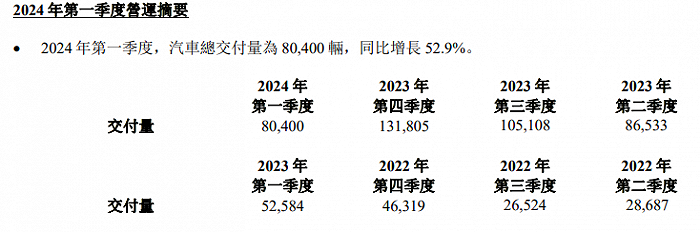

Article | Leverage Game by Zhang Yinyin Editor | Xinxin After the release of Ideal Car’s first quarter report, many people said its performance was not good and below expectations. Some even said it was operating at a loss, strictly speaking, it was an operating loss; but looking at net profit, it was still profitable – and it has been six consecutive quarters of positive net profit. Of course, the leverage game is not here to boast about Ideal Car. Today, let’s take a detailed look at Ideal Car’s first quarter report for 2024, and discuss its expansion. 1. The delivery data for the first quarter is actually not bad, just slightly behind expectations In the first quarter of 2024, Ideal Car delivered 80,400 vehicles, a year-on-year increase of 52.9% – what does this growth rate mean?

First, let’s look at the chart. Compared to Ideal Motors, although not as strong as the second, third, and fourth quarters of 2023, the sales volume and growth rate in the first quarter are not bad considering factors such as the Spring Festival.

Then we compared with our peers and noticed that, according to the statistics of the China Automobile Dealers Association’s Automobile Market Research Branch, in the first quarter of 2024, the cumulative sales of passenger cars in China reached 4.832 million, an increase of 13.2% year-on-year. In the first quarter, SUV sales reached 2.407 million, an increase of 20.3% year-on-year; during the same period, sales of new energy passenger cars reached 1.772 million, an increase of 34.5% year-on-year. In other words, whether looking at the overall sales growth of the passenger car industry, SUV sales growth, or new energy passenger car sales growth, in the first quarter, Ideal Automobiles outperformed the market. However, it lost to Wanjie.

The new M5 from WM Motor has started delivery. In 2024, other new models like the M8 will be launched. This marks a new phase for WM Motor, challenging more than just Tesla. WM Motor had high hopes for the MEGA and L series 2024 models, but sales fell short after their release on March 1. In April, WM Motor introduced the extended-range hybrid models L6 Pro and Max, priced at 249,800 and 279,800 yuan (38620$) respectively. Customers who order before May 5 can enjoy benefits worth 20,000 yuan (2760$). The pricing of WM Motor’s models was previously above 300,000 yuan (41410$), so the success of the L6 in increasing sales remains to be seen. There are also concerns about whether the L6 will cannibalize sales of the L7. WM Motor has its own considerations. In an effort to regain the top spot in new energy vehicle sales, WM Motor announced on April 22, 2024, that the 2024 models of the L7, L8, L9, and MEGA will adopt a new pricing system, with prices reduced by 18,000 to 30,000 yuan (4140$). New and existing customers can benefit from the new prices. Specifically, the L9 will be reduced by 20,000 yuan (2760$), while the L7, L8, and MEGA will see reductions of 18,000 to 30,000 yuan (4140$), with the MEGA now priced at 529,800 yuan (73120$). WM Motor will also provide cash rebates to customers who have already received their 2024 models of the L7, L8, L9, and MEGA. It is known that, including Tesla, major new energy manufacturers are reducing prices, both to stay competitive with WM Motor and due to market pressures. As of the end of March 2024, Ideal Car has 474 retail centers in 142 cities, 356 after-sales service centers, and authorized spray centers in 209 cities, and has put into operation 357 Ideal Supercharging stations with 1,544 charging piles. The sales and after-sales network of Ideal Car is considered good, but how to maintain and increase sales will be the main focus in the next stage. Is there really a loss? In the first quarter of 2024, Ideal Car operated at a loss of about 580 million yuan, compared to a profit of 4 billion yuan in the same period in 2023, and a profit of 30 billion yuan in the fourth quarter of 2023. This is the issue of loss that everyone is talking about. On another level, the net profit in the first quarter is around 590 million yuan, and it has been positive for the sixth consecutive quarter. Let’s take a detailed look at the financial performance. In the first quarter of 2024, Ideal Car’s total revenue was 25.6 billion yuan, an increase of 36.4% from the first quarter of 2023, but a decrease of 38.6% from the fourth quarter of 2023. Vehicle sales revenue in the first quarter was 24.3 billion yuan, an increase of 32.3% from the same period in 2023, but a decrease of 39.9% from the fourth quarter of 2023. In the first quarter of 2024, Ideal Car’s gross profit margin was 20.6%, compared to 20.4% in the same period in 2023 and 23.5% in the fourth quarter of 2023. The vehicle gross profit margin was 19.3%, compared to 19.8% in the same period in 2023 and 22.7% in the fourth quarter of 2023. Although it has declined slightly, overall it is still at a high level, and the gross profit margin of luxury cars is still very good. We continue to look at the first quarter gross profit of 53 billion yuan in 2024, an increase of 38.0% from the same period in 2023 of 38 billion yuan, and a decrease of 46.0% from the fourth quarter of 2023 of 98 billion yuan. In the first quarter of 2024, operating expenses were 59 billion yuan, an increase of 71.4% from the same period in 2023 of 34 billion yuan, and a decrease of 13.1% from the fourth quarter of 2023 of 68 billion yuan. The operating loss in the first quarter was 584.9 million yuan, compared to an operating profit of 405.2 million yuan in the same period in 2023 – which is the operating profit of 3 billion yuan in the fourth quarter of 2023 mentioned earlier. Looking at net profit, it is still positive – 591.1 million yuan, a decrease of 36.7% from the same period in 2023 of 933.8 million yuan, and a decrease of 89.7% from the fourth quarter of 2023 of 5.8 billion yuan. In the first quarter of 2024, Ideal Car’s non-US GAAP net profit was 1.3 billion yuan, a decrease of 9.7% from the same period in 2023 of 1.4 billion yuan, and a decrease of 72.2% from the fourth quarter of 2023 of 4.6 billion yuan. In the first quarter of 2024, Ideal Car’s net cash used in operating activities was 3.3 billion yuan, compared to 7.8 billion yuan in the same period in 2023, and 17.3 billion yuan in the fourth quarter of 2023. In the first quarter of 2024, Ideal Car’s free cash flow also changed from 6.7 billion yuan in the same period in 2023 to -5.1 billion yuan, and in the fourth quarter of 2023, it was 14.6 billion yuan. Ideal Car’s first quarter performance announcement outlook predicts that in the second quarter of 2024, vehicle deliveries will be between 105,000 and 110,000 units, an increase of 21.3% to 27.1% from the second quarter of 2023. This sales volume estimate seems to be lower compared to the previous annual sales targets converted to quarterly figures. Revenue for the second quarter is expected to be between 29.9 billion yuan and 31.4 billion yuan, an increase of 4.2% to 9.4% from the second quarter of 2023. 3 things to note: Recently, we have seen that restructuring the ideal organizational structure, that is, layoffs, makes sense. Since so many people have not created more sales, optimizing at least reduces operating costs. Combining price reductions and the previous unsuccessful launch of ideal MEGA, the leverage game believes that there are 3 things worth noting for Ideal Car. 1) On March 21, Li Xiang, CEO of Ideal Car, stated in an internal memo that the main issues in March were: One is the pacing issue of Ideal MEGA, mistakenly treating the 0 to 1 phase of Ideal MEGA as the 1 to 10 phase of operation; The second is the problem of excessive desire for sales, focusing too much on sales and competition from top to bottom, letting desire surpass value, significantly reducing the originally best user value and operational efficiency. These statements are certainly correct, but now it’s useless to say anything. Everyone is lowering prices. No matter how you do it, you have to lower prices. Lowering prices is one aspect. For Ideal Car, while gaining industry status with extended-range hybrid technology, on the one hand, it must stabilize the extended-range position, and on the other hand, it must make breakthroughs in exploring pure electric vehicles. Looking ahead, if you cannot establish a foothold in the pure electric field, lowering prices will be in vain – after all, pure electric vehicles still require investment in people and money. Ideal Car seems to have adjusted to make a major push for pure electric vehicles by 2025. After the setback of MEGA in 2024, Ideal Car hopes to make progress and have good luck. 2) Lowering prices means profits are affected. Looking back to 2023, the first new force in car manufacturing with annual revenue exceeding one trillion yuan was born – Ideal Car. In 2023, Ideal Car achieved revenue of 123.85 billion yuan for the full year, a year-on-year increase of 173.5%. This number was 45.29 billion yuan in 2022. Ideal Car achieved its first full fiscal year profit, with a net profit of 11.7 billion yuan, wiping out losses from the past 5 years in one go. From this simple data, we can roughly calculate that the net profit margin of Ideal Cars is over 10%. The reason for this outstanding performance is that Ideal Cars are expensive, so once the volume is up and costs are spread out, they have profits that other car companies cannot reach. In 2023, Ideal Cars won the championship in the Chinese market for SUVs priced above 300,000 RMB, as well as for sales of new energy vehicles priced above 300,000 RMB, with a total delivery volume of 376,030 vehicles, a year-on-year increase of 182.2%, becoming the first Chinese new force car company to surpass the 300,000 vehicle annual delivery mark. In 2023, Ideal Cars’ sales cost was 96.35 billion RMB, an increase of 164.0% from around 36.5 billion RMB in 2022, achieving a gross profit of 27.50 billion RMB, an increase of 212.8% from 8.79 billion RMB in 2022, with a gross profit margin of 22.2%, up from 19.4% in 2022. Due to the above reasons, Ideal Cars had an operating profit of 7.41 billion RMB in 2023, compared to an operating loss of 3.65 billion RMB in 2022. With recent price reductions across the board, Ideal Cars may have lost more than 20% of their gross profit margin, and if other factors are considered, some models may have lost even more. Ultimately, if sales do not increase, it will inevitably lead to a decrease in Ideal Cars’ net profit. Whether they return to a loss is uncertain. Regardless, the impact on profits is undeniable. For Ideal Cars, maintaining industry and sales positions is more important than temporary profits. This is truly a battle for survival. After recent layoffs, the key issue for Ideal Motors is whether there will be enough output per person to boost productivity and sales. With fewer employees, it’s still a challenge to increase productiveness or sales. Currently, in terms of product positioning, Ideal Motors’ main rival is Wenshi. However, more and more competitors are entering this market segment, making future competition even more intense. If Ideal Motors can’t win the battle in 2024, it will be even harder to fight in 2025.