In the past two years, the popularity of 4D imaging millimeter wave radar has been rising. Now in 2024, the year of large-scale production has arrived. Just in the past month, there have been continuous releases of new products and news about vehicles equipped with this technology. On May 15, NIO’s second brand, Lixiang L60, directly equipped all models with 4D imaging millimeter wave radar. Not only that, all models on the NIO NT3.0 platform will also be equipped. Behind the supplier, SAEON Lingdong, there have been multiple investments from Xiaomi and NIO Capital. On May 9, Huawei Gan Kun released a high-precision 4D millimeter wave radar with a detection range increased to 280 meters, imaging accuracy improved by 4 times, a 65% reduction in latency, and support for parking mode, greatly enhancing the perception capabilities of intelligent driving. On April 24, Uhnder launched a new 4D digital imaging radar solution, the S81, using a highly integrated single-chip solution supporting up to 96 MIMO channels, significantly improving cost-effectiveness. As of now, models including Lixiang L60, SAIC Fei Fan R7, Ideal L7, Changan Deep Blue SL03, and Lotus Eletre have all been mass-produced and launched with 4D imaging radar. With the technological accumulation, market, and capital driving forces, a high-profile trend of pre-installed vehicles equipped with 4D imaging radar has been set off.

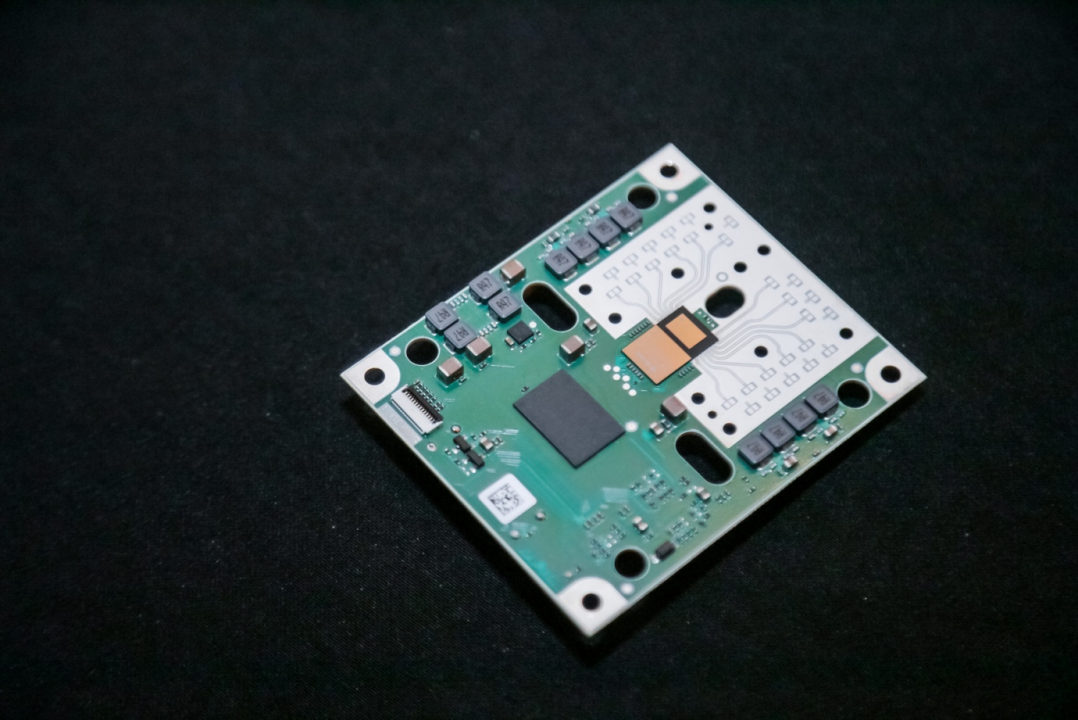

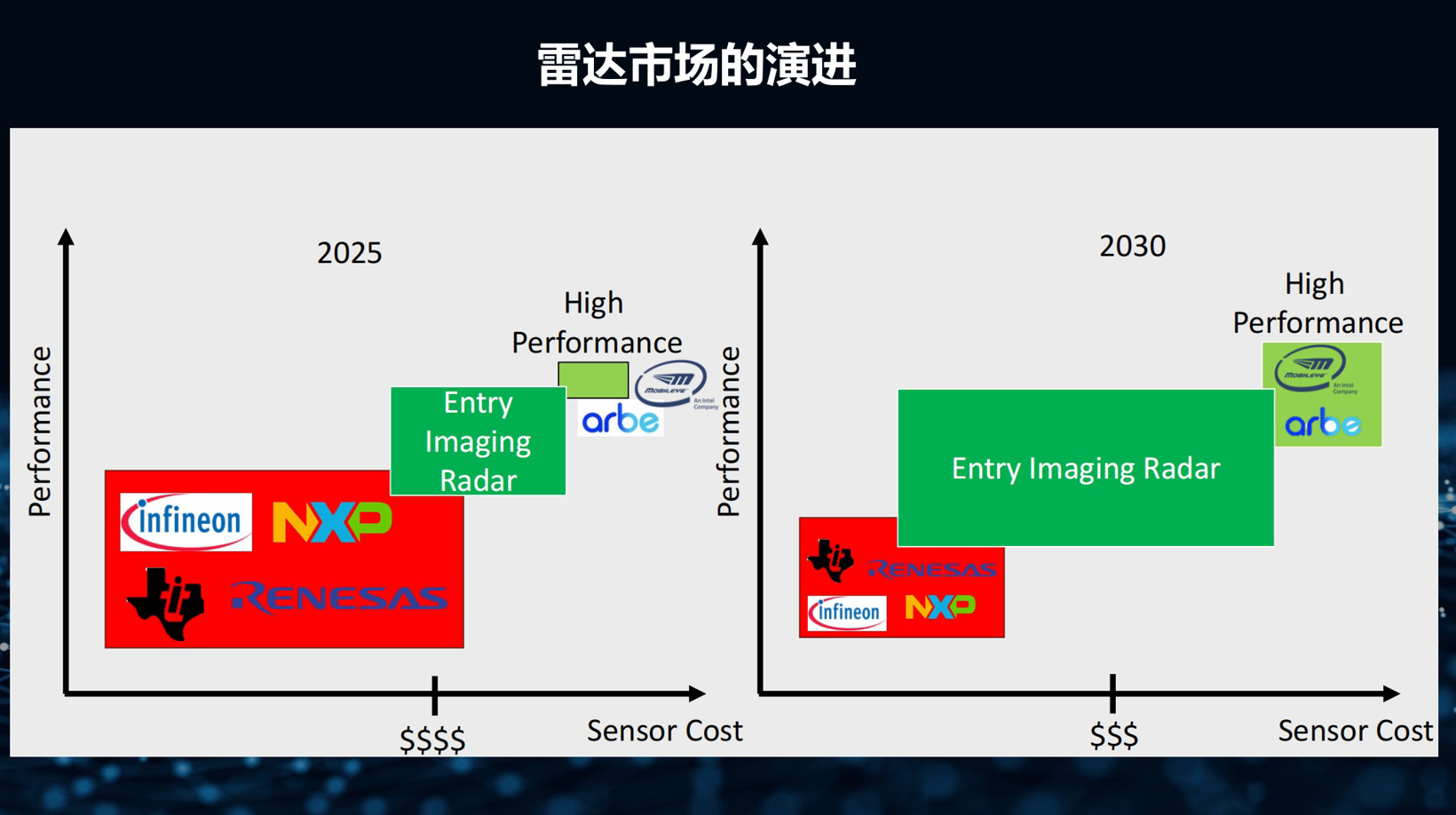

4D imaging radar, ushering in the year of mass production Looking back at the trends in the 4D imaging radar track over the past two years, it is clear to see that 4D radar is rapidly gaining popularity. More and more tech companies, startups, traditional Tier 1 companies are entering the track, with new vehicles being equipped and sensor configurations being adjusted. When it comes to the layout of 4D imaging radar, foreign manufacturers and traditional Tier 1 companies have taken action relatively early. For example, Israeli company Arbe launched the in-car 4D mmWave radar Phoenix as early as 2019; in 2021, Continental and Xilinx jointly released the world’s first mass producible 4D imaging radar ARS540; in 2022, Uhnder released the first automotive-grade certified 4D digital imaging radar solution S80 radar chip and achieved mass production; in 2023, Bosch announced the abandonment of developing autonomous driving LiDAR, with resources shifting towards the development of 4D mmWave radar and other radars… In addition to tech giants like Huawei, most domestic players are newly emerging startups in recent years. With the continuous acceleration of automotive intelligence, more and more companies are entering the field. Over 20 companies, including Sionlead, Aotu Technology, Sensatai, Muniu Technology, Chengtai Technology, Zongmu Technology, Geometry Partner, Chuanghang Technology, Xingyidao, Huayu Automobile, have already made layouts, and many have secured projects with car manufacturers, some entering the camp of pre-installed mass production. For example, Sionlead’s product CarJoy is on the market, Sensatai’s 4D imaging radar STA77-6 is equipped with Ideal L7 for mass production, Zongmu Technology’s product is equipped with Wenjie M5, Furuizhihang will deliver 4D mmWave forward radar hardware products and corresponding algorithm development to leading OEMs.

Industry insiders generally believe that local manufacturers of 4D imaging radar are expected to accelerate their development and even “overtake” by 2024, thanks to the increasingly improved supply chain system and intelligent electric vehicle ecosystem backed by China’s new energy vehicles. The first year of mass production of 4D millimeter wave radar is also expected to come. Max Liberman, Vice President of Chip at Uhnder, recently stated in an interview with Gasgoo that one of the reasons why the Chinese market is developing faster than any other region is that Chinese consumers actively seek to understand what cameras, LiDAR, or millimeter wave radar are installed on the car when they buy a car. This situation is less common in Europe and the United States, so we believe that the development of digital imaging radar in the Chinese market will be faster. In response to the huge demand in the Chinese market, Uhnder recently reached a strategic cooperation with the Automotive Electronics Division of Huayu, jointly launching in-vehicle digital radar and next-generation ADAS perception solutions. Uhnder also revealed that it does not rule out plans to establish a Chinese subsidiary or joint venture in the future. In fact, Uhnder’s layout in China this time is a microcosm of overseas manufacturers rushing into the domestic 4D millimeter wave radar market. As overseas manufacturers’ strategies in China become increasingly closer, this will inevitably lead to more intense competition on the racetrack. The timing for the hot wind of 4D imaging radar is just right. As we all know, radar is not a new technology, and traditional millimeter wave radar has been in use for more than 30 years. However, it has been tepid until the breakthrough of 4D imaging technology, which has finally brought millimeter wave radar into the spotlight. As an extension of millimeter wave technology, 4D imaging radar has two core technical breakthroughs compared to 3D millimeter wave radar: first, it adds height information on top of detecting objects in distance, speed, and horizontal angle, allowing real-time tracking of object motion trajectory with imaging capability; second, it has more transmitting and receiving antennas, higher point cloud resolution, approaching the level of low-beam lidar. 4D imaging radar can detect various objects up to 300 meters away, with a cost advantage of only 10%-20% compared to lidar. This has led to a rising popularity of 4D imaging radar, with at least 10 domestic enterprises in the field receiving financing since 2023, with disclosed total financing exceeding ten billion yuan. Not only reflected in corporate strategic actions, but also immediately impacting the capital market. It’s undeniable that in the current emphasis on cost reduction and efficiency improvement, the popularity of 4D imaging radar comes at just the right time. Once upon a time, domestic intelligent electric vehicles were piling up crazily, with the head of Great Wall’s salon Mech Dragon boldly stating “Less than 4, please don’t talk”, echoing the sentiments of many mid-to-high-end car companies. Now, under pressure to reduce costs and increase efficiency, the voices advocating for the shift away from lidar are becoming more and more prevalent. 4D imaging radar, with its technological and cost advantages, is advancing into the L2+ level intelligent driving field, competing with the lidar market.

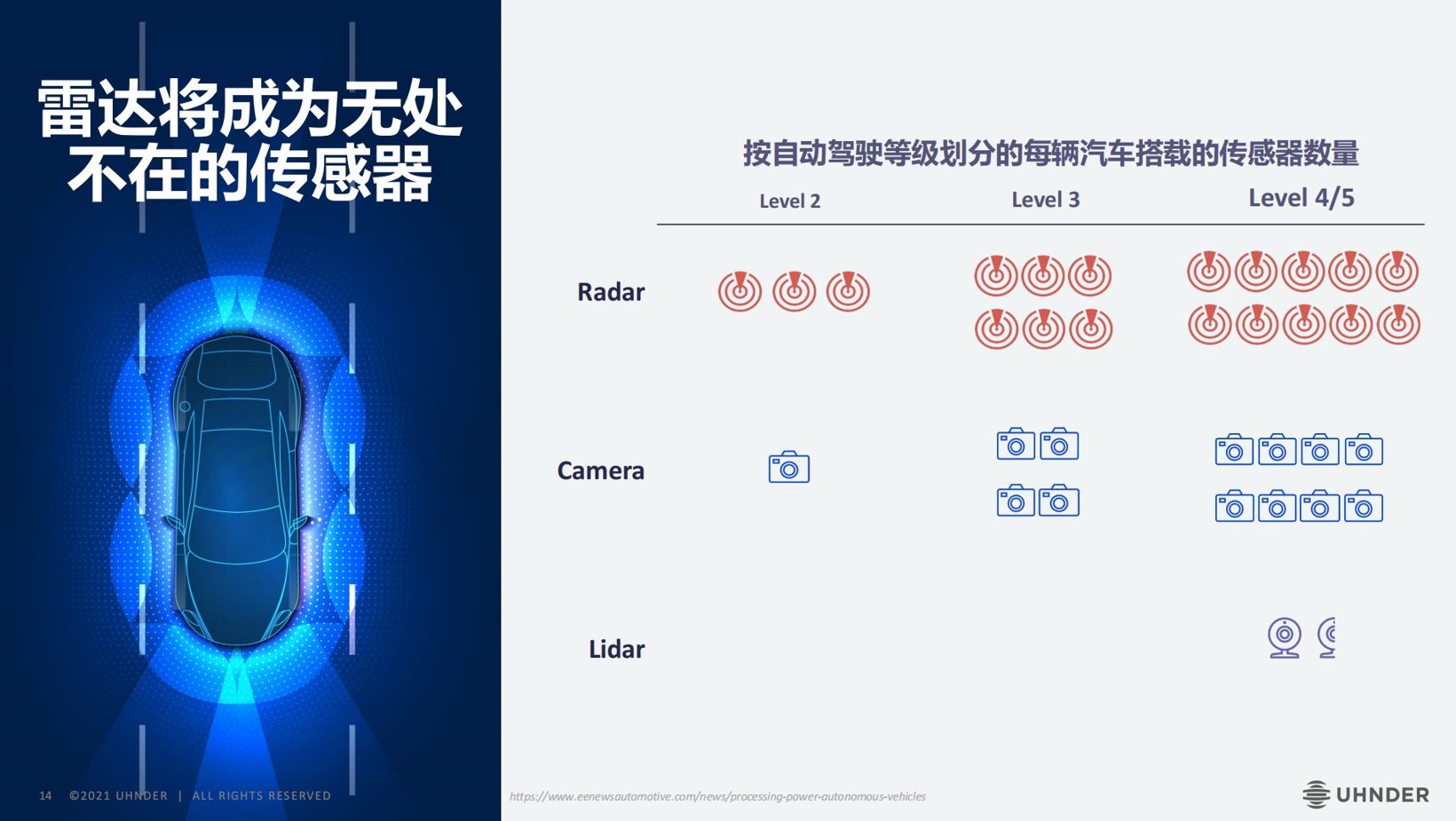

Although 4D imaging radar has not yet been widely used in the overall market, it is still in the early stages of small-scale testing. According to Max Liberman, the performance of 4D imaging radar is gradually catching up with lidar, and the cost is further decreasing. As technology matures, the market share of 4D imaging radar will continue to expand. This also responds to some voices in the industry that the positioning of the 4D millimeter wave radar market is not clear enough. At present, basic L2 intelligent driving solutions on the market generally choose a 1V1R perception scheme, which combines ordinary millimeter wave radar with a camera to pursue extreme cost savings. Higher-level L2+ intelligent driving solutions mostly still use lidar. So where is the growth space for 4D millimeter wave radar? According to the views of many industry insiders, the answer lies in the L2+ and even L3 target markets. Perception “new nobility” aims to compete with lidar In the development of automotive intelligence for many years, various perception technologies have evolved in controversy, and the industry has different opinions on the capabilities and advantages of various sensors in obtaining information about the surrounding environment. 4D imaging radar, as the “new nobility” in technology perception, is considered by many industry insiders to be the best cost-effective solution for L2+ intelligent driving perception hardware. Uhnder’s CEO and co-founder, Manju Hegde, mentioned at the end of last year that for the current L2++ level and NOA functions, a resolution of about 0.5° to 1° is sufficient, and 4D digital imaging radar can replace lidar. However, for further development to higher levels, lidar is still needed.

As autonomous driving advances to higher levels, the 1V1R solution is not enough. Max Liberman emphasized that while LiDAR has advantages in certain scenarios, it is still affected by adverse weather. Radar is the only sensor unaffected by weather, making it indispensable for autonomous driving. In terms of cost, imaging radar has a clear advantage over LiDAR. Additionally, the design size of LiDAR is difficult to make very small or compact, limiting its development. Currently, domestic intelligent electric vehicles have generally entered the L2 level of intelligent driving. According to the latest data from the Gaishi Automobile Research Institute, the standard configuration volume of L2-level new energy passenger cars in the market reached 924,000 units from January to March 2024, with a market penetration rate exceeding 53.3%. Among them, the penetration rate of L2 models in the price range of over 200,000 has exceeded 89%. As intelligent driving continues to advance, the penetration rate of higher-level intelligent driving is expected to increase. Undoubtedly, this will drive explosive growth in the future radar market, and the volume of the 4D imaging radar market will continue to expand. According to data from Yole, by 2028, the 4D radar market will reach $8.3 billion, a 36% increase from 2022. The 4D imaging radar market size will be $2.2 billion, a 49% increase from 2022. As the popularity of 4D radar continues to soar, an interesting phenomenon is that the car-mounted LiDAR market, which has long been criticized for its high cost, is gradually entering the sub-thousand-dollar segment. In mid-April, Speed Juchuang released the medium and long-range car-mounted LiDAR MX, with a price down to $200; Hesai Technology launched the ultra-wide-angle long-range LiDAR ATX based on the fourth-generation chip architecture, although the price was not disclosed, it has repeatedly mentioned “cost-effectiveness”; earlier, Geely’s Yikatong released two LiDAR products, claiming that the price of its short-range LiDAR can drop to around $100, and the long-range LiDAR is around $200. At the same time, with the expansion of production scale, cost reduction, and the improvement of market pricing capabilities, LiDAR manufacturers represented by Hesai Technology and Speed Juchuang are gradually moving towards profitability.

Technology advances, costs decrease. In the uncertain market landscape, competition between laser radar driven by factors such as pure visual route, cost-effectiveness, and the rising 4D millimeter wave radar will continue, especially targeting the L2+ market. Overall, as the penetration rate of high-level ADAS continues to increase, the high safety redundancy requirements determine that multi-sensor fusion is the future trend, and the sensor market such as laser radar and 4D imaging radar will maintain rapid growth. Of course, at the current stage, there is no doubt that the “new noble” 4D imaging radar is stirring up a wave of “replacement”.