CATL’s attitude towards solid-state batteries has become ambiguous. Recently, CATL’s chief scientist Wu Kai revealed that CATL has the opportunity to mass produce solid-state batteries in small quantities by 2027. He also emphasized that CATL’s current maturity level in solid-state batteries is at level 4 on a scale of 1-9, with a target of reaching level 7-8 by 2027.

Just over a month ago, Ningde Times Chairman Zeng Yuqun believed that the commercialization of solid-state batteries was a distant prospect. By the end of March, Zeng Yuqun stated in an interview that the current technology of solid-state batteries was not good enough and had safety issues, still years away from commercialization. In just a month, Ningde Times’ attitude towards solid-state batteries shifted from “distant from commercialization” to “possibility of small-scale production.” The subtle change in between makes one ponder the reasons behind it. Recently, the hype around solid-state batteries has been on the rise. Compared to the past when companies were lining up for batteries and the era of battery supply shortage, now there is an excess of battery production capacity and Ningde Times’ growth has slowed down. Facing the trend of industrial transformation, Ningde Times’ dominant position has become a thing of the past. Under the strong marketing rhythm of solid-state batteries, is the “Ning Wang” starting to panic? The marketing trend blows towards “solid-state batteries.” It is well known that the core of the transition from liquid batteries to semi-solid and solid-state batteries lies in the change of electrolyte. The shift from liquid batteries to solid-state batteries requires changes in chemical materials to enhance energy density, safety performance, etc., which is not easy in terms of technology, cost, or manufacturing processes. It is widely predicted in the industry that solid-state batteries will not truly achieve mass production until 2030. However, the hype around solid-state batteries has unexpectedly surged, with a momentum of getting on board early. On April 8, Zhi Ji Auto launched the new all-electric model Zhi Ji L6, featuring the “first generation of Lightyear solid-state batteries.” Subsequently, GAC Group announced plans to introduce solid-state batteries in 2026, starting with the Hao Bo model. Of course, the controversy arose when Zhi Ji L6 claimed to be equipped with the “first generation of Lightyear solid-state batteries,” which were not truly full solid-state batteries. After several rounds of in-depth discussions and analysis, Li Zheng, the general manager of Qingtao Energy, clarified that “this battery is actually a semi-solid-state battery,” gradually calming the controversy.

As a supplier of Zhi Ji L6 solid-state batteries, Qing Tao Energy clarifies the truth about semi-solid-state batteries, while another company claims to have made new progress in the field of all-solid-state batteries. On April 9, GAC Aian Hao Bo announced that its 100% all-solid-state battery will be officially released on April 12. However, the originally scheduled product release date has been changed to “mass production in 2026.” This repeated advertising strategy has attracted criticism from many industry insiders. Although both companies are playing word games in the marketing of solid-state batteries, the popularity of solid-state batteries has once again reached a climax. On April 2, Tai Lan New Energy announced that the company has made significant progress in the research and development of “automotive-grade all-solid-state lithium batteries,” successfully producing the world’s first automotive-grade single cell with a capacity of 120Ah and an actual energy density of 720Wh/kg, breaking the industry record for single cell capacity and highest energy density of automotive-grade lithium batteries. On April 5, the German Association for the Promotion of Sustainable Physical Technologies announced that a team of German experts has invented a complete set of high-performance, high-safety solid-state sodium-sulfur batteries with an automatic continuous production process, which can achieve an energy density of over 1000Wh/kg and a theoretical loading capacity of up to 20000Wh/kg. In addition, from late April to the present, Lingxin New Energy and Enli Power have successively announced the commissioning of their solid-state battery phase one projects. According to the latter’s previous plan, it will achieve mass production of a 10GWh production line in 2026, and strive to establish a global industrial base layout of over 100+GWh by 2030. All-solid-state or semi-solid-state? Ning Wang accelerates anxiety. Compared to liquid batteries, solid-state batteries are attracting attention because of their high energy density, high safety, small size, wide temperature range operation, and many other significant advantages, making them an important representative of the next generation of high-performance lithium batteries.

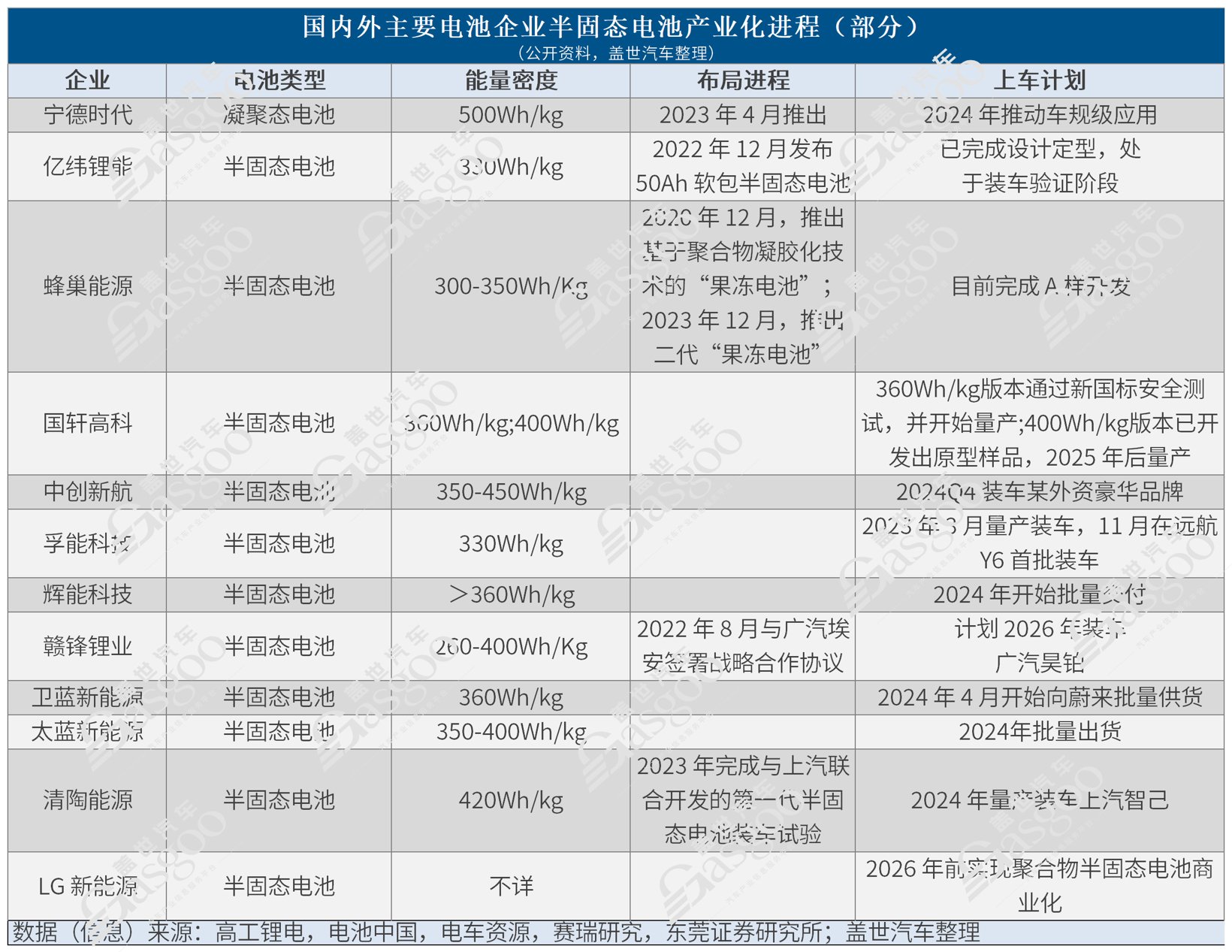

According to the content of liquid electrolyte, industry experts have made a clearer distinction for solid-state batteries. The development path of solid-state batteries can be roughly divided into semi-solid, quasi-solid, and all-solid stages, with semi-solid and quasi-solid electrolytes being used. While it may take some time for all-solid-state batteries to hit the market, semi-solid-state batteries are already on the road. According to incomplete statistics from Gasgoo Auto, currently more than ten domestic and foreign power battery companies, including Zhongke Innovation, Honeycomb Energy, Huineng Technology, Ganfeng Lithium, EVE Energy, and Guoxuan High-tech, have all laid out plans for semi-solid-state batteries and have clearly defined their market entry strategies.

According to statistics from relevant agencies, by the end of 2023, the domestic semi-solid-state battery production capacity planned has accumulated over 298GWh, with 15GWh expected to be in operation by 2024. This year is set to be a crucial point for the development of the solid-state battery industry, with the potential for large-scale application of solid-state batteries and an estimated total installation exceeding 5GWh for the year. Facing the rapid advancement of solid-state batteries, the anxiety at CATL has started to spread. Compared to others, CATL has not been moving quickly in the development of solid-state batteries. It was not until recently that they finally confirmed the production schedule for solid-state batteries. The reason for CATL’s urgency to “explain” may be due to overall industry restructuring and the pressure of their own growth slowdown. On April 15, CATL released its financial report for the first quarter of 2024: total revenue was 79.77 billion yuan, a year-on-year decrease of 10.41%; net profit attributable to shareholders of the listed company was 10.51 billion yuan, a 7% increase year-on-year; non-GAAP net profit was 9.25 billion yuan, an 18.56% increase year-on-year. It is worth mentioning that this is the second consecutive quarter that CATL has experienced a year-on-year decrease in operating income. In the fourth quarter of 2023, CATL’s total revenue decreased by 10%. With the continuous decline in the price of power batteries and limited room for improvement in the market share of enterprises in the power battery market, CATL is bidding farewell to its high-growth state. Looking from a different perspective, CATL’s change in attitude towards solid-state batteries is more like being forced to do business. Amid the “solid-state battery frenzy” in the entire battery industry, if CATL remains silent or appears to be lagging behind in solid-state batteries, it may be misunderstood as falling behind in new technologies. CATL’s response: More than just solid-state batteries CATL’s main business includes four segments: power batteries, energy storage batteries, battery materials, and recycling and battery mineral resources. In 2023, the power battery segment contributed 71% of CATL’s revenue, while the energy storage battery segment accounted for nearly 15%. According to SNE Research data, in the first quarter of this year, CATL’s global battery installation volume reached 60.1GWh, a year-on-year increase of 31.9%, with a market share of 37.9%. Statistics from the China Automotive Power Battery Industry Innovation Alliance show that in the first quarter of 2024, CATL ranked first in the domestic market with a vehicle installation volume of 41.31GWh and a market share of 48.93%, a slight increase from 44.42% in the same period last year. Of course, new technologies and products are always the key to CATL’s market share. In August 2023, CATL released the Shenxing ultra-fast charging battery, the world’s first 4C ultra-fast charging battery with lithium iron phosphate, incorporating innovative technologies such as super electron network cathode, graphite fast ion ring, and ultra-high conductivity electrolyte, capable of achieving a 400 km range in just 10 minutes of supercharging.

CATL summarized in the first quarter financial report of 2024 that Shenxing batteries have begun large-scale deliveries. At the same time, CATL released the Tianheng energy storage system integrating “5 years of zero attenuation, 6.25 megawatt-hour level, multidimensional true safety.” CATL believes that the company still maintains an excellent industry position, leading technology, good demand prospects, diversified customer base, and high entry barriers. For CATL, solid-state batteries are not the only choice for the future. In addition to Shenxing batteries, CATL also cooperated with Chery last year to launch the first sodium-ion battery vehicle model. In January of this year, CATL applied for a patent named “sodium-ion battery positive electrode material and preparation method, positive electrode sheet, battery, and electrical device,” which is expected to further improve the performance of sodium-ion batteries in terms of cost, lifespan, and low-temperature performance. Furthermore, CATL is actively expanding its customer base. In recent years, CATL has actively expanded overseas markets. Considering the impact of geopolitical factors, CATL has chosen a lighter technology licensing model as a breakthrough, with potential customers such as Ford, General Motors, and Tesla. Looking at the heat of solid-state battery marketing, it is not so much that CATL has shifted from “conservative” to “active” regarding solid-state batteries, but rather that CATL has begun to learn to respond to market demands and is actively building an image of an advanced and forward-looking leader in power battery technology.

Just like CATL said in their brand promotion video, “Choose electric vehicles, choose CATL batteries.” For CATL, it doesn’t matter which car model users buy or which battery they choose, as long as users have a need, CATL can “make” it. It can be seen that in the rapid development of the industry, it is always necessary to be close to consumers, discover user needs, and B-end leading companies are no exception.