Smart driving “unicorns” are flocking to IPOs. According to incomplete statistics from Gaishi Auto, more than 10 domestic companies in the field of autonomous driving have confirmed or are rumored to be advancing IPOs since the second half of last year, involving various core technical areas such as overall solutions, LiDAR, computing chips, and simulation testing. Most of them choose Hong Kong stocks, including Zhihang Technology and Speed Teng Juchuang. Recently, the China Securities Regulatory Commission website showed that Momenta Global Limited’s overseas issuance and listing filing materials submitted by its domestic operating entity, MMT Technology Co., Ltd., have been received by the CSRC, officially confirming the news of Momenta’s IPO in the United States. The competition in the intelligent driving industry is becoming increasingly fierce, and players are generally facing insufficient ability to generate profits and high capital pressure. Due to external factors, the difficulty of relying on primary market financing is also increasing. Under multiple challenges, new exits are inevitably needed. Even if they successfully enter the IPO, does it mean that the crisis has really been completely resolved? Smart driving “unicorns” collectively sprinting for IPOs. Recently, Heizhima Intelligence officially passed the listing hearing of the Hong Kong Stock Exchange, taking an important step towards listing on the Hong Kong stock market. Heizhima Intelligence first submitted an application to the Hong Kong Stock Exchange on June 30, 2023, aiming to become the “first domestic autonomous driving computing chip stock.” However, due to Heizhima Intelligence not passing the listing hearing within six months, the IPO application expired in early January.

Later, Heizhima Intelligence submitted a second application for listing in March this year, making good progress towards a Hong Kong IPO. If the listing process continues smoothly, Heizhima Intelligence is expected to become the first domestic automatic driving calculation chip company to go public. In the field of automatic driving calculation chips, Heizhima Intelligence is the first domestic company to sprint for a Hong Kong Stock Exchange IPO, but not the only one. In March this year, after Heizhima Intelligence submitted its application to the Hong Kong Stock Exchange for the second time, Horizon also submitted its prospectus to the Hong Kong Stock Exchange, officially starting the IPO listing process. Prior to this, Horizon had announced plans to go public several times. In 2020, Horizon was rumored to be listing on the Sci-Tech Innovation Board. In 2021, there were reports that Horizon was moving forward with a US IPO, aiming to raise about $1 billion. With the submission of the prospectus this time, it means that Horizon has officially put the IPO on the agenda. In addition, Wang Kai, founder, director, and CEO of ChipEng Technology, revealed that the shipment volume of the “Dragon Eagle No. 1” chip from ChipEng Technology is expected to reach millions by 2024, and the company will consider launching an IPO when sales and revenue increase rapidly. It is reported that ChipEng Technology is expected to achieve an IPO around 2025. This means that following the successful IPO listings of two major LiDAR “unicorns”, Hesai Technology and Suteng Juchuang, the leading players in the automatic driving calculation chip race have quietly begun a new round of capital competition. Similarly, the camp of automatic driving solution providers is also bustling. In addition to Zhihang Technology, which officially landed on the Hong Kong Stock Exchange in December 2023, according to Gasgoo Auto, there are currently many companies in this field, such as Youjia Innovation, Zongmu Technology, Wenyuan Zhihang, Xiaoma Zhixing, Momenta, etc., lining up for an IPO.

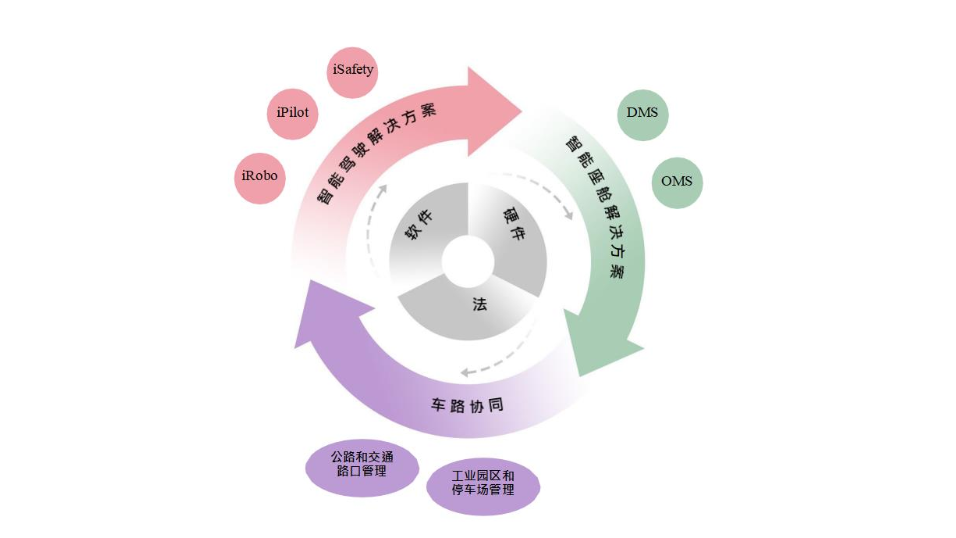

Yujia Innovation initially planned to go public on the A-share market and officially launched the IPO process in August 2023. However, considering changes in the overall market environment and future development opportunities in the international market, Yujia Innovation ultimately suspended its A-share listing in May this year and chose to switch to the Hong Kong Stock Exchange. On May 27, it formally submitted its listing application to the Hong Kong Stock Exchange. Zongmu Technology submitted its listing application to the main board of the Hong Kong Stock Exchange on March 28 this year. It is worth noting that this is the company’s third attempt at an IPO. As one of the earliest domestic startups in the field of autonomous driving, Zongmu Technology was approved for listing on the National Equities Exchange and Quotations system on January 19, 2017, with the stock code 870816. However, this listing did not last long. In December 2017, Zongmu Technology submitted an application to terminate the listing and it was delisted on the same day. Five years later, Zongmu Technology made another attempt at an IPO, applying to list on the Sci-Tech Innovation Board in November 2022, but was unsuccessful. On September 27, 2023, Zongmu Technology announced the withdrawal of its application to list on the Sci-Tech Innovation Board, marking its second failed IPO attempt. After the previous termination of the Sci-Tech Innovation Board IPO, analysts believed that Zongmu Technology would likely seek a listing and may turn to overseas capital markets represented by Hong Kong and U.S. stocks. After all, Zongmu has few choices in the IPO process, so the key now is whether they can “persevere through the storm to see the moonlight.” Like Zongmu Technology, Saimu Technology, as a leading representative in the field of intelligent networked simulation testing, has also experienced a difficult IPO journey. Established jointly by the Sidi Group under the Ministry of Industry and Information Technology and Beijing Bangbang Security Technology Co., Ltd., Saimu Technology has attracted investments from Huawei, Weixing Hengrun, and others. According to relevant statistics, Saimu Technology ranked first in the Chinese ICV simulation testing software and platform market in 2023, with a market share of about 5.9%. On May 29, Saimu Technology submitted its listing application to the Hong Kong Stock Exchange for the third time. The company had previously attempted to list on the Hong Kong Stock Exchange in December 2022 and October 2023, but was unsuccessful both times. According to relevant sources, Foritech is also in the final sprint stage of applying for a Hong Kong IPO. It can be seen that in this round of IPO frenzy, the majority of companies have ultimately chosen to list in Hong Kong. On one hand, compared to the A-share market, listing in Hong Kong is more advantageous for smart driving “unicorns” to seize international market opportunities, obtain more financing channels and business development opportunities, and seek more overseas market development possibilities. On the other hand, the current A-share IPO issuance policy continues to tighten, while the Hong Kong stock market is constantly lowering the threshold for overseas listing of technology companies. Moreover, policy support is still ongoing for mainland companies listing in Hong Kong. As of May 31, besides the companies that have obtained the filing notice, there are still 110 companies that have submitted filing applications, with 87 planning to list in Hong Kong. It is foreseeable that in this wave of Hong Kong IPO frenzy, more smart driving companies will seek to list in Hong Kong in the future. The lowering of listing thresholds has indeed provided more opportunities for IPOs for more smart driving startups. However, fundamentally, the key driver for smart driving companies seeking IPOs is the industry-wide funding shortage or performance loss issues. This is particularly evident in the prospectuses of various companies. According to Black Sesame Intelligence’s financial report data, as of December 31, 2023, Black Sesame Intelligence’s SoC products have accumulated shipments of over 152,000 pieces, accounting for 7.2% of China’s high computing power SoC market in 2023. Despite this, Black Sesame Intelligence has still not been able to escape losses.

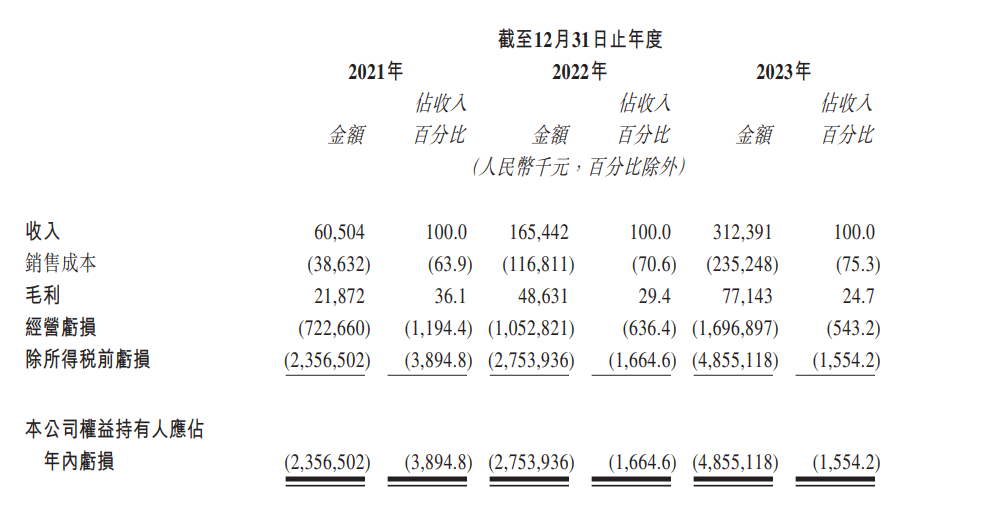

From 2021 to 2023, Heizhima Intelligence achieved revenues of 610 million yuan, 1.65 billion yuan, and 3.12 billion yuan. While revenue steadily increased, the company’s losses also grew year by year. The net losses for the past three years were 23.57 billion yuan, 27.54 billion yuan, and 48.55 billion yuan, totaling nearly one hundred billion yuan. Adjusted net losses for the same period were 6.1 billion yuan, 7.0 billion yuan, and 12.5 billion yuan, totaling 25.6 billion yuan, still in substantial losses. Heizhima Intelligence pointed out that the company’s significant losses were mainly due to excessive research and development investment. It is well known that chips themselves have multiple typical characteristics such as intensive funding, talent, and technology, all of which require substantial financial investment. From 2021 to 2023, Heizhima Intelligence’s research and development investment were 5.95 billion yuan, 7.64 billion yuan, and 13.63 billion yuan, accounting for 984%, 461.8%, and 436.2% of total revenue for each respective period. Similar to Heizhima Intelligence’s situation, due to a high input-output ratio and insufficient blood-making ability, Horizon also faces significant losses.

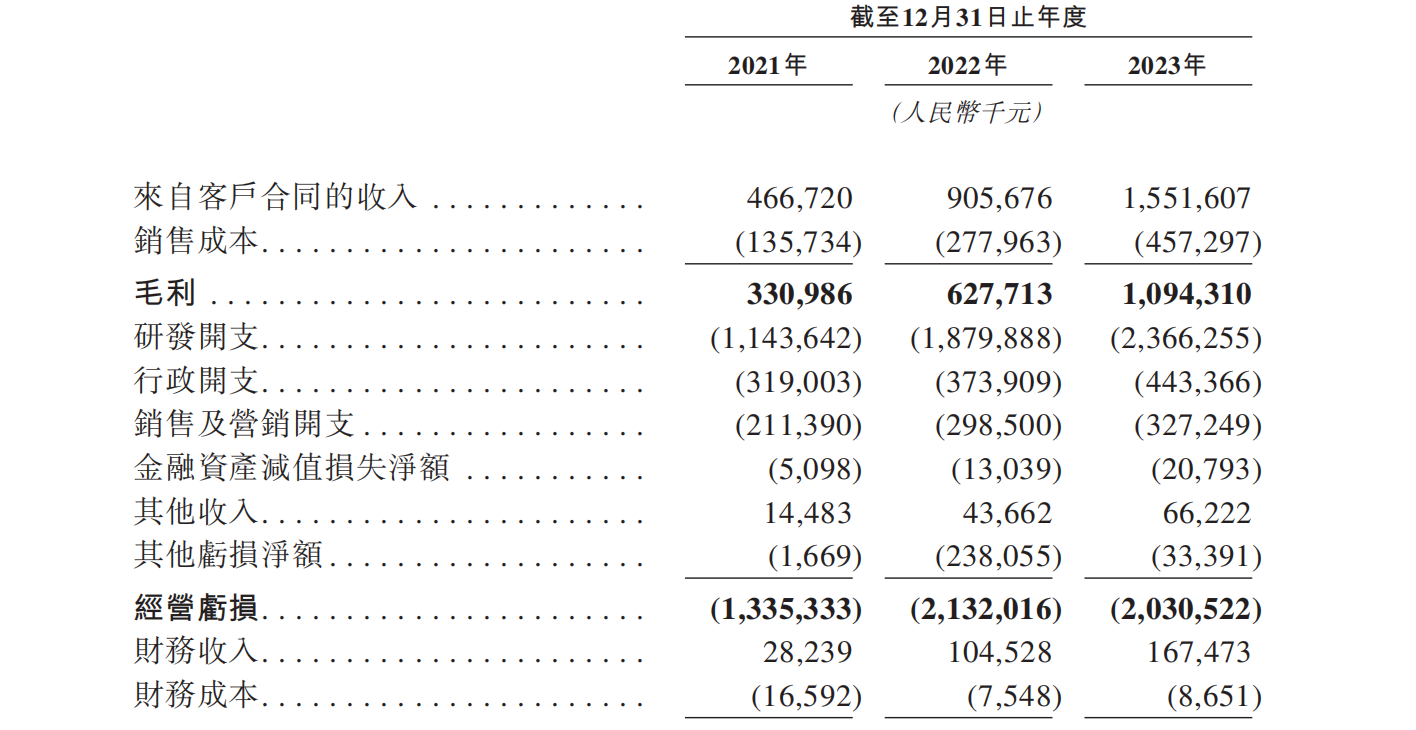

From 2021 to 2023, Horizon achieved revenues of 4.67 billion yuan, 9.06 billion yuan, and 15.52 billion yuan, with a compound annual growth rate of 82.3%. Since then, Horizon’s production scale has continued to expand, serving as the core support for its business growth. According to the prospectus data, as of the last feasible date, Horizon’s integrated solution has been adopted by 24 OEMs, deployed in over 230 models. Since the large-scale production began in 2021, Horizon’s hardware delivery has reached 5 million units. However, due to high R&D expenses and the early stage of commercialization, Horizon requires significant investment in market expansion, brand marketing, and technology enhancement. In the past few years, Horizon’s performance has remained consistently in the red. From 2021 to 2023, Horizon’s net losses were 20.64 billion yuan, 87.2 billion yuan, and 67.39 billion yuan, totaling 175.23 billion yuan. Adjusted net losses were 11.03 billion yuan, 18.91 billion yuan, and 16.35 billion yuan, totaling 46.29 billion yuan. R&D expenses during the same period were 11.4 billion yuan, 18.8 billion yuan, and 23.66 billion yuan, representing 245%, 207.6%, and 152.5% of the revenue respectively. In addition, YOUDRIVE Innovation, Zongmu Technology, and even the successfully listed Hesai Technology, Suteng Juchuang, and Zhixing Technology, have not yet turned a profit, with some companies still experiencing increasing losses. The only exception may be Saimu Technology.

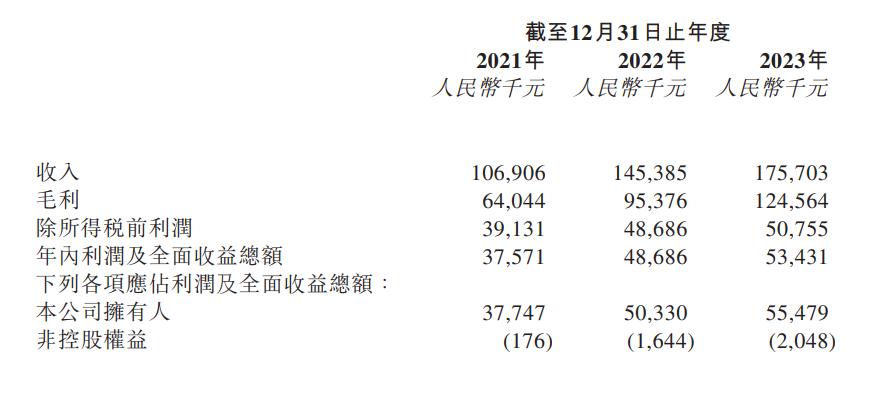

According to the data disclosed by the company, from 2021 to 2023, Saime Technology achieved revenues of 106 million yuan, 145 million yuan, and 176 million yuan respectively; net profits were 37.57 million yuan, 48.68 million yuan, and 53.43 million yuan, making it one of the few enterprises in the current smart driving track that have achieved positive profitability. While the main business continues to lose money, the smart driving track has gone through several years of trials. Although some leading players have emerged in various sub-tracks, the overall market structure is far from mature and stable. Even the leading companies still need continuous capital investment to upgrade technology and expand the market to build sustainable competitiveness. In the past, when smart driving companies lacked the ability to “generate blood” on their own, they could still obtain sufficient financial support through financing in the primary market. According to the information disclosed by Tianyancha, before submitting IPO applications, Horizon Robotics, Black Sesame Intelligence, Youdrive Innovation, Zongmu Technology, Suteng Juchuang, and Hesai Technology disclosed 14, 9, 12, 10, 14, and 10 financing rounds, respectively. However, as more and more players in the smart driving industry chain start commercial mass production, the entire track has transitioned from concept and demo competition to targeted production and mass production. Meanwhile, influenced by multiple factors such as the pandemic and changes in the international situation, coupled with the appearance of valuation bubbles in leading companies, financing for smart driving companies in the primary market has become increasingly difficult. Under the dual pressures from within and outside, going public through IPO will open up new financing channels and business development space, which will inevitably become the choice for more and more companies. On the other hand, while IPO listing can alleviate the current financial pressure to a certain extent for smart driving companies, it is more important to build a solid and sustainable business model. Otherwise, relying solely on capital market financing and neglecting the sustainability of internal growth drivers and profit models is no different from a “house of cards.”

Early-listed overseas lidar companies such as Velodyne, Luminar, Aeva, Innoviz, Ouster, and Quanergy have seen significant declines in stock prices and market values over the past two years due to weak business development and lack of sustainable profit support. Luminar, which went public at the end of 2020 with a valuation of $3.4 billion, once the highest-valued lidar company in the US stock market, is now worth less than $700 million, a nearly 80% drop. Quanergy, which went public through a SPAC in early 2022 with a valuation of up to $2 billion, filed for bankruptcy protection just 10 months later. In comparison, several domestic smart driving industry chain companies that have successfully IPO’d since 2023 have shown relatively stable performance. For example, ZhiXing Technology, which went public at the end of 2023 at a price of HK$29.65 per share, is now trading close to HK$80 per share, with a total market value of HK$18 billion, compared to just over HK$6 billion at the time of listing.

The performance of Suteng Juchuang is also very impressive. The IPO price was HK$43 per share at the beginning of the year, and now it has risen to HK$70, with a total market value exceeding HK$30 billion. On June 11, the market value of Suteng Juchuang once reached the milestone of HK$40 billion. Behind this, in addition to the strong development momentum of the listed company itself, the continuous improvement of technological maturity and the continuous acceleration of commercial applications, to a large extent, may also benefit from the overall vigorous development trend of the Chinese intelligent driving industry. This has led to the value chain of this track being revalued and reshaped, further highlighting its long-term investment value and growth potential. For whatever reason, the situation where companies in the intelligent driving industry chain are undervalued and overlooked in overseas secondary markets is quietly being rewritten.