEO Sato Hisashi emphasized the importance of a strong supply chain behind good performance. Toyota believes that this support will help ensure sustainable growth as the global economy transitions out of the production and business disruptions caused by the long-term COVID-19 pandemic. Sato Hisashi also believes that Toyota needs to rethink its way of doing things, improve efficiency, break free from traditional thinking, and embrace the new era of global competition. Every Toyota employee should spend 30 minutes a day thinking about how to improve their work and career. Despite high operational efficiency, there are still many things that need to change as Toyota transitions from a car manufacturer to a mobility company. In order to achieve long-term growth in the future, Toyota is willing to make proactive efforts for sustainable growth during this stable period. However, due to the plan of investing substantial profits in long-term development, Toyota will face pressure from declining profits and slowing sales, with operating profit and net profit expected to decline in the current fiscal year from the record just set.

Toyota executives expect the company’s global retail sales to drop 1.3% to 10.95 million units this fiscal year from last year’s peak, with operating profit falling 20% to 4.3 trillion yen and net profit dropping 39% to 3.57 trillion yen. Macquarie’s James Hong said Toyota’s profit outlook for this fiscal year seems disappointing, with additional costs from suppliers and investments being unexpected. However, SBI Securities’ Koji Endo believes Toyota’s forecast is conservative considering the current exchange rates and sales prospects. Toyota’s forecast is based on the assumption that a weaker yen usually increases the value of repatriated profits, but the benefits of a weaker yen will be offset by rising costs such as raw materials. Additionally, the increasingly competitive Chinese market is also affecting Toyota’s forecast. Takehiko Masuzawa, head of stock trading at Phillip Securities Japan Ltd, noted that like many Japanese companies, Toyota tends to provide conservative estimates and then adjust expectations upward. Toyota’s preliminary estimate of last year’s record-breaking profit is only 3 trillion yen. “Bloomberg industry research senior automotive analyst Tatsuo Yoshida said Toyota’s forecast is conservative, which is expected, but should not be seen as negative.” Opportunities and challenges coexist, how Toyota plans its layout. Looking ahead, Toyota will also face a situation of “opportunities and challenges coexisting.” From the perspective of opportunities, as some markets cool down on the demand for pure electric vehicles, more and more consumers are beginning to favor hybrid vehicles, which is Toyota’s traditional strength. In the past fiscal year, Toyota’s performance benefited from hybrid vehicles, and in the next fiscal year, Toyota will continue to focus on the hybrid vehicle market. In the just-ended fiscal year, Toyota sold about 3.7 million hybrid vehicles, a 32% increase year-on-year, and the proportion of hybrid vehicles in Toyota’s global sales also increased from 26% to one-third. In contrast, Toyota only sold 116,654 pure electric vehicles during the same period, but this is more than three times the sales volume of the previous year, and in 2020, Toyota’s sales of pure electric vehicles were zero.

Toyota’s Chief Financial Officer Yoichi Miyazaki said consumers are choosing hybrid cars because they are environmentally friendly, efficient, and driving has become more fun with technological advancements. In some cases, hybrid car prices have dropped to levels comparable to gasoline cars. Additionally, hybrid cars do not have range anxiety like pure electric cars because they do not rely on charging networks. “Hybrid cars have become very attractive models,” Miyazaki said. “Hybrid cars sell very well in the North American market.” In the US market, Toyota dealers have an average supply of all models for 15 days. However, for popular hybrid cars, the inventory is only 5 to 8 days, Miyazaki added. Most importantly, Toyota revealed that the profit from their hybrid cars is at least equivalent to, and often higher than, pure gasoline models. Therefore, the more hybrid cars they sell, the more profit Toyota will make. Based on this, Toyota expects global sales of hybrid cars to increase by 25% this fiscal year, reaching 4.7 million units, and expects hybrid cars to account for 42% of its total global sales. Furthermore, Toyota also expects sales of pure electric cars to increase by 46% this fiscal year, reaching 171,000 units. When asked about the slowdown in the growth of the pure electric car market, Toshio Kanji responded that Toyota will maintain its “multi-path” approach, offering a range of environmentally friendly models, not just focusing on pure electric cars. Toshio Kanji said: “We need to focus on customers’ actual needs and respond to them.” He also stated that there are “different views” on pure electric cars, but “our position has not changed.”

In the hybrid car market, Toyota is facing challenges in both the Chinese and Japanese markets. Toyota has been plagued by a series of quality scandals, leading to production and sales halts and damage to its reputation. Last December, improper conduct in safety certification tests led Daihatsu to halt shipments of all models. SBI Securities research director Koji Endo noted Toyota’s cautious stance on Daihatsu’s issues. In January, Toyota stopped global shipments of 10 models due to improper engine horsepower and torque testing by Toyota Industries. The negative impact of these events was immediately reflected in sales. In the first quarter of this year, Toyota’s deliveries in North America and Europe increased by 18% and 13% respectively, but deliveries in Japan almost halved to 363,000 units. In the Chinese market, Toyota’s situation is also unfavorable, with declining sales and market share. Data shows Toyota sold 1.9076 million vehicles in China in 2023, a 1.7% decrease compared to the previous year, while global sales reached a new high. Additionally, according to the China Passenger Car Association’s “December 2023 National Passenger Car Market Deep Analysis Report,” Japanese brands had a 17% retail market share in 2023, a 3 percentage point decrease year-on-year. Japanese brands in the Chinese market have seen their market share decline for three consecutive years, dropping from 24.1% in 2020 to 17% in 2023. Toyota reiterated at a press conference that the competition in the Chinese market is becoming increasingly fierce. Miyazaki has a cautious attitude towards the Chinese market. “The price war in the Chinese car market is intensifying,” Miyazaki said. Due to the oversupply of affordable electric cars in the current Chinese market, Toyota will try to avoid getting involved in the price war. “We need to continue to endure for a few more years before we offer more electric cars,” Miyazaki emphasized. Plug-in hybrid cars are becoming more popular in the market, proving that Toyota can leverage its expertise and technology to come out of what he called “years of endurance.” After announcing their performance, Toyota’s stock price fell by 0.56% on May 8, closing at 3,579 yen. However, Toyota’s stock price has risen by 37% since the beginning of the year. Toyota plans to buy back up to 1 trillion yen in stocks, which will help limit the decline in stock prices. Analyst Mio Kato from LightStream Research said, “The buyback is a pleasant positive news.” He added that investors can see it as a sign that Japanese companies will continue to improve shareholder returns.