Source: Kanjian Finance 1. Rewrite in TSN style without adding any explanation. 2. Write in active voice, using passive voice only in rare cases. 3. Use short sentences. 4. Keep subject and verb close. 5. Omit unneeded words.

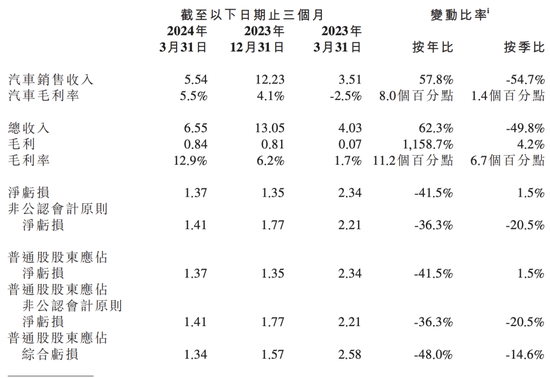

Following Ideal Auto, Xiaopeng released its first quarter report for 2024. Compared to Ideal Auto’s financial report, Xiaopeng’s report is much better. According to the report, Xiaopeng’s revenue in the first quarter reached 65.5 billion yuan, a 62.3% increase year-on-year; net profit was a loss of 13.68 billion yuan, a significant decrease of 41.5% year-on-year. It is worth mentioning that Xiaopeng’s gross profit margin in the first quarter has increased to 12.89%.

According to reports, Xiaopeng Motors’ gross profit margin has returned to double digits after more than a year. Driven by performance, Xiaopeng Motors’ stock price has seen a long-awaited surge. After the financial report was released, Xiaopeng Motors’ US stock price rose by as much as 26% intraday, closing down to 5.92%. In fact, after entering 2024, the new energy vehicle industry has entered the “elimination round” stage. Xiaopeng Motors has lowered prices multiple times to increase sales. Against this backdrop, Xiaopeng Motors’ performance gradually warming up and gross profit margin returning to double digits again indicate that despite intense competition in the industry, there are still opportunities. Kanjian Finance believes that although it is difficult for new carmakers, they have already formed their own competitive advantages globally. After the elimination round, going global will provide significant performance growth space for the final winners. In addition, when new energy vehicle companies penetrate into the mid-to-low-end vehicle models, it can also be a breakthrough method.

The better-than-expected performance of XPeng Motors is attributed to the increase in sales volume and prices. Breaking down the financial report, we believe that the significant improvement in performance is mainly due to the following factors: Firstly, the increase in the average selling price per vehicle. According to analysis by “Dolphin Research,” XPeng Motors’ average selling price per vehicle in the first quarter was 254,000 yuan (35060$), which is 51,000 yuan (7040$) higher than the fourth quarter of last year, a more than 20% increase. Despite multiple price cuts since the beginning of the year, the delivery of XPeng X9 in January offset the impact of the price cuts. Data shows that the XPeng X9, priced between 359,800 and 419,800 yuan (57940$), accounted for 36% of sales in the first quarter. Unlike the “Waterloo” of the Ideal Mega, the sales of the XPeng X9 prove that it has achieved a phase of success. Secondly, XPeng Motors “strictly controls” expenses. According to the financial report, XPeng Motors’ operating loss in the first quarter was 1.646 billion yuan, a significant improvement compared to the loss of 2.585 billion yuan last year. Media reports indicate that XPeng Motors initiated the “Jupiter Plan” channel transformation program last year, increasing the proportion of authorized stores and rapidly expanding into lower-tier markets through an expanded distribution model. By reducing the sales rebate percentage for dealers, XPeng Motors significantly reduced operating losses despite expanding by more than 70 stores, demonstrating that the channel transformation is taking effect.

Third, the technology research and development service fees in cooperation with the public have been received. According to the financial report, Xiaopeng Motors’ service and other sales in the first quarter of this year were 4.623 billion, while in the first quarter of 2023, the revenue from this business was 3.659 billion. According to relevant analysis, the main reason for the growth of this business is the receipt of income from the shared research and development expenses in cooperation with the public. Currently, Xiaopeng Motors seems to have found a “way out” in the fiercely competitive new energy vehicle market by selling technology to make money. Overall, Xiaopeng Motors’ ability to make money through technology also relies on past research and development investment. According to financial data, from 2020 to 2023, Xiaopeng Motors’ research and development expenses were 17.26 billion, 41.14 billion, 52.15 billion, and 52.77 billion respectively, totaling over 150 billion in four years. In the first quarter of 2024, Xiaopeng Motors has not slackened in research and development, with R&D expenses still reaching 13.5 billion. Undeniably, in the face of intensified competition, especially with the recent poor performance of Ideal Motors, Xiaopeng Motors’ financial report is indeed very impressive. The stock price performance shows that Xiaopeng Motors is now turning the tide.

In fact, although Xiaopeng has achieved outstanding results, it is far from time to “relax”. In terms of sales, Xiaopeng Motors’ cumulative sales in the first quarter of this year were 21,821 units, an increase of 19.7% year-on-year. Although sales have increased, the average monthly sales are only about 7,000 units. Xiaopeng Motors has not yet reached the “life and death line” of monthly sales of 10,000 units as mentioned by financial analysts before. He Xiaopeng once said that the goal for 2024 is to double performance, fill all organizational gaps, and strive for high-quality operation. It is expected that the sales target for 2024 will exceed 280,000 units. Data shows that Xiaopeng Motors’ cumulative sales in the first four months of this year were 31,214 units, only achieving 15.6% of the target. If sales do not accelerate in the second half of the year, based on current sales, the completion rate of this year’s target will only be about 50%. Of course, this is not just Xiaopeng’s problem, as Ideal Motors and NIO Motors also struggle to achieve their previously set targets.

In fact, Kuaikan Finance has analyzed Xiaopeng Motors more than once. The biggest challenge facing Xiaopeng Motors is the loss of its intelligent advantage. With the cooperation of Huawei and many car companies in the past two years, Huawei’s excellent intelligent technology has overshadowed Xiaopeng Motors’ intelligent technology. Comparing in terms of algorithms and computing power, Xiaopeng Motors uses NVIDIA Drive series chips for algorithms, while Huawei uses self-developed chips. In terms of computing power, Huawei’s investment in autonomous driving training is three times that of Xiaopeng Motors. Currently, new energy vehicles have entered the “second half.” All car companies are focusing on intelligence. Although Xiaopeng Motors has been able to maintain its advantage through technological accumulation, this advantage will become less and less obvious over time. In this background, Xiaopeng Motors can only focus on the lower-priced A-level market to seek opportunities and compete in a differentiated way. Xiaopeng has previously stated that they will launch A-level cars priced between 100,000 and 150,000, targeting the global market. Their future goal is to bring high-level intelligent driving and even autonomous driving into these cars while ensuring profitability. Undoubtedly, the strategy of incorporating autonomous driving into A-level cars is good, but in the A-level market, the ultimate cost-effectiveness is key. Autonomous driving is a bonus, not a necessity. With the competition from BYD, Geely, and other joint venture car companies, it is foreseeable that Xiaopeng Motors will face challenges in successfully entering the A-level car market. Although the road ahead is difficult, Xiaopeng Motors’ efforts have been recognized by the market, bringing a glimmer of hope. To break through, Xiaopeng still needs to work hard.