Finance News by Hua Feng Editor: Zhao Tong As we pass the halfway point of 2024, sales data for the first half of the year from various brands have been released. It’s time to assess their performance so far this year. Ideal and Hongmeng Zhixing, the two leading players in the field of extended-range vehicles, are still in a tense state; Jike and Weilai, as high-end pure electric brands, closely follow, with a small gap between them; Zerun and NIO have shown significant progress in following the example; Xiaopeng is falling behind and hasn’t recovered yet, not living up to the title of “Weilai’s little brother”; Xiaomi, although towards the bottom of the list, is hiding potential waiting to be unleashed. If we consider the halfway point as a midterm exam, with progress towards the annual sales target as the standard, most brands are scoring below 40, and some trailing brands can only manage a score of 20.

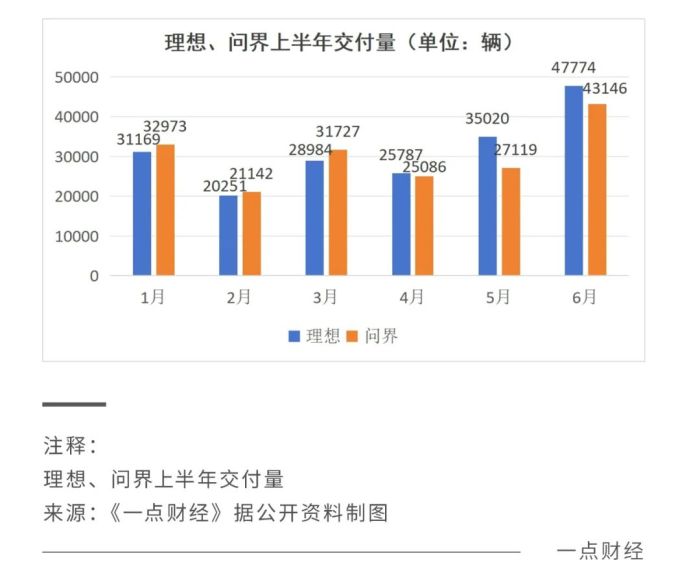

The status of each brand is different, but they all face the same pressure: under the price war, no one can stay out of it, the only way is to work hard to roll down. Ideal and Hongmeng are fighting, Xpeng and NIO are catching up. From the newly released sales data in June, the differentiation of new energy vehicle companies is still obvious. The best-performing Ideal car and Huawei Hongmeng Smart Travel firmly hold the first echelon, with a total of about 93,900 vehicles sold, equivalent to the monthly sales of the second and third echelons such as NIO, Leapmotor, Xpeng, Neta, Zhiji, etc. The top-ranked Ideal continues to lead, with a delivery volume of 188,981 vehicles in the first half of the year, achieving 33.7% of the annual target of 560,000-640,000 vehicles. In June, 47,774 vehicles were sold, an increase of 36.4% compared to the previous month, with Ideal L delivering over 20,000 units in June. After the defeat of the all-electric route pioneer Ideal MEGA, the price of Ideal L6, released in April, dropped below 300,000 yuan (41270$), taking the cost-effective route and promptly taking over the burden of boosting sales. However, Ideal L6 seems to have squeezed the sales of Ideal L7. In April and May, Ideal L7 sales showed a continuous decline compared to the same period last year and the previous month, indicating that the “nesting doll” product strategy is not a one-time solution. Since April this year, Huawei has begun to merge the sales of the Hongmeng Smart Travel brand, all for one word – win, but still unable to beat Ideal, with a delivery volume of 181,197 vehicles in the first half of the year. In June, Hongmeng Smart Travel sold a total of 46,141 vehicles, with 43,146 units of the Wanjie and 2,995 units of the Zhijie. The Wanjie M9 and the mid-range flagship new M7, priced at over 500,000 yuan (68790$), each delivered around 18,000 units in June, while the lowest-priced Wanjie new M5 performed slightly worse, delivering 7,046 units in June. Obviously, Wanjie users are willing to pay for higher-end models. A recent salesperson at Wanjie claimed on social media: “Wanjie M9 combines technology, while Ideal L9 combines parts.” Ideal’s vice president Liu Jie openly refuted, “Ideal L9 is the pioneer of new energy full-size SUVs.” From sales competition to war of words, the close combat between Ideal and Wanjie will continue, perhaps this is the fate of direct competitors.

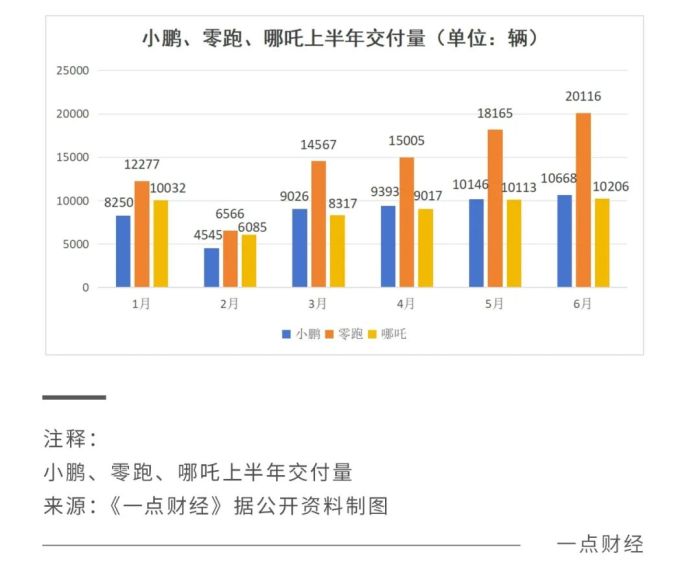

Under the dominance of the two major extended-range leaders, NIO and Xpeng are currently the best-selling high-end pure electric brands, supporting the second tier. NIO’s situation is clearly improving, delivering 21,209 vehicles in June, breaking the 20,000 mark again. With the adjustment of NIO’s BaaS strategy and prices, the willingness of users to accept battery rental models is increasing. NIO’s sub-brand, Lixiang, is also a major weapon. The first model, Lixiang L60, will be launched in September with a starting price of 219,900 yuan (30250$). Xpeng, which went public on the US stock market in May, has delivered a total of 87,870 vehicles in the first half of the year, an increase of 106% year-on-year. Xpeng’s current most successful model is the Xpeng P7, a unique electric mid-sized sedan that single-handedly supports most of the brand’s sales. The Xpeng P7’s sales in May were 13,480 units, accounting for 72.4% of total sales. The Xpeng 007’s sales were 4,308, below expectations. The recently released 2025 Xpeng X has a starting price of approximately 179,000 yuan (24630$) after discounts, making it 20,000 yuan (2750$) cheaper than the previous model. Xpeng is actively trying to find ways to support sales. Overall, the competition among the top brands on the list remains intense, with differentiation likely to intensify. NIO’s imitation show, XPeng falling behind is quite disappointing. The pressure on the second-tier brands is much greater than on the top brands on the list. In the first half of the year, NIO delivered a total of 53,770 vehicles, with a monthly average of less than 10,000 vehicles. The completion progress of the 300,000 annual target is less than 20%, facing significant pressure in the second half of the year. The NIO L, which was launched in April, gave NIO a breather. As a family extended-range SUV, its pure electric range exceeds 300km, with a comprehensive range of 1300km, starting at a friendly price of 129,900 yuan (17870$). Boosted by the NIO L in June, performance improved slightly, delivering 10,206 vehicles. However, due to long-term low sales, its operational situation is not very good, accumulating losses of 18.4 billion yuan over the past three years. NIO officially submitted an IPO application to the Hong Kong Stock Exchange in June. Whether developing new car models, preparing for a price war, or expanding overseas markets, NIO’s need for funds is quite significant, requiring sales support. The question is, is it easy to sell if it’s cheap? Not necessarily, as the pressure from participating in price wars is significant. NIO’s gross profit margin has been negative since the beginning of the year, with limited room for price cuts. Additionally, with BYD leading the way, competition pressure is also high. The NIO L is filled with shadows of the ideal L series, claiming to be “half-price ideal.” However, in this respect, XPeng is also a “master.” In the first half of this year, XPeng delivered a total of 86,696 vehicles, a year-on-year increase of 94.8%, completing 34.6% of the annual target of 250,000 vehicles. Among them, 20,116 vehicles were delivered in June, achieving an unprecedented good result, thanks to the strategy of “extended-range SUV + low threshold” hitting the needs of family cars. Since March, XPeng has been delivering the C10 in large quantities, with monthly sales stable at around 5,000 vehicles. The C16 claimed to have sold 5,208 units within 48 hours of its launch, with prices ranging from 130,000 to 190,000 yuan (26140$), in a highly competitive price segment. XPeng adopted the “pure electric version + extended-range version” dual-line strategy early on, which seems to be somewhat effective. However, the not-so-good news is that in the second half of this year, more and more brands will enter the extended-range track. Faced with competitive pressure, everyone is no longer holding back.

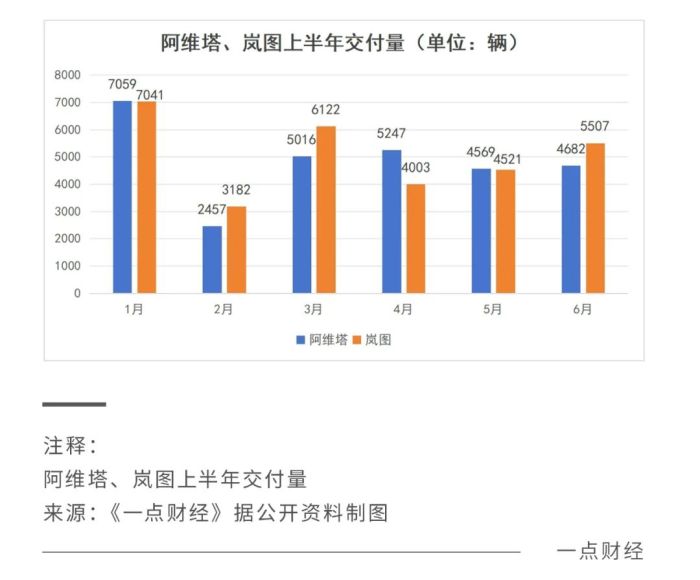

Xiaopeng, despite the reputation of “Wei Xiaoli”, has fallen behind in sales, with a weak performance for several months. In the first half of the year, a total of 52,028 vehicles were delivered, achieving only 18.5% of the annual sales target. The iconic product P7 of Xiaopeng has been struggling for years and has not been refreshed. The current monthly delivery volume has dropped to the level of one or two thousand vehicles. The situation is even worse for P5, with only a few hundred vehicles delivered. Xiaopeng’s G6, which competes with Tesla Model Y, had an average monthly delivery volume of only about 2,000 vehicles in the first six months of this year. He Xiaopeng stated that starting from the third quarter of this year, Xiaopeng will launch a strong product cycle of introducing more than 10 new models within three years. On July 3rd, the first model M03 officially debuted, positioned as “the most beautiful A-class intelligent pure electric coupe hatchback” in China, priced at under 200,000 yuan (27510$), making it a more popular model. Whether Xiaopeng can return to the top tier depends heavily on the performance of this model in the second half of the year, which could be Xiaopeng’s opportunity for a comeback. With intense competition in the domestic market, one major way for the second-tier brands is to expand overseas. Nezha has been thriving in the Southeast Asian market, and in its prospectus, it stated plans to further invest in the Southeast Asian market and expand to Latin America, the Middle East, and Africa. Lingpao, on the other hand, has mature channels overseas through the Stellantis Group, with rapid progress and plans for a wide-ranging expansion from Europe to Southeast Asia and even Africa. Xiaopeng is also advancing in the layout of overseas markets. The main task of Xiaopeng G9 and Xiaopeng P7 is to open up the European market, with delivery volumes expected to continue to increase in the second half of the year. With the competitive configurations and technology developed in the domestic market, Chinese brands do have strong competitiveness in overseas markets. Under the pressure to survive, expanding overseas is indeed an effective strategy. Xiaomi leads the way, Lantu and Avita are struggling In the third tier, rankings are close, but actual situations differ greatly Xiaomi’s SU7 entered the battlefield in the first half of the year, with deliveries exceeding 25,000 units and over 100,000 orders on hand With the keywords “first car, single model, non-SUV, 100,000 orders, monthly deliveries exceeding 10,000,” many brands envy and imitate Xiaomi’s explosive growth In just three months, Xiaomi has entered the third tier, increasing production capacity can boost deliveries and prevent order losses However, Xiaomi is a new player in the industry, recent signal interference issues reflect the need for more manufacturing experience Lantu and Avita, similar in rankings, each face their own challenges Lantu delivered 5,507 units in June, with a total of 30,376 units in the first half of the year, facing difficulties with a niche market for their main model Lantu’s Dreamer has monthly deliveries of around 3,000 units, better than most competitors but still behind BYD’s Tang D9. Overall, Rantoo still lacks a popular product for the mass market.

Avita delivered 29,030 vehicles in the first half of the year, which is definitely not a satisfactory result. As a brand created by Changan Automobile, Huawei, and CATL, Avita was expected to perform better in the market but has not been able to gain traction. The main reason is overestimating the support from Huawei and CATL. The iteration of core configurations is slow, pricing no longer matches the market, and competitiveness is declining. Avita is 70% short of its annual sales target of 100,000 vehicles, disappointing Changan Automobile’s goal of transitioning to new energy vehicles. Changan Automobile has begun a major reform of Avita. Reports suggest a shift in marketing channels from direct sales to dealerships, highlighting a cost-saving purpose. The first extended-range model, Avita 07, has been teased, and another new model, Avita E16, will offer both extended-range and pure electric powertrains, planning to launch in the fourth quarter of this year. Similar to Avita, Zhiji is also transitioning to extended-range vehicles. The price war is intense, with the elimination round already underway. Brands delivering over 30,000 vehicles in the first half of the year are in a dangerous position, and no one wants to sit back and wait for defeat. It is clear that everyone needs to learn from their ideals. After all, increasing sales is what really matters. In the current situation, car companies know well whether face or substance is more important. In conclusion, the automotive industry is full of news about price cuts, with fierce competition and no longer the harmonious atmosphere of the past. According to data from Gaishi Research Institute, as of April this year, nearly 40 car brands and over 130 models have participated in the “price war” in the domestic car market. There are different opinions within the industry about the phenomenon of intense competition.

Under pressure, brands are showing their strengths in two ways: embracing the extended range route and participating in price reductions and upgrades. The extended range route is extremely popular this year, as can be seen from the sales rankings, with four of the top six brands focusing on extended range. Competition is fierce, with brands getting closer to the extended range route, leading to shorter update cycles for models. For example, the Wanjie M7 took only 8 months to update, while the Jike X refreshed twice in just half a year. The ever-changing competition pressure is evident. Nevertheless, in the wave of survival of the fittest, competition in the second half of the year will be even more intense, and only time will tell which factors weigh more heavily.