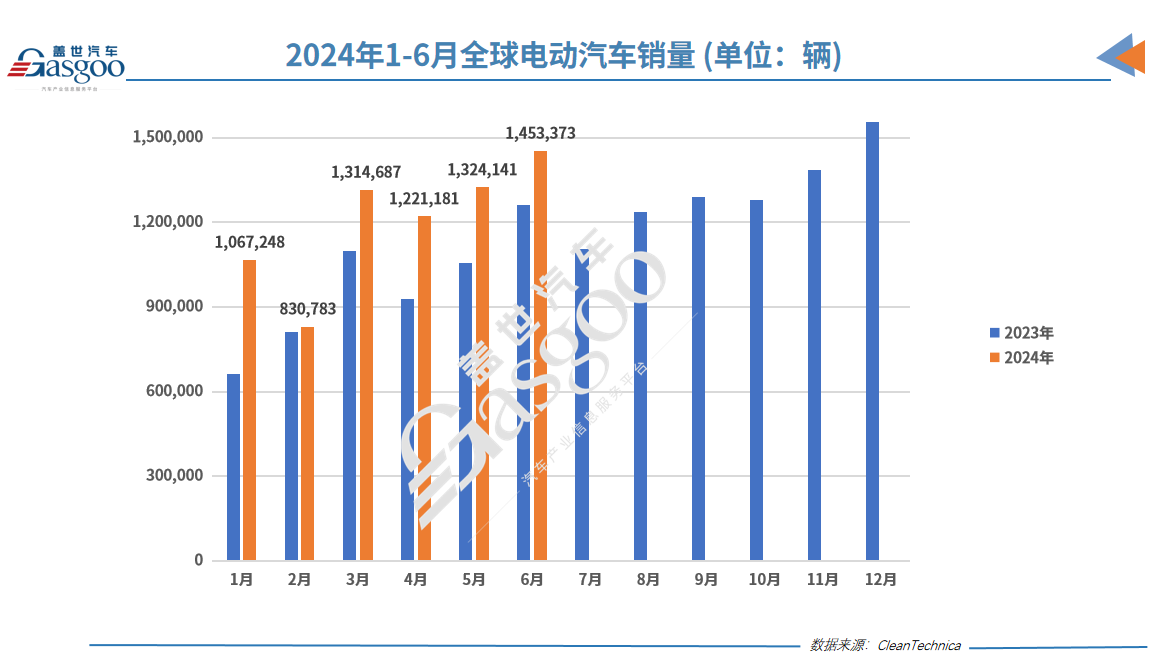

This year, electric vehicle sales continue to grow steadily, despite the rise of hybrid vehicles. CleanTechnica reports that in June, global electric vehicle registrations increased by 15% year-on-year to 1,453,373 units. This marks the second-best sales month ever, following last December’s record of 1,556,728 units. Pure electric vehicle registrations grew only 4%, while plug-in hybrid registrations surged by 41% to over 500,000, setting a new record. In June, the global electric vehicle market share rose by 2 percentage points to 22%. Pure electric vehicles alone held 14% of the global automotive market.

Thanks to strong performance in June, global electric vehicle registrations reached 7,169,712 in the first half of this year. This marks a 23% increase compared to last year. Electric vehicles now hold 18% of the global car market, up 3 percentage points. Pure electric vehicles account for 12%. The global Top 20 electric vehicle models in June include Xiaomi SU7 and exclude Wuling.

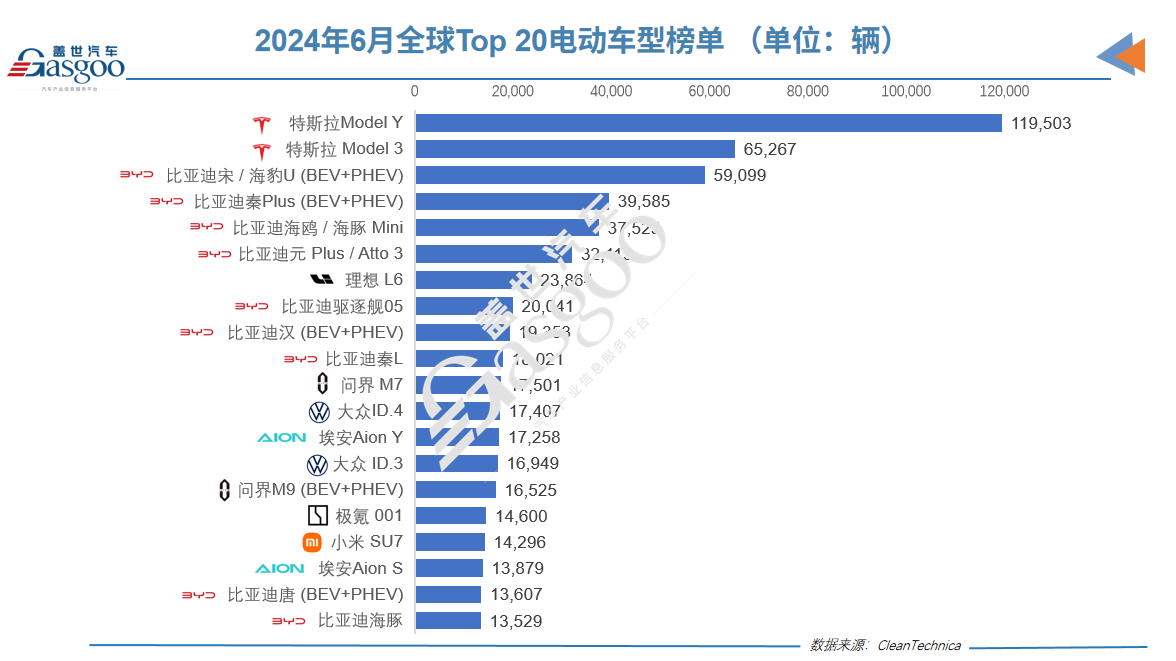

In June, Tesla Model Y led with about 119,000 registrations. However, this marked a 10% year-on-year decline. Thanks to a sales surge at the quarter’s end, Tesla Model 3 registered 65,000 units in June. This number surpassed BYD Qin Plus and BYD Song, placing Model 3 second. Still, Model 3’s registrations fell 5% compared to last year. Tesla must take note. Consumer demand for both flagship models has weakened. Meanwhile, the launch of the new affordable electric vehicle remains uncertain. BYD follows closely. It occupies seven spots in the top 10 list. The standout is BYD Qin L. In its first full month after launch, it achieved 18,000 registrations and entered the Top 10. This performance may pressure BYD Qin Plus in the market. Notably, amidst BYD and Tesla’s dominance in the Top 10, Li Auto L6 broke through and secured a position. This medium-sized SUV launched just three months ago. In June, it registered nearly 24,000 units, ranking 7th. We await to see if it can break into the Top 5. Other standout models include the Zeekr 001. It registered 14,600 units, placing 16th. This marks its third consecutive month of record registrations, thanks to recent updates. The Volkswagen ID.3 and Aion Aion Y also saw their best registration numbers this year in June. We also see a new contender on the list—the Xiaomi SU7. This model matches the size of the Tesla Model S and resembles a Porsche, but its price is closer to the Model 3. In June, its third month on the market, the Xiaomi SU7 registered 14,000 units, currently ranking 17th. As production ramps up, we expect its ranking to rise, potentially reaching the Top 10 by year-end. With new entries come exits. The popular Wuling models, Hongguang MINIEV and Bingo, dropped off the list. Neither made the Top 20 in June. This is the first time in years that Wuling has no models represented. Is it a coincidence, or are former “hot models” losing their appeal? Top 20 electric vehicle models worldwide in the first half of the year: Wenjie M7 enters the top ten.

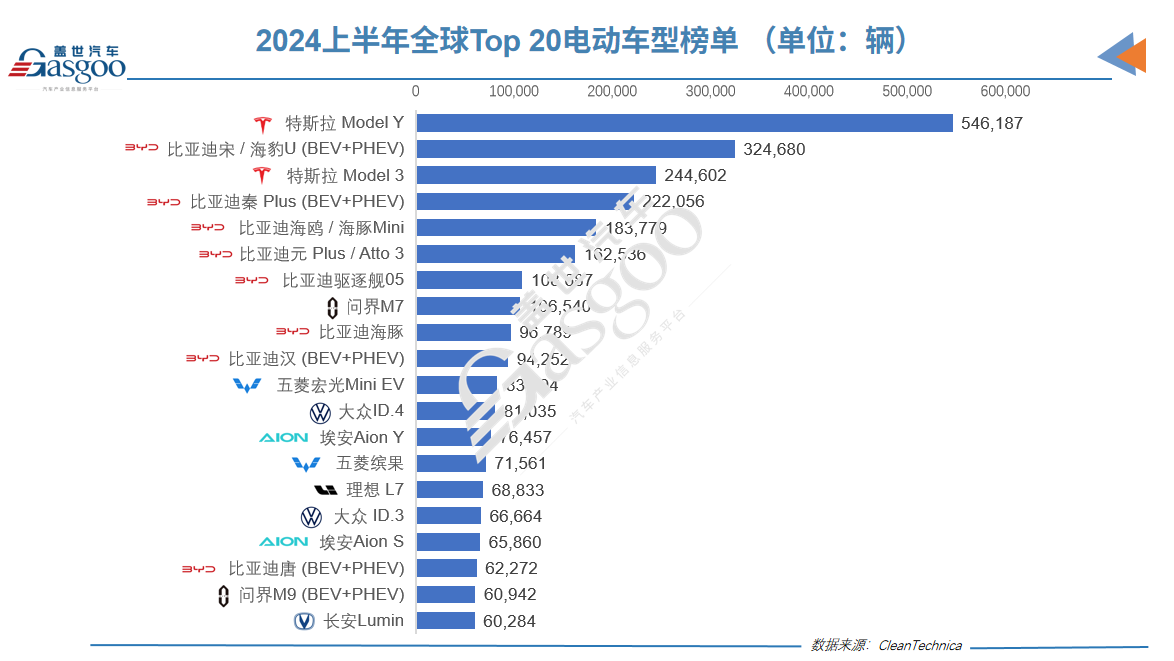

In the first half of this year, Tesla Model Y remains the best-selling electric vehicle globally. It leads the second place by over 220,000 units. It is expected to maintain this advantage until the end of the year. Tesla Model 3 also benefits from a strong sales push at the quarter’s end, returning to the top three. BYD has seven models in the top ten, showing the price war has paid off. BYD Song holds the second position comfortably, with a sales gap of over 80,000 units from Tesla Model 3. Given Model 3’s poor sales performance this year, BYD Song is likely to keep its position until year-end. BYD Destroyer 05 climbs the rankings, swapping places with Wenjie M7 at the end of June, now sitting in eighth place. Wenjie M7 is the only non-Tesla or BYD model in the top ten. In the lower half of the list, Aion Aion Y rises to thirteenth place. Thanks to strong sales in June, Volkswagen ID.3 moves up two spots to sixteenth. Changan Lumin’s poor sales in June allow BYD Tang and Wenjie M9 to each gain one position. This highlights the declining popularity of small city cars while full-size vehicle sales continue to rise. In June, the global Top 20 electric vehicle brands list shows Li Auto jumping to fourth place, while Wuling drops out of the top ten.

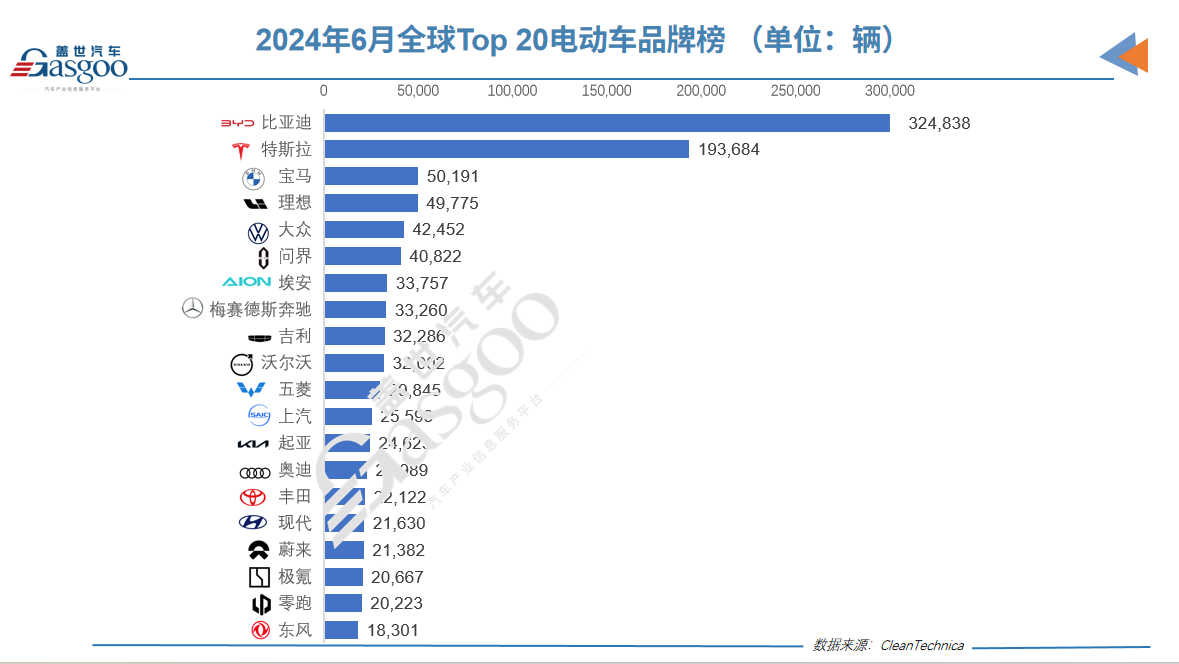

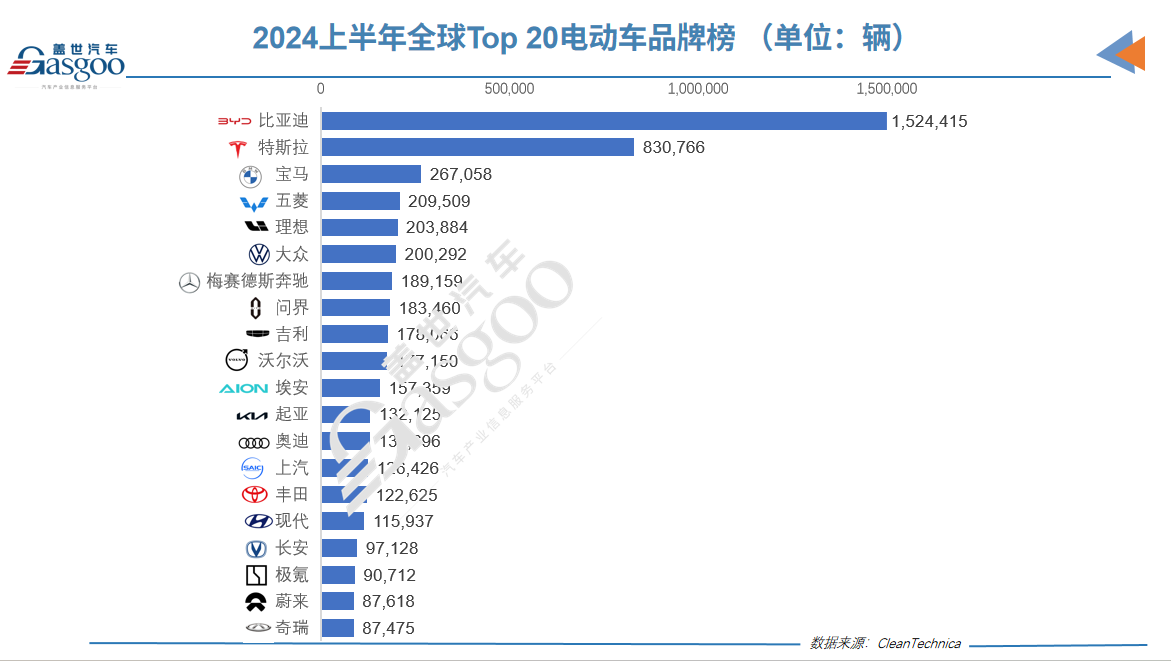

In June, BYD topped the brand performance. It registered nearly 325,000 vehicles, marking the second-best monthly result ever, just behind December last year. Tesla saw a decline in registrations in June, following encouraging growth in May. Its year-on-year drop reached 8%. However, Tesla maintains a solid advantage over other brands. BMW secured the last spot on the podium, achieving a new annual high in registrations for June. Volkswagen also hit a yearly best, thanks to the ID.4 and ID.3 models. Several Chinese electric vehicle brands made notable progress. Li Auto excelled with 49,775 registrations in June, driven by the success of the L6 model. It surpassed Volkswagen and Wuling, ranking fourth, just 416 units behind BMW. This indicates Li Auto’s potential to enter the top three. Aion brand showed impressive results with 33,757 registrations, moving up two spots to seventh place. NIO also set a record with 21,382 registrations, benefiting from the ES6 SUV and ET5 wagon. Leap Motor registered 20,223 vehicles, ranking 19th and achieving its best result of the year. Due to the rise of brands like Li Auto, Aion, and Wenjie, Wuling, previously known as the “God Car Maker,” fell out of the top ten in June. In summary, in June, well-known brands like Ford, Peugeot, and Jeep dropped out of the top 20. Eleven Chinese brands entered the top 20 that month. In the first half of the year, BYD led the global top 20 electric vehicle brands by a wide margin.

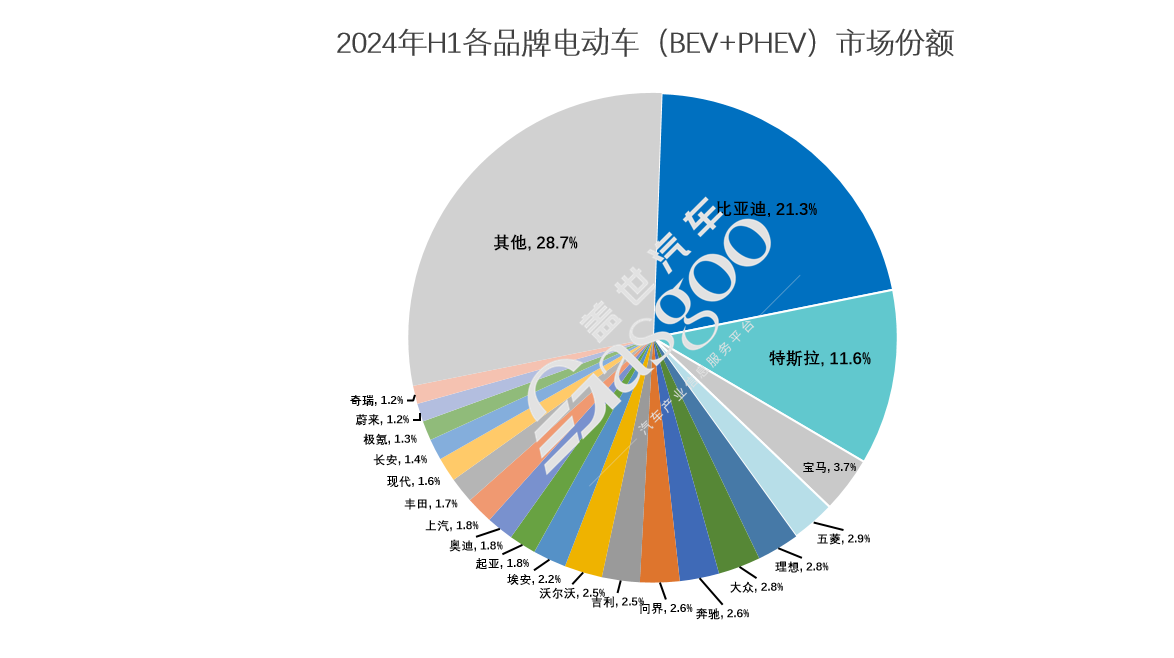

In the first half of this year, the top three brands remain stable. BYD continues to grow at a double-digit rate, leading Tesla by a wide margin. It holds 21.3% of the global electric vehicle market. In contrast, Tesla’s cumulative registrations fell by 7% compared to last year. Its market share dropped from 15.2% to 11.6%. In the first six months, Tesla only saw growth in two months. The other four months showed declines compared to the same period last year. Tesla must perform well in the second half to avoid 2024 being its first year of declining sales. Despite this, Tesla’s electric vehicle registrations are still three times higher than third-place BMW. Other brands have a long way to go to catch up. Li Auto benefited from strong performance in June, rising to fifth place. Its market share now matches Volkswagen’s. Meanwhile, competitor Aion moved up one spot to eighth place. Aion’s limited sales in China hinder its growth. In contrast, Li Auto established a successful business in Russia, selling over 2,000 vehicles monthly. With Li Auto’s expansion into the Middle East, its overseas sales will continue to grow. NIO and Chery jumped to 19th and 20th places, pushing Ford and Jeep off the list. Their market shares are slowly increasing.

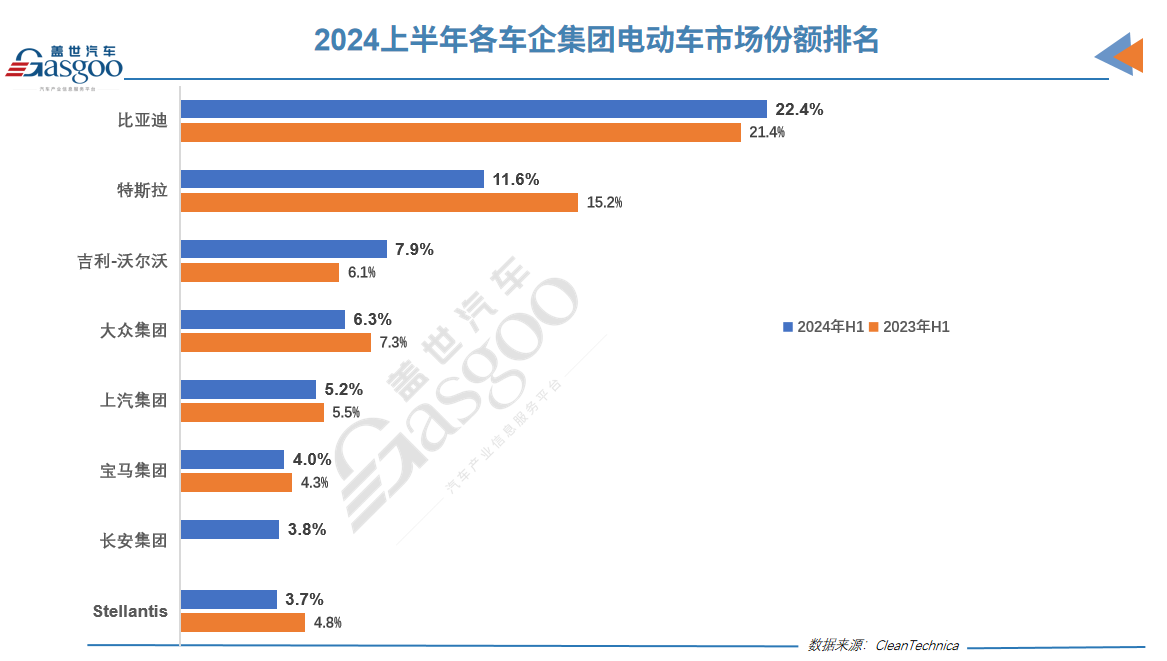

Chinese automakers, led by BYD, continue to increase their market share in electric vehicles. BYD’s market share rose by 1 percentage point year-on-year. Geely-Volvo’s market share increased by 1.8 percentage points. In contrast, foreign automakers, led by Tesla, see a decline in market share. Tesla’s market share dropped by 3.6 percentage points over the year. Volkswagen Group, BMW Group, and Stellantis also experienced decreases of 1, 0.3, and 1.1 percentage points, respectively.