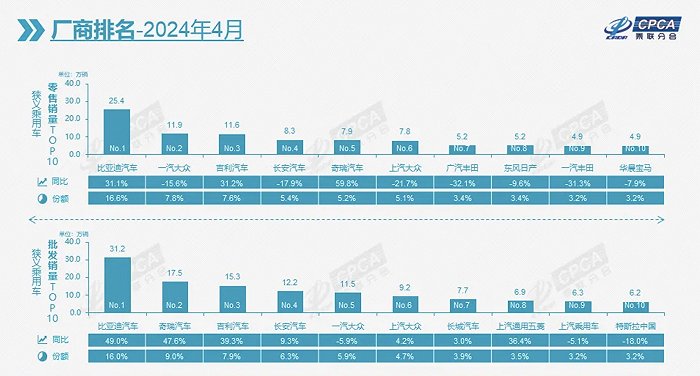

On May 10, the China Passenger Car Association released the April national passenger car market analysis report. In April, 1.988 million passenger cars were produced, a year-on-year increase of 14.9%, surpassing the previous high point in 2018 by 18,000 units. Independent brands led the growth in production, increasing by 30% year-on-year, while joint venture brands saw a 10 percentage point decrease. In contrast to the rising production, national passenger car retail sales in the same month decreased by 5.7% year-on-year and 9.4% month-on-month. The report mentioned that consumer sentiment was affected by unstable prices. The price war led by new energy manufacturers had boosted sales to some extent, but the sustainability was weak and there was severe differentiation among brands. Most traditional fuel models had no room for further price reductions, facing accelerated competition from new energy rivals, making it harder for some consumers to make purchasing decisions, further suppressing overall delivery volume. As a result, both independent and joint venture brand retail sales in April decreased compared to the previous month. Luxury car retail sales plummeted by 24% month-on-month. A sales manager from a second-tier luxury brand mentioned that the impact of economic changes on the high-end consumer market has not dissipated. Despite price cuts, brands are trying to increase sales through online channels, with some dealers conducting detailed product live streams for over 2 hours daily, but the actual sales promotion effect remains to be seen. In terms of the top ten brands in sales volume, the downward trend in retail sales of joint venture brands is evident. Toyota’s two major joint venture brands in China, FAW Toyota and GAC Toyota, saw a 30% decrease year-on-year, far exceeding the declines of Dongfeng Nissan and FAW Volkswagen. BYD and Geely continued to hold the first and third market share positions, with both seeing year-on-year growth of over 30% in the latest month.

Image source: China Association of Automobile Manufacturers Chery Automobile maintains high growth momentum since the beginning of the year, with a nearly 60% year-on-year increase in April, surpassing SAIC Volkswagen and moving up in the rankings. Chery Chairman Yin Tongyue reiterated the group’s goal of entering the top three in the industry in terms of sales of new energy products at the new car launch event yesterday. As the domestic new energy market is booming, the retail penetration rate of new energy vehicles among mainstream joint venture brands is only 7.5%, while this figure for independent brands is nearly nine times that of the former. The retail share of independent brand new energy vehicles in that month has reached 64%. With the emergence of the scale advantage of the new energy vehicle industry and the demand for market expansion, domestic cars are accelerating their overseas expansion. In April, the export of new energy passenger vehicles increased by 26.8% year-on-year, with small and micro pure electric vehicles dominating the exports. However, the report points out that the growth rate of China’s automobile exports in the first quarter of this year has slowed down compared to the previous three years. Among the major export countries, the trend of new energy vehicles in Europe and America is slowing down, and mainstream consumers still have significant concerns about charging infrastructure, battery life, and insurance costs. The report specifically points out that exports are an important source of profits for domestic car manufacturers. In the domestic market, major companies are facing increasing competitive pressures, with profits from gasoline vehicles still existent but the market is shrinking rapidly, while new energy vehicles, despite high growth, are struggling to break even. In the first quarter of this year, the profit margin of the automotive industry was 4.6%, still lower than the average profit margin of 4.9% for the entire industrial sector. Fitch Ratings recently released a report stating that as idle capacity for gasoline vehicles increases, the industry’s capacity utilization rate in the first quarter decreased by 7.1 percentage points year-on-year to 64.9%, the lowest level since the first quarter of 2020 impacted by the COVID-19 pandemic. The low capacity utilization rate will continue to squeeze profit levels, with concerns about the profitability of the domestic car market gradually emerging. Looking ahead to May, the China Association of Automobile Manufacturers believes that with the implementation of the national “scrappage for new” policy and the temporary cooling of the car new price war, the consumer enthusiasm of the wait-and-see group is expected to be stimulated, which is conducive to the gradual strengthening of the car market in the coming months. With the decrease in upstream lithium carbonate costs and the continuous increase in the guidance intensity of macro policies, the overall profitability of car companies will improve.