SAIC, stirring things up again. Recently, SAIC Group announced that its “Seven Major Technological Platforms” have entered the 2.0 era. The “Seven Major Technological Platforms” include the “SAIC Nebula” pure electric exclusive systematic platform, the “SAIC Zhufeng” electromechanical integrated vehicle architecture, the “SAIC Xinghe” hydrogen-electric integrated architecture, and the key system technologies of the “Blue Core” powertrain system, the “Magic Cube” battery system, the “Green Core” electric drive system, and the “Galaxy” full-stack intelligent vehicle solution. This upgrade relies on breakthroughs and applications of innovative technologies such as solid-state batteries, energy closed-loop, high-efficiency powertrain, intelligent chassis, full-stack software architecture, and new electronic architecture. Key points include: Solid-state batteries: By 2026, mass production of solid-state batteries with energy density exceeding 400 wh/kg; Energy closed-loop: Challenging the industry’s new record of “12 kilometers per kilowatt-hour” for pure electric vehicle energy consumption; Powertrain: By 2026, the power density of the electric drive system will exceed 4.4 kW/kg, leading the industry average by more than 40%; the thermal efficiency of hybrid drive systems will be increased to 46%; Intelligent chassis: By 2026, the line-controlled chassis system integrating vehicle motion control technology will be gradually put into mass production application; Full-stack solution: By 2025, the “Central Computing + Regional Control” intelligent vehicle full-stack solution 3.0 will be fully implemented, achieving integration of “compartment, driving, computing, and connectivity”, supporting Level 3 mass production of autonomous driving. According to SAIC, this is its new generation of platform technology for the new track. At the “Smart Coffee Summit” technology sharing event held by SAIC before this, several senior executives of SAIC discussed the challenges of transitioning from traditional automotive companies to new tracks, the difficulties of technological breakthroughs and industrialization, and also revealed some thoughts behind the new generation platform technology and its potential impact.

“Traditional automotive companies transitioning to new tracks is not easy” Zu Sijie, Vice President of SAIC Group, Chief Engineer, and Director of the Innovation Research and Development Institute, stated that for a traditional automotive company, transitioning to new tracks is not easy. He pointed out that over the past decade, SAIC has been simultaneously focusing on fuel and new energy, maintaining the base of fuel vehicle users, utilizing the fuel vehicle market to ensure profitability, and establishing core competitiveness in new energy. For traditional cars, SAIC is still the leader. In terms of new energy vehicles, SAIC has already reached international levels in terms of technological capabilities. However, in his view, SAIC still needs to strengthen its understanding of users. In addition, the first half of electrification has not ended, and fundamental issues still need to be resolved, such as the safety, comprehensive application, and cost issues of solid-state batteries. “SAIC is focusing on solid-state batteries to solve the core issues of electrification, and will be more down-to-earth in terms of intelligence.” In terms of product supply, he believes that SAIC needs to showcase its unique characteristics to users. “For an enterprise to achieve sustainable development, first, the values of the enterprise must be correct. Incorrect values will not lead far; second, the essence of an enterprise possessing core competitiveness lies in two points: core technology and the connection and feedback with users. I believe SAIC will definitely be at the forefront.” “We have learned a lot from the consumer electronics industry” According to Zu Sijie, “In the next two years, the seven major technological platforms 2.0 will fully empower nearly 30 new models of various vehicle brands under SAIC Group, accelerating the comprehensive evolution of the technological life form.”

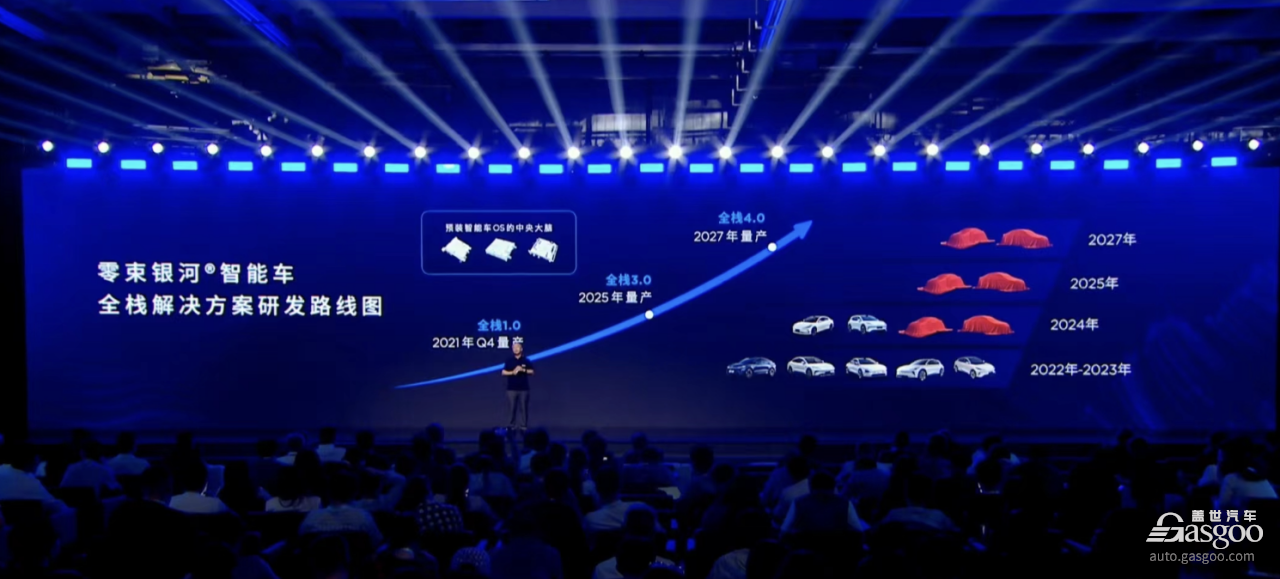

SAIC established a technical platform to adapt to the transformation of traditional cars to new tracks. The effects of shortening product cycles and reducing costs brought by the technical platform are particularly important for car companies. Zu Sijie said, “The concept of consumer electronics has entered traditional cars. The traditional car R&D cycle, we initially learned from GM, was 48 months, then reduced to 36 months, and further reduced to 26 months in our own development cycle, now it is 18 months. This is quite typical, of course, there are even shorter cycles.” In addition, costs are greatly reduced. He mentioned, “We are now not adding manpower, but reducing human factors through scientific methods.” “In terms of hardware, there used to be many test cars, and now simulation calculations cannot fully cover them, but now we have a technical platform. When fully verifying the platform, we basically reduce half of all test cars, and some experiments have been completed on the platform, so this area also saves a lot.” “In terms of software, although there are many changes in the new generation, much of the software is reusable.” He pointed out that SAIC’s Innovation R&D Institute has undergone a qualitative change in overall R&D paradigm and development methodology. “Objectively speaking, we have learned a lot from consumer electronics products because a major characteristic of the traditional automotive industry is that we think we are industrial giants, but in fact, we now have to learn from many other industries.” “Traffic, a part of traditional cars that need to learn from consumer electronics, because the big advantage of mobile internet is empowerment. Now with the internet, the masses can speak up, can have traffic transmission. From SAIC’s perspective, we also need to strengthen traffic management, communicate face-to-face with everyone, speak up about the bad things, and improve even more. SAIC’s values are user-oriented. We believe we have not done enough in this regard. We are not just providing a technology or a product, we need to provide solutions for users. We are also strengthening in this area. We need to actively communicate with everyone, and truly solve users’ problems. Users do not need technology, they need solutions. We need to explain technology in simple language, this is also an aspect to consider for users. “We can achieve ‘T+0’ the fastest.” SAIC Lingzhu Technology has already laid out the roadmap for the full-stack architecture of intelligent car cloud management end: Lingzhu Galaxy intelligent car full-stack solution 1.0 achieves “domain concentration”, focusing on L2++ intelligent driving, intelligent cockpit, and OTA; full-stack 3.0 achieves “centralized + regional control”, focusing on cost control and L3 level automatic driving; the future full-stack 4.0 solution focuses on intelligent human architecture, AI big models, AI OS, supporting L4/L5 level automatic driving.”

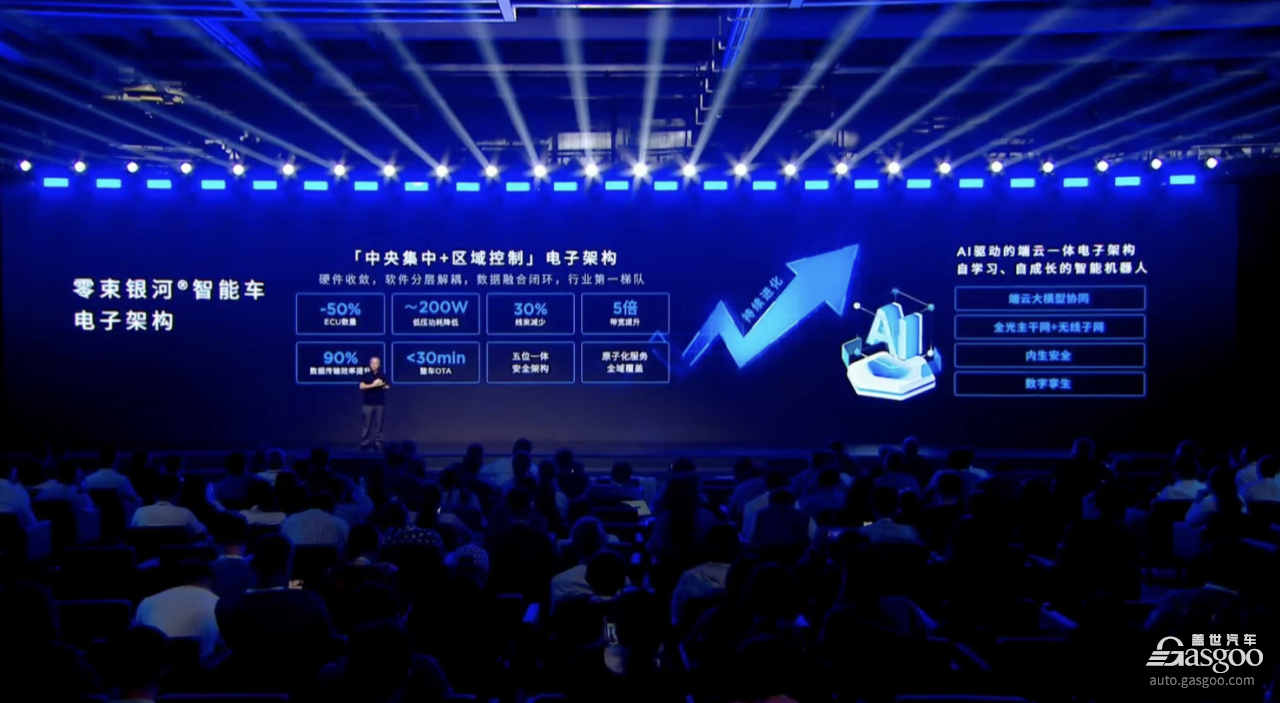

In 2022, SAIC launched the SAIC Zero Bundle Galaxy Full Stack 1.0, which has now evolved to version 3.0. On one hand, the central computing unit and the vehicle central motion control unit of the “brain” cabin and “cerebellum” were developed in synergy in terms of electronic architecture and software. The VMC, as a regional controller, has become an important node of the full stack 3.0, able to fully share signals from the vehicle’s sensors and actuators. By achieving centralized control of the vehicle’s 3 to 6 degrees of freedom, it can subsequently achieve features such as variable driving characteristics, and never slip during driving and braking, providing users with a safer, more comfortable, and energy-efficient experience. On the other hand, the full stack 3.0 fully supports large-scale edge applications and supports L3 mass-produced autonomous driving solutions. In addition, SAIC has joined hands with partners to launch the “ecosystem domain,” expanding smart terminals such as smartphones into a domain of smart vehicles. More and more brands of smart terminals will be connected to the Galaxy full stack, achieving a seamless and ultimate intelligent experience. Currently, SAIC’s “ecosystem domain” covers multiple smartphone brands including OPPO, vivo, Xiaomi, Huawei, and Apple. According to the plan, in 2024, the Galaxy full stack 3.0 is gradually “getting on board,” and by 2025, it will be fully implemented. It will effectively reduce the vehicle’s low-voltage power consumption, reduce the number of controllers by more than half, increase data bandwidth by 5 times, reduce wire harness length by 30%, and shorten OTA download and installation time to less than 30 minutes.

“The entire market is driving us to continue innovating,” said Li Jun, Deputy Dean of Innovation Research and Development at SAIC Group, and CEO of SAIC Lingbu. “We are truly standing from the user’s perspective on the foundation of technology and product concepts, continuously innovating and iterating for end-to-end products, digital experience products.” At the same time, speed is crucial. SAIC has full control over seven major technology foundations, including software architecture, intelligent cloud platform, and OTA. Therefore, speed is in their own hands. “Previously, it took us a month to iterate a version of the entire vehicle software. Now, iterating a version of the entire vehicle software with dozens of controllers only takes a week. If it’s applications and software, it can be done in just three days. For some small software, it can be done in ‘T+0.’ Therefore, from the perspective of whole vehicle products, our R&D system, R&D process, and R&D tool chain support the iteration of whole vehicle products approaching Moore’s Law of semiconductors,” Li Jun added. “Solid-state batteries are expected to reduce battery costs by 40%.” In the midst of the ongoing price war, Li Zheng stated that lowering prices is actually about lowering costs through technology upgrades, not negotiating with suppliers for lower prices. “In the battery field, reducing costs further in the lithium battery field can only be done through solid-state pathways.” He pointed out that currently, in the battery disassembly cost model, the cathode material accounts for about 40% of the cost, and there are usually only two choices for cathode materials: lithium iron phosphate and ternary lithium. Why other materials are not suitable. The reason is the compatibility between the battery system and the electrolyte. The stability of the reaction interface between solid and liquid is very high. Therefore, after careful consideration, ternary and lithium iron phosphate materials were chosen. “As the liquid content decreases and moves towards solidification, especially in the process of broadening the selection of positive electrode materials, the original liquid electrolyte may not coexist stably. However, more cost-effective materials can be chosen for solid-state batteries.” Usually, the cost of a product consists of material cost and manufacturing cost. Li Zheng stated, “By designing low-material-cost technology in the early stage, we have the opportunity to have better cost competitiveness, achieve scale faster, and ultimately achieve cost reduction on a larger scale. At least when the liquid content drops to 5%, the battery can have a cost advantage of approximately 10%-30%. Different batteries have different cost reduction rates, between 10% and 30%, which can further decrease to 40% in full solid state due to a wider range of material choices.” It is not difficult to imagine that this will greatly contribute to the further popularization of new energy vehicles in the future. “Mass production of all-solid-state batteries in China can proceed faster,” said Li Zheng, General Manager of SAIC Qingtao. Japan has been leading in lithium-ion battery industrialization with early start and advanced technology. China’s lithium battery industry development and industrialization started later compared to Japan. However, with a vast market, clear industrial guidance, and complete supply chain, Chinese companies are catching up in the lithium battery field. Li Zheng mentioned that China has transitioned from following to running alongside top international companies in battery innovation. The focus is now on all-solid-state batteries as the key to technological dominance. Japan has a strong foundation in solid-state battery research, holding 68% of related international patents. However, Li Zheng believes that there are significant opportunities for China and other countries in this field, despite Japan’s early lead. China has the largest advantage in the field of mass production of solid-state batteries, with the most complete industry chain, the largest market, and the most researchers. We are confident that mass production of solid-state batteries in China can proceed faster.

According to SAIC’s plan, the Zhiji L6 with Everlasting solid-state battery will be officially delivered to users in October this year, with energy density exceeding 300Wh/kg and range over 1000 kilometers. By 2026, SAIC’s all solid-state battery will achieve mass production and complete prototype testing, with energy density exceeding 400Wh/kg, more than double that of traditional power batteries. In 2027, the new Zhiji vehicle equipped with all solid-state battery will be mass-produced and delivered to users. In the future, energy density is expected to further increase to 500Wh/kg. Of course, Li Zheng also emphasized that it’s not a choice between one or the other, with or without him. “In the process of battery and electrochemical development, we have always been in a process of learning from advanced countries and technologies. Companies like Toyota, representing the industry, have been at the forefront of research and development in the field of all solid-state batteries. We greatly respect and admire their research progress, and have been learning, absorbing, integrating, and developing. Of course, we have our own route and ideas. In this process, we are not completely closed off, for example, in the industrial chain, we communicate and learn from relevant Japanese companies.”