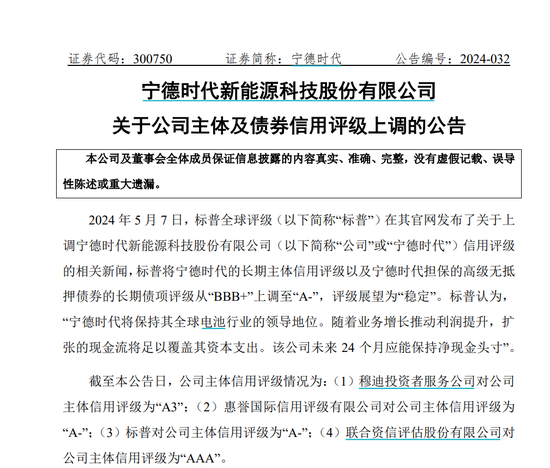

On May 9, CATL disclosed that on May 7, S&P Global Ratings announced the upgrade of CATL’s credit ratings. S&P raised CATL’s long-term corporate credit rating and the long-term debt rating of CATL’s senior unsecured bonds guaranteed by CATL from “BBB+” to “A-“, with a stable outlook.

S&P believes CATL will maintain its global leadership in the battery industry. With business growth driving profit improvement, expanding cash flow will be enough to cover its capital expenditures. The company should be able to maintain a net cash position in the next 24 months. S&P expects CATL’s overseas sales volume to grow by 34%-37% in 2024, while global sales will increase by 19%-23% year-on-year, reflected in revenue, with a year-on-year growth of 8%. In addition, benefiting from the expected decline in raw material prices over the next two years, CATL’s EBITDA profit margin is expected to further expand to 19.7%-19.8% in 2024-2025. It is worth noting that international rating agencies have recently upgraded their ratings for CATL. On April 15, Moody’s upgraded CATL’s corporate rating from Baa1 to A3, citing recognition of CATL’s industry position, leading technology, good demand prospects, diversified customer base, high barriers to entry, and prudent financial policies, with a stable outlook. Moody’s also upgraded the guaranteed senior unsecured bonds issued by CATL’s wholly-owned subsidiary Contemporary Ruiding Development Limited to A3. Previously, Fitch also upgraded CATL’s long-term foreign currency issuer default rating and senior unsecured rating from “BBB+” to “A-“, with a stable outlook for the issuer default rating. This is the first time CATL has received an A-range credit rating from Fitch. The consecutive upgrades of CATL’s credit ratings by the three major rating agencies have greatly boosted the entire new energy sector. Data shows that on May 9, CATL had a total turnover of 1.773 billion yuan, with a net purchase of 147 million yuan, marking the eighth consecutive day of net purchases. During this period, the stock has accumulated a total turnover of 15.845 billion yuan through the Shenzhen-Hong Kong Stock Connect, with a total net purchase of 2.858 billion yuan. As of the close on May 9, CATL closed at 209.40 yuan (10$) per share, up 3.04%.

Not only Ningde era, recently, the new energy sector has seen explosive growth. On May 9th, the new energy sector surged across the board, especially the lithium battery industry chain collectively rose under favorable policies, with many stocks such as Tianli Lithium Energy, Jinyang Stock, Blue Sea Huateng, and Lingpai Technology hitting the limit up.

Guangda Securities analysis said that with the switch from off-season to peak season for new energy vehicles leading to increased capacity utilization, combined with the “old for new” policy boosting demand for new energy vehicles, the lithium battery industry chain may usher in a supply and demand turning point. Additionally, on May 9th, CATL also replied to investors through the interactive platform about the company’s progress in solid-state batteries and sodium-ion batteries. CATL stated that the energy density of the company’s solid-state batteries can reach up to 500Wh/kg, and is currently collaborating on a civil electric passenger aircraft project, implementing aviation-grade standards and testing to meet aviation-grade safety and quality requirements. At the same time, the company will also launch a vehicle-grade application version of solid-state batteries. Regarding the progress of sodium-ion battery layout, CATL responded to investors that the company has released the first generation of sodium-ion batteries and is developing the second generation, expecting better performance in terms of cost, lifespan, and low-temperature performance.