Leverage Game by Yinyin Zhang Recently in the automotive industry, three things are worth mentioning. 1) On May 15, 2024, NIO launched a new sub-brand, Ledian, instead of the long-rumored second brand “Alps”, releasing the first model Ledian L60. 2) On May 14, in Hangzhou, Zero Run Auto and Stellantis Group held a joint press conference, officially establishing the Zero Run International Joint Venture Company, planning to launch models in nine European countries starting in September 2024. The preparation of Zero Run International only took seven months, showing high efficiency and urgency in going global.

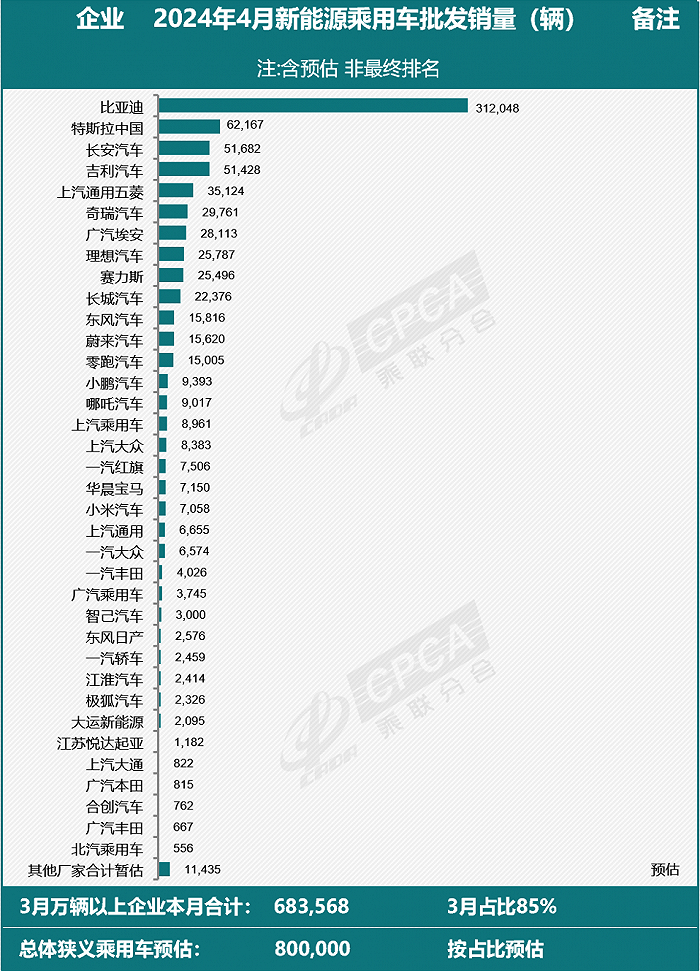

1. “21st Century Business News” reported that after the May Day holiday, Ideal Motors is undergoing a new round of company-wide personnel optimization, with an overall optimization rate exceeding 18%. The 2023 financial report shows that Ideal Motors has nearly 31,600 employees, a year-on-year increase of 63%. Based on the optimization rate, this round of optimization involves more than 5,600 people. 2. Three things, different paths leading to the same result, reflect the fierce competition and ambition of the automotive industry. We must hope for a good industry and good companies, otherwise the end result will be the same – forced layoffs. 3. As the media has pointed out, Ideal Motors’ CEO Li Xiang is obviously a person with a strong sense of crisis, otherwise Ideal Motors would not have made such a large-scale layoff move. Today, we will discuss these three things and three automotive companies in the “Leverage Car View”. 1. NIO: High-end stagnation, must find a way Looking at the recent monthly rankings of new energy vehicle sales by the China Passenger Car Association, we can see that the unlucky NIO continues to fall out of the top ten. In February, it was just in tenth place, then dropped out in March, and continued to be absent in April. Of course, other new forces like Xiaopeng Motors, Leapmotor, and Neta Motors also did not make it into the top ten.

You said it was bad, but NIO is not bad either. Every month, there are thousands of high-end cars sold, with high prices. Achieving this result is impressive. However, we know that this sales volume is just the beginning. Making a profit is always a problem. In the past, NIO ranked first, but now the spotlight is taken by Xpeng. Looking back to 2023, NIO’s revenue exceeded 55.6 billion yuan, a new high, but the growth rate is not fast, with losses exceeding 20 billion yuan. Even so, this is the highest revenue since NIO was founded. In 2023, the revenue was over 49.2 billion yuan, an increase of over 30% from the previous year, breaking the record. In 2023, NIO’s gross profit was 3.052 billion yuan, a decrease of 40.7% from 2022. The gross profit margin for the whole year was 5.5%, compared to 10.4% in 2022. The net loss in 2023 was 20.72 billion yuan, an increase of 43.5% from 2022. Excluding equity incentive expenses, the adjusted net loss in 2023 was 18.351 billion yuan, an increase of 51.1% from 2022. In 2023, NIO’s net loss attributable to shareholders was -21.15 billion yuan, compared to -14.56 billion yuan in 2022 and -23.33 billion yuan in 2018. As of the end of 2023, NIO’s cash and cash equivalents, restricted cash, short-term investments, and long-term deposits amounted to 57.3 billion yuan. In 2023, NIO also received a strategic equity investment of 2.2 billion US dollars from CYVN Investments RSC Ltd, the investment entity of Abu Dhabi. Despite the temporary losses, NIO can still afford to burn money in 2024. NIO’s sales volume has always been a problem. To make money, they need to boost sales to dilute costs. NIO is also planning for a second growth curve, rumored to be launched in the second quarter of 2023 by Alps. In addition, NIO’s third brand, the Firefly project, is planned to be launched in 2025, targeting the market of tens of thousands of yuan. Developing the lower-tier market is NIO’s strategic layout. Later we saw “Alps” finally called “Le Dao” Le Dao and ideal debut are actually a bit similar, wanting to make friends with family users, Li Bin proposed the “family car value formula” Le Dao’s launch date is International Family Day in 2024, Li Bin also brought his wife Wang Yizhi to the scene, and shared his experience as a new father Interesting, on the one hand, wanting to break into the advantageous territory of Ideal Cars; on the other hand, looking at the price, 219,900 yuan (30430$), the product is benchmarked against Tesla Model Y, the price is about 30,000 yuan (4150$) lower than Model Y Over a month ago, after the Xiaomi SU7 launch event, Li Bin joked with Lei Jun in a co-produced short video, “After Xiaomi SU7 came out, it’s hard to price Le Dao L60” the reality is, although most domestic new energy vehicles are already fully equipped, only with a truly sincere price can they attract users Ai Tiecheng, who previously served as the General Manager of Greater China at WeWork and Vice President of the Marketing Department at Shanghai Disney Resort, has been appointed as the brand president of Le Dao. He described himself at the launch event as coming from an ordinary family, a small-town youth, and a father of two children. He himself has many similarities with the target group of Le Dao brand “Happy family, good at managing the household,” ordinary families, small-town youth, 219,900 yuan (30430$) price, NIO’s Le Dao, as my classmates said, “enjoying the simple life,” is trying to connect with this group Can Le Dao successfully define this group’s family car? For Le Dao, this question may determine NIO’s profit potential, and may even be a crucial battle that cannot be lost, after all, relying solely on NIO selling over ten thousand cars every month is not a sustainable solution 2. Zéro Run Automobile: Running on a shoestring, needs money, needs new markets Previously, I summarized that Zéro Run Automobile is a company that saves money and runs on a shoestring Looking at the latest 2023 financial report, we will find that the company achieved revenue of 16.747 billion yuan, a year-on-year increase of 35.2%, with a full-year gross margin of 0.5%, turning positive for the first time, an increase of nearly 16 percentage points compared to 2022 However, in terms of sales volume, there are also difficulties and regrets In 2023, the total delivery volume of Zero Run Auto was 144,155 vehicles, an increase of 29.7% from 111,168 vehicles in 2022. It seems like a good growth rate, but as a new force in car manufacturing, achieving sales of over 100,000 vehicles for consecutive years and reaching over 140,000 vehicles in 2023 is not easy. However, according to the data from the China Passenger Car Association, the cumulative sales of new energy narrow passenger vehicles in 2023 reached 7.74 million vehicles, a year-on-year increase of 36.3%. This means that the sales growth of Zero Run Auto, as well as other companies like Xiaopeng Auto, fell behind the market. Additionally, similar to Nio Auto, Zero Run Auto did not make significant progress in sales and it is difficult to break into the top ten in the industry. Speaking of the operation of Zero Run Auto in 2023, the company achieved revenue of 16.747 billion yuan, an increase of 35.2% from 2022. The most noteworthy point is that the gross profit margin of Zero Run Auto in 2023 was 0.5%, a significant improvement from -15.4% in 2022, marking the first annual profit and an increase of about 16%. Of course, the absolute profit is still negative. In 2023, Zero Run Auto had a net loss of 4.216 billion yuan, compared to a loss of 5.109 billion yuan in 2022, at least reducing the loss. Excluding stock-based expenses as part of employee benefits, the adjusted net loss for 2023 was 3.519 billion yuan, compared to a loss of 4.566 billion yuan in 2022. In addition, the net cash flow from operating activities for Zero Run Auto in 2023 was 1.082 billion yuan, while it was -2.4 billion yuan in 2022. This is also the first time this number has turned positive, similar to the gross profit margin. Compared to companies like Nio Auto, Xiaopeng Auto, and Ideal Auto, which were previously known as the first legion of new carmakers, Zero Run Auto is not as aggressive in terms of positioning and spending. For example, Zeropao Motors also emphasizes its full self-research. Full self-research refers to the three electric systems that account for about 60% of the vehicle’s BOM cost, all of which have been independently developed and manufactured, forming Zeropao’s best product strength and cost advantage. This sounds like burning money, but even so, the performance announcement says: In the past five years, we have invested approximately 4.7 billion yuan in research and development, achieving the self-research, self-production, and mass production of the core components of the three electric systems and 8 models of vehicles. By the end of 2023, we had achieved rapid growth with cumulative deliveries of over 300,000 units… You read that right, compared to car companies that spend tens of billions on research and development every year, this is indeed very cost-effective. Running a small business is good, but the problem is that no matter how much you save and even after the gross profit margin turns positive, you still have to pursue corporate profits, and sales volume must break through. In addition to the domestic market, Zeropao Motors, like many other car companies, values overseas sales. On October 26, 2023, Zeropao Motors and Stellantis Group established a global strategic partnership, planning to jointly establish a joint venture named “Zeropao International.” By November 20, 2023, Stellantis subscribed to 14.53% of Zeropao Motors’ H shares issued, becoming the main shareholder of Zeropao Motors and obtaining two seats on the board of directors. After more than seven months of preparation, Zeropao International officially announced its establishment and started operations on May 14, 2024, with an efficient and smooth process worthy of praise. According to Zeropao International’s business development plan, sales of Zeropao Motors will first start in nine countries in Europe in September this year, and by the end of the year, the sales range will be further expanded to the five continents globally. To some extent, the controlling party of Zeropao International is Stellantis Group. The Zeropao brand has, in a sense, become one of the many automotive brands of Stellantis Group facing the global market, and perhaps can avoid some unfriendliness from Chinese state-owned car companies. With Stellantis Group’s global manufacturing and distribution channels, will 1+1 be greater than 2? Zhu Jiangming believes that “Zeekr’s products have surpassed some domestic and foreign car companies in terms of speed of global expansion and sales volume” – we wait and see. Ideal Car: After the best historical record, it encounters the strongest opponent. For Ideal Car, if it cannot win the defense battle in 2024, then the battle in 2025 will be even harder. Therefore, media reports about Ideal Car layoffs are not surprising. For this reason, Ideal Car has already launched a series of combinations from Li Xiang. While laying off employees, Ideal Car continues to make moves. First, it launched the L6 model below 300,000 yuan (41510$), and then on April 22, 2024, it announced that the 2024 models of Ideal L7, Ideal L8, Ideal L9, and Ideal MEGA will adopt a new pricing system, with prices reduced by 18,000 to 30,000 yuan (4150$). New and existing users who have ordered but not yet delivered can enjoy the new prices. In detail, the entire Ideal L9 series has been reduced by 20,000 yuan (2770$), L7 and L8 prices have been reduced by 18,000 to 20,000 yuan (2770$), and MEGA prices have been reduced by 30,000 to 529,800 yuan (73310$). At the same time, Ideal Car will provide cash rebates for owners who have received the 2024 models of Ideal L7, Ideal L8, Ideal L9, and Ideal MEGA. We know that, including Tesla, major new energy manufacturers are reducing prices, and Ideal Car is no exception. Additionally, a topic that cannot be ignored is the competition with Wenjie. On one hand, BYD, the big brother, early on started a price reduction trend, with a pile of companies following suit, including Tesla. Ideal Car cannot afford not to follow. At the same time, a very practical issue is that Ideal Car’s position as the sales champion of new forces in 2023 was challenged early in 2024. Of course, this may have been expected as early as October 2023, when Wenjie’s new M7 orders grew rapidly, followed by increased production and deliveries. Starting in January 2024, the Wenjie series produced in collaboration with Saicelus and Huawei, for the first time, took the top spot in monthly sales of new forces. In February and March 2024, Wenjie’s performance remained strong, but in April, Ideal Car’s sales slightly exceeded Wenjie’s. But in the first four months, Tesla’s new energy vehicle sales not only surpassed those of NIO, but also secured the 6th place in the entire new energy vehicle industry in China, which was previously unimaginable. As shown in the chart below, the top 5 players are all major players.

The new WM5 from WM Motor has started deliveries. In 2024, there will be other new models like the M8. WM Motor’s challenge to Ideal Cars has entered a new stage, perhaps aiming for more than just Ideal Cars. Ideal Cars had high hopes for their first all-electric flagship model MEGA and the 2024 facelift of the L series. However, these products did not meet expectations after their release on March 1. In April, Ideal Cars introduced new plug-in hybrid models L6 Pro and Max, priced at 249,800 yuan (34560$) and 279,800 yuan (38720$) respectively. Customers who order before May 5 can enjoy benefits worth 20,000 yuan (2770$). Previously, Ideal Cars’ models were priced at over 300,000 yuan (41510$). The L6 is responsible for increasing Ideal Cars’ sales volume. It remains to be seen if this strategy will be successful, but Ideal Cars couldn’t wait and decided to reduce prices across the board. In terms of organizational structure, it makes sense for Ideal Cars to lay off employees. If these employees are not contributing to increased sales, then optimizing to reduce operating costs is necessary. Of course, the consequence of this is whether laying off employees can increase the average output per person. If there are fewer people, the product strength and sales volume may not improve, which remains a problem. Laying off employees and reducing prices is one aspect. For Ideal Cars, gaining industry recognition in plug-in hybrid technology is crucial. Balancing the plug-in hybrid market while pushing forward with pure electric vehicles exploration is necessary. Looking ahead, if Ideal Cars cannot establish a presence in the pure electric vehicle field, then laying off employees and reducing prices will be in vain – investing in people and money is still necessary for pure electric vehicles.