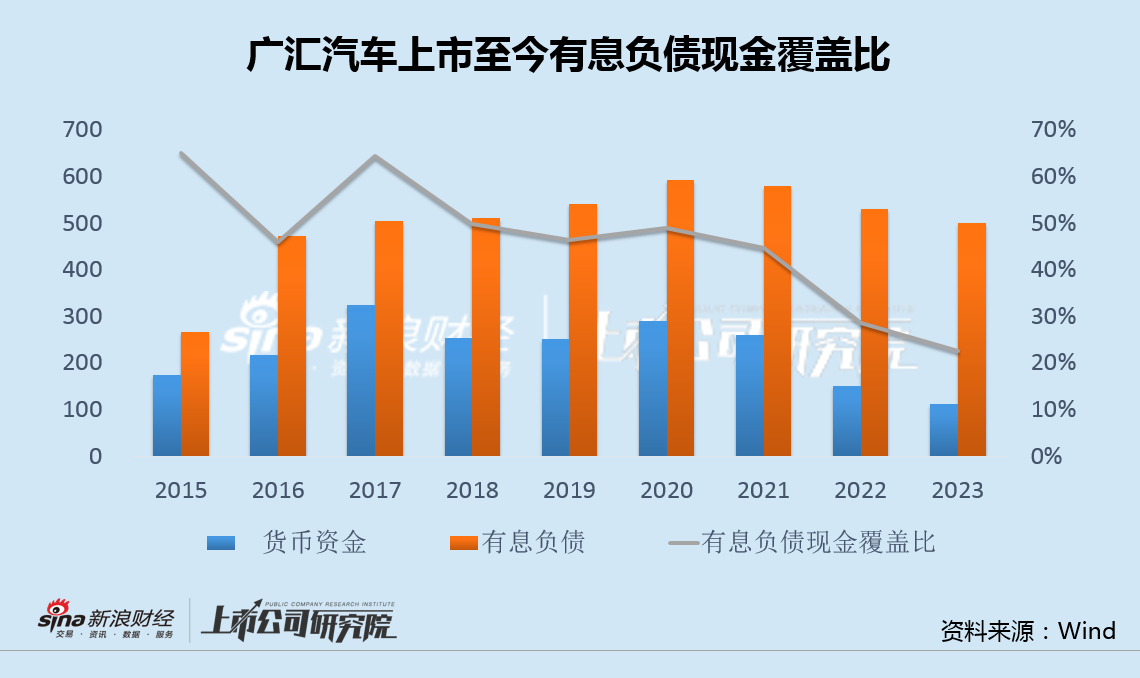

After struggling for 20 trading days, Guanghui Automotive could not escape delisting. On July 17, Guanghui Automotive hit the daily limit down, closing at 0.78 yuan (10$) per share. The sell orders exceeded 1.6 billion shares. According to the Shanghai Stock Exchange’s listing rules, if a company’s stock price closes below 1 yuan (0$) for 20 consecutive trading days, the exchange may terminate its listing. Guanghui Automotive triggered the delisting rule due to its stock price falling below 1 yuan (0$) for 20 consecutive days. Since its closing price dropped below 1 yuan (0$) on June 20, Guanghui Automotive attempted to regain stability. It planned to transfer control to Jinzheng Technology, signed a strategic cooperation agreement with Zhongjun Technology, and increased its shareholding. However, these efforts failed to prevent delisting. In fact, signs of trouble appeared earlier. Since 2020, Sina Finance published several articles warning of Guanghui Automotive’s operational and financial risks. These included reports on declining sales, increasing prepayments, and significant impairment losses. Reviewing Guanghui Automotive’s journey from backdoor listing to delisting reveals key issues. Despite generating over 100 billion in revenue and not suffering severe losses, the company faced mounting debt amid a declining automotive dealership industry. Continuous financing and share expansion set the stage for the stock to fall below 1 yuan (0$), triggering delisting. In many ways, Guanghui Automotive’s excessive financing backfired. Guanghui Auto faces a survival crisis. Rising debt pressures, a shrinking number of stores, and the loss of crucial financing channels after delisting contribute to this challenge. Since its listing nine years ago, Guanghui Auto has distributed 2.4 billion in dividends while raising 40 billion through excessive financing and stock expansion, setting the stage for delisting. In 2002, Sun Guangxin led Guanghui Group into the automotive dealership sector. In 2006, Guanghui Auto officially launched. It acquired various car sales companies, becoming a leading player in the industry. In June 2015, Guanghui Auto went public by reverse merging with Meiluo Pharmaceutical. After listing, Guanghui Auto accelerated acquisitions to expand further. It incorporated Baoxin Auto and Pengfeng Group, becoming the first domestic auto dealer with both asset and revenue exceeding 100 billion. However, the industry changed dramatically after 2018. The rise of new energy vehicles squeezed the market share of fuel cars. New car makers and traditional automakers’ electric brands adopted direct sales models, severely impacting auto dealers. Companies like Pangda and Zhengtong fell into debt. The shrinking market and escalating price wars led to inventory buildup and plummeting profits for Guanghui Auto, pushing it into financial distress. Data shows that Guanghui Auto’s interest-bearing debt cash coverage ratio dropped from 65% at its 2015 listing to 22% in 2023. The financial pressure became overwhelming. Last year, Fitch Ratings downgraded Guanghui Auto’s rating twice to “CCC-,” indicating tight liquidity and an inability to significantly reduce leverage. As of the end of Q1 this year, Guanghui Auto’s interest-bearing liabilities exceeded 46 billion. Its cash on hand was only 8.3 billion. The financial expenses for the quarter reached 630 million. The debt-to-asset ratio stood above 60%.

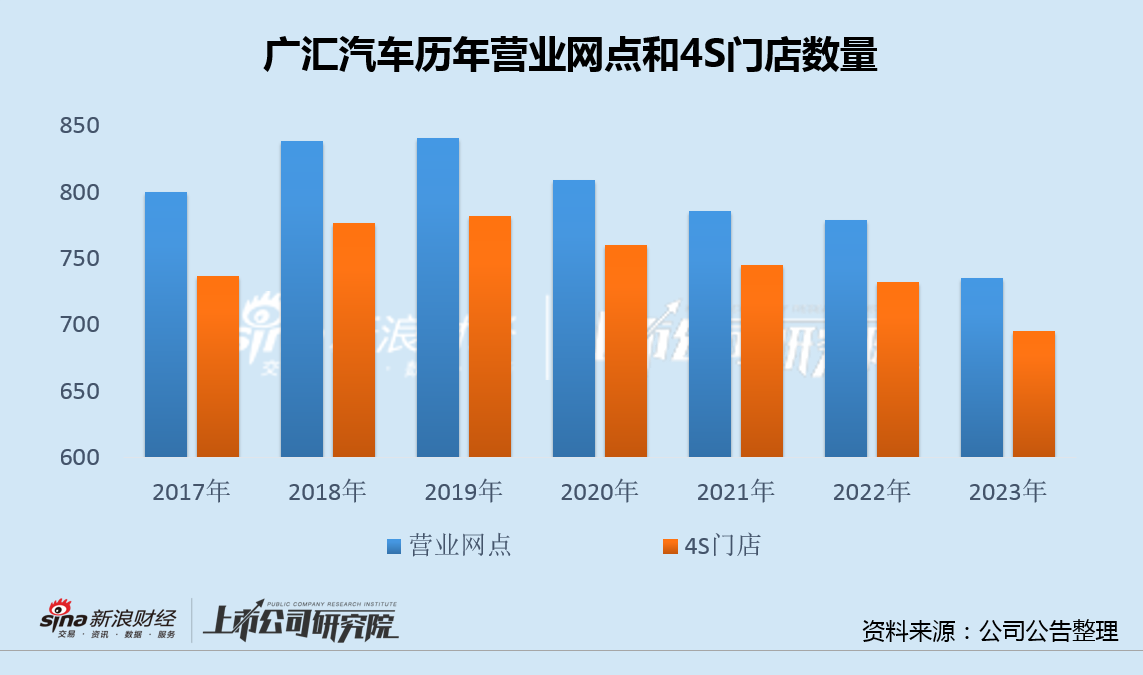

Amid increasing financial pressure, Guanghui Motors accelerated its financing efforts. It injected 22.83 billion yuan during its shell listing. It also completed two private placements and one convertible bond financing. Over nine years, its direct financing reached 40 billion yuan, while dividends totaled only 2.445 billion yuan. Ongoing financing and equity expansion increased Guanghui Motors’ total shares from 3.37 billion at listing to 8.29 billion. This significantly diluted stock value and set the stage for a potential delisting. Luxury car price cuts may become the final straw. Will it lead to delisting or bankruptcy? However, delisting did not resolve the crisis. Post-delisting, Guanghui Motors may face tougher challenges. Statistics show that only 27.3% of domestic car dealers met their annual sales targets in 2023. Meanwhile, 43.5% of dealers reported losses for the year. Recent data from the Passenger Car Association reveals that the monthly penetration rate of domestic new energy vehicles reached 50%. This indicates that electric vehicles have officially surpassed traditional fuel vehicles in new market share, with the gap likely to widen. Notably, in previous years, luxury car brands still gained sales despite declines in the passenger car market. Many dealers relied on luxury car showrooms. This year, however, a deepening price war affected high-end brands like Mercedes-Benz, BMW, Audi, and Porsche. Their sales stagnated, and prices plummeted. The simultaneous drop in volume and price for luxury brands may crush Guanghui Motors. The annual report shows that in 2023, Guanghui Motors employed 35,750 people and operated 735 outlets, including 695 4S stores and 245 ultra-luxury and luxury brand outlets. These figures continued a declining trend from previous years. The sharp drop in luxury car prices undoubtedly further pressured Guanghui Motors’ performance.

For dealers, the agency model offers light assets and low inventory. However, it strips away pricing power. This change disrupts the existing operations and management systems centered on new car sales. Consequently, dealers lose influence. They face low commissions and profit margins. Guanghui Auto attempts to transform. In the first half of this year, it applied for authorization for 70 new energy stores and launched 29 operations. Yet, years of operational pressure and debt burden hinder progress. After its delisting, it lacks convenient financing channels. These challenges make Guanghui Auto’s situation even more difficult. Recently, reports emerged from cities like Wuxi, Shenyang, and Jiangsu. Employees claim Guanghui Auto owes them wages. Some have chosen to resign, leading to store closures. In the future, Guanghui Auto may confront not just a zero market value, but a survival crisis.