To replicate the D9’s success, Tengshi needs a breakthrough. Although the Tengshi Z9GT hasn’t launched yet, the spy shots of the Tengshi N9 have surfaced. With the already dominant Tengshi D9 in the MPV market, the brand now has flagship models in sedans, SUVs, and MPVs. “Tengshi D9 holds a 30% market share. We aim for the Z9GT to achieve 30% of a target of 45,000 units,” said Zhao Changjiang, general manager of BYD Tengshi Sales Division. Besides accelerating new model launches, Tengshi has high hopes for its new cars. Tengshi positions the Z9GT as a D-class shooting brake. It aims to match the design of the Porsche Panamera and the luxury feel of Maybach. However, it targets a price range of 400,000 to 600,000 yuan (82490$), focusing on the long-standing “56E” price point. Based on “56E” sales of 45,000 units per month, the Z9GT needs to sell about 13,000 units to capture a 30% share. Zhao Changjiang emphasizes the Z9GT’s importance due to significant sales pressure on Tengshi this year.

At the beginning of this year, Zhao Changjiang announced that Tengshi aims for a sales target of 200,000 units in 2024. The Tengshi D9 targets 120,000 units. This year, Tengshi plans to launch three flagship models and have six models available by year-end. “The three new models will debut in the second half of the year, contributing little to overall sales,” Zhao said. In addition to the previously mentioned Z9GT coupe and N9 SUV, the Z9 sedan will also debut by the end of this year. Since the brand’s renewal on May 16, 2022, Tengshi has been active for over two years. It launched the D9, N7, and N8 models. However, only the D9 has performed well. The N7 and N8 have not met expectations. Tengshi urgently needs a new brand support point. Securing the MPV market does not equal entry into the luxury car market. “BYD will inject the best new energy power and smart technology into Tengshi, redefining luxury with advanced technology,” said Yang Dongsheng, then Vice President of BYD Group, at the brand renewal event in May 2022. Tengshi’s goal is clear: to establish a strong presence in the luxury car market and support BYD’s upward development. The MPV market serves as a good breakthrough point. Before the D9’s launch, the MPV market was dominated by the Buick GL8. While smart electric vehicles thrived in the SUV and sedan markets, they performed modestly in the MPV sector. In May 2022, the Lantu Dreamer launched with an official price range of 369,900 to 639,900 yuan (87970$). It offered both pure electric and hybrid options, introducing electric and smart features to the MPV market. However, Lantu’s weak brand power prevented the Dreamer from disrupting traditional MPVs like the GL8 and Sienna.

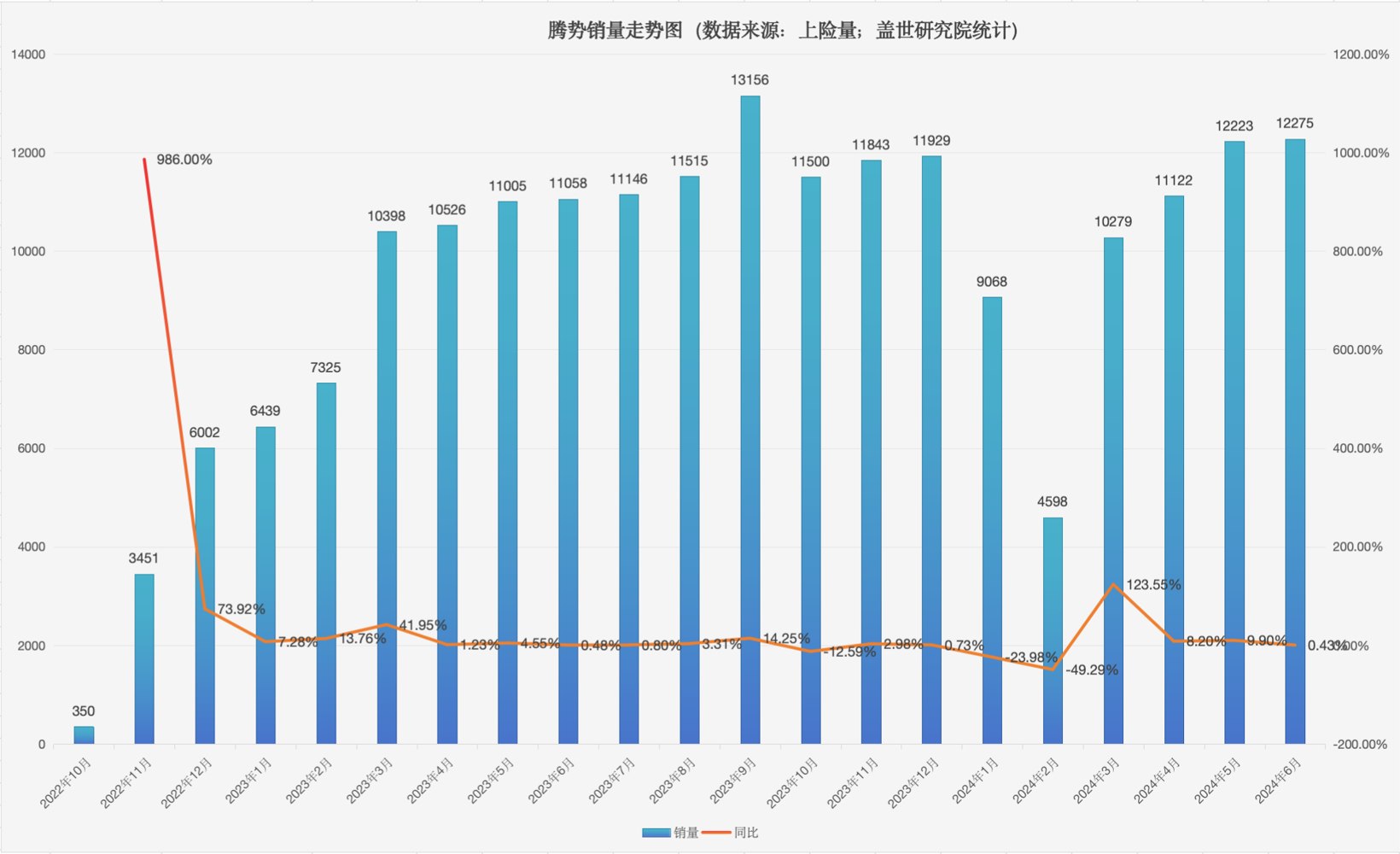

In August 2022, the Tengshi D9 officially launched. It is priced between 329,800 and 459,800 yuan (63210$). The D9 offers both DM-i super hybrid and pure electric powertrains. Deliveries began in September. At that time, BYD was gaining momentum. The DM-i super hybrid system is fuel-efficient and performs well. It quickly gained a positive market response. According to data from the Gaishi Research Institute, the Tengshi D9 sold 350 units in October 2022. Sales steadily increased afterward. By March 2023, sales surpassed 10,000 units per month. The D9 maintained this level, surpassing the GL8 and becoming the new king of the MPV market. The Tengshi D9 fought a strong battle. However, this does not mean the Tengshi brand has firmly established itself in the luxury car market. The MPV market is too niche and does not represent the entire consumer market. Data from the Passenger Car Association shows that from January to June this year, MPV retail sales totaled 480,611 units, down 8.1% year-on-year. The total MPV retail sales for 2023 are expected to reach 1,092,867 units, accounting for about 5% of the narrow passenger car market. In a domestic market with over 20 million annual sales, MPV’s share is too low. Tengshi, already leading in the MPV market, still faces tough challenges when entering other markets. The competitive SUV market taught Tengshi a lesson. On July 3, 2023, Tengshi launched its second new car after rebranding—the Tengshi N7. It offers six versions with rear-wheel and all-wheel drive. Prices range from 301,800 to 379,800 yuan (52220$). The Tengshi N7 features the family’s π-Motion design language. The cabin includes a 17.3-inch central screen, a 10.25-inch secondary screen, NAPPA leather, and a Devialet sound system. It incorporates CTB battery-body integration technology, the Yunlian-A intelligent air body control system, the iADC intelligent drift control system, and the iCVC intelligent vector control system. The CLTC pure electric range exceeds 700 km. Additionally, Zhao Changjiang revealed at the launch that Tengshi upgraded the front face based on user feedback. They introduced the co-created “Time-Space Light Wing Front Face.” This requires new molds and significant investment. From Tengshi’s perspective, the N7 achieves unprecedented heights in luxury, technology, and user focus. However, its market response is lackluster. The Tengshi N8, launched in August 2023, also faces poor market reception.

The data from the Gaishi Research Institute shows that from August to December last year, the Tengshi N7 sold 6,437 units. The Tengshi N8 sold 2,221 units from September to December. Both models fell short of expectations. In this context, the Tengshi N7 launched its annual facelift early. On April 1, 2024, the new Tengshi N7 debuted. It offers four versions, with prices ranging from 239,800 to 329,800 yuan (45340$). The 2023 Tengshi N7 only sold for 10 months, and its starting price dropped by 60,000 yuan (8250$). To protect existing owners’ rights, Tengshi provided a 50,000 yuan (6870$) trade-in subsidy for upgrading to the 2024 model. The price cut improved the Tengshi N7’s cost-effectiveness, leading to increased sales. In May and June, the Tengshi N7 sold 2,031 and 2,089 units, respectively. However, in a fiercely competitive market with ongoing price wars, the “price drop refresh” effect was not significant. The performance of the Tengshi N7 and N8 indicates that the Tengshi D9’s dominance in the MPV market does not translate into strong brand influence. This limits Tengshi’s ability to achieve positive market responses in other segments. In the SUV market, which it has explored, and the upcoming sedan market, Tengshi must rely on products with real strength to gain market recognition and gradually build a luxury brand image. Denza must avoid the old path of the N7 to regain glory. Looking back at the N7’s development, one can see it is a good car that deserves more recognition. Its monthly sales should not linger around one or two thousand units. When Denza launched the N7 in July last year, it gained attention for its iADC intelligent drift control system. This feature promised to fulfill the drifting dreams of ordinary consumers. However, drifting is not a necessary function for most buyers. The cost of replacing tires after drifting can deter many. Denza actively develops new features to enhance consumer enjoyment. This approach is commendable. However, promoting non-essential features like drifting can mislead buyers about the car’s true value. Additionally, the N7 features the Yunliang-A intelligent air body control system. In BYD’s technology lineup, Yunliang serves as a strong label. At the launch, the cars with Yunliang showcased impressive capabilities, like moving sideways and jumping, which amazed many. Unfortunately, Yunliang is not exclusive to Denza. The brands Yangwang, Fangchengbao, Denza, and BYD all offer models with Yunliang technology. BYD attempts to differentiate with labels like Yunliang+A, B, and C. However, ordinary consumers struggle to understand these differences. Thus, the value of the N7’s Yunliang-A system remains unclear to buyers. Perhaps BYD is beginning to recognize this issue. Only by granting Denza exclusive or priority access to advanced technology can the luxury brand image gradually take shape. Thus, Tengshi gained the right to be the first to use BYD’s smart driving technology.

From BYD’s perspective, the Tengshi N7’s high-speed and urban NOA features mark a technological breakthrough. However, in terms of industry development, the Tengshi N7 merely addresses a gap in intelligent driving. Currently, intelligent driving is not the main factor driving consumer purchases. Xpeng’s strong intelligent driving capabilities have not translated into high sales, serving as a prime example. The Tengshi N7’s development faced challenges, but it provided valuable insights for Tengshi. Avoiding the N7’s pitfalls gives future models a chance to replicate the Tengshi D9’s success. Take the upcoming Tengshi Z9GT as an example. Besides its coupe design, cloud platform, and dual refrigerators, it needs a standout feature to spark industry discussions. Similar to the attention garnered by blade batteries, cloud platform, and DM-i system, BYD must catch a big fish from the tech pool. Only then can Tengshi gradually establish a foothold in the luxury market.