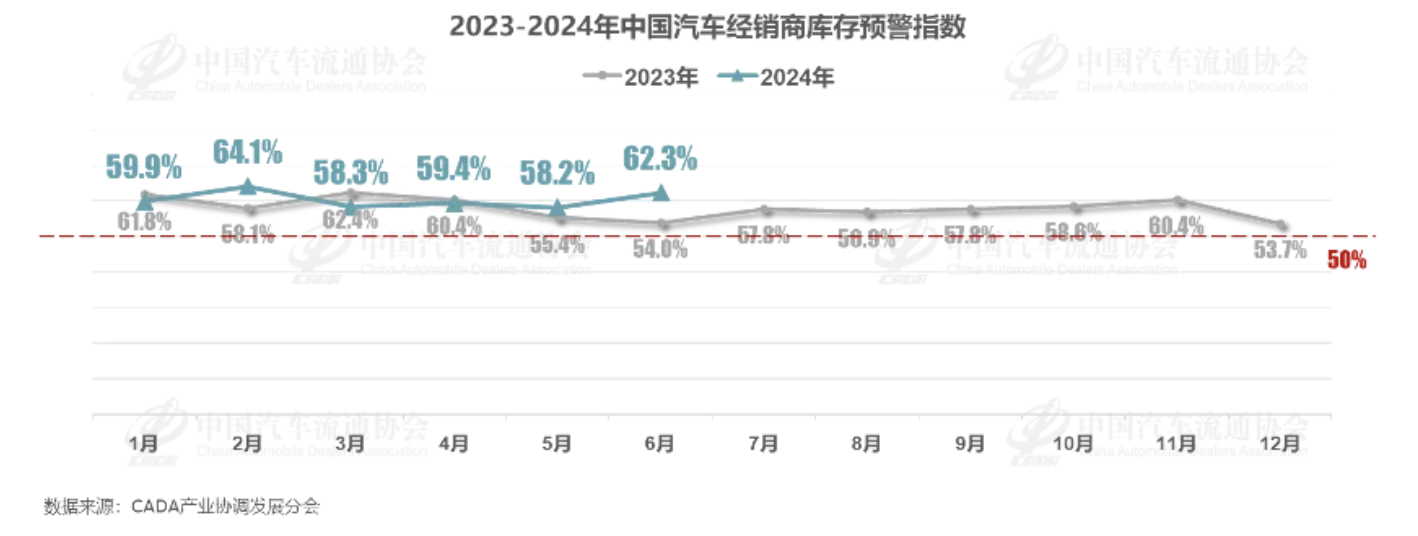

On June 30, the latest “China Automobile Dealers Inventory Alert Index Survey” released by the China Automobile Circulation Association showed that in June, the inventory alert index for automobile dealers in China was 62.3%, an increase of 8.3% year-on-year and 4.1% month-on-month. Dealer inventory pressure remains high.

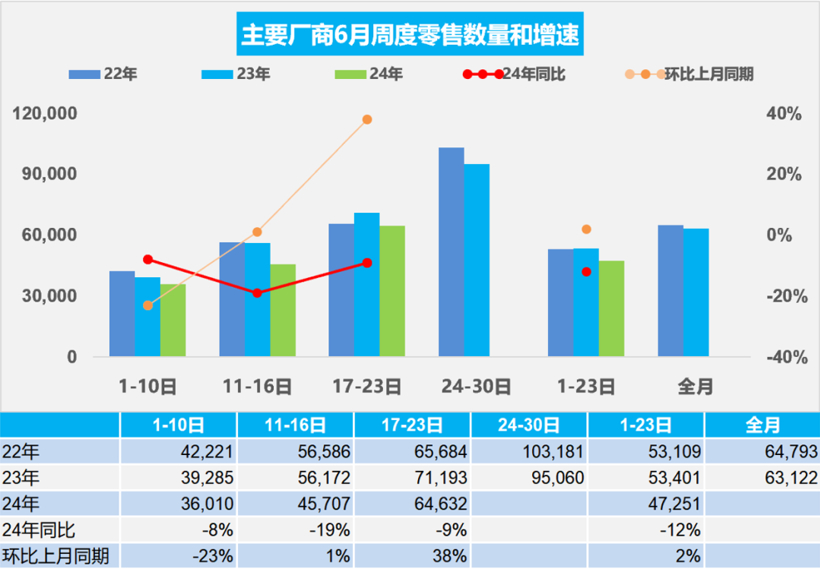

Passenger car market enters the final stage of the first half of the year, with sales in June showing an upward trend compared to the previous month. Car manufacturers and dealers are making strong efforts to boost sales performance. New car price wars have cooled down temporarily, while policies such as incentives for trading in old cars and large-scale promotions like “618” continue to drive the momentum of car purchases in June. Data released by the China Passenger Car Association shows that from June 1st to 23rd, retail sales of passenger cars reached 1.087 million units, a 12% decrease compared to the same period last year but a 2% increase from the previous month. New energy vehicles remain the main driver of sales growth, with retail sales of 534,000 units from June 1st to 23rd, a 19% increase from the same period last year and a 7% increase from the previous month. It is worth mentioning that looking at the weekly sales trend, sales in the first week of June saw a noticeable decline, but there was a rapid increase in the third week, with a 38% increase compared to the previous week, showing an overall upward trend. The China Automobile Dealers Association predicts that terminal sales of passenger cars in June will see a slight increase compared to the previous month, reaching around 1.75 million units.

Despite a slight increase in monthly sales in the auto market, the year-on-year decline is more noticeable, indicating insufficient consumer confidence in the country. In addition, in June, many areas entered the busy farming season, with hot weather and heavy rain in the south affecting dealer traffic and transactions. Combined with mid-year inventory clearance, wholesale volume was high in May and June, leading to an increase in dealer inventory in June. Dealer sales performance in the first half of the year varied significantly, with only 18.4% meeting their targets. A survey showed that dealer sales performance in the first half of the year varied significantly, with 18.4% of dealers already meeting their targets, 34.8% achieving over 80% of their targets, and 13.5% falling short of 50% completion. Furthermore, in order to meet their mid-year targets, many dealers resorted to “price for volume” tactics, lowering new car prices significantly and reducing gross profits, deteriorating their business operations. Even some of the top dealerships are experiencing turmoil, with the stock price of the well-known domestic dealership group Guanghui Auto continuously falling. As of the close of trading on the 28th, the stock price has fallen below 1 yuan (0$) for 7 consecutive trading days, facing the risk of delisting, which has dampened sentiment in the circulation sector.

Entering July, traditionally a slow season for the automotive market, dealers believe the market is holding steady compared to June. With price wars cooling down, several car companies are reducing discounts, leading to a decrease in consumer purchasing intentions and an increase in wait-and-see sentiment. Looking ahead to the second half of the year, dealers are cautiously optimistic, expecting the overall automotive market to maintain last year’s level, with downward pressure on end sales. 22.0% of dealers believe sales will remain stable, while 17.7% anticipate a decrease of over 15% in sales in the second half of the year. The China Automobile Dealers Association suggests that uncertainty in the future automotive market is increasing, and dealers should rationally estimate actual market demand based on the situation. They also recommend increasing publicity for the “trade-in for new and scrap renewal policy,” boosting consumer confidence through enhanced services, prioritizing cost reduction and efficiency improvement, and guarding against operational risks.