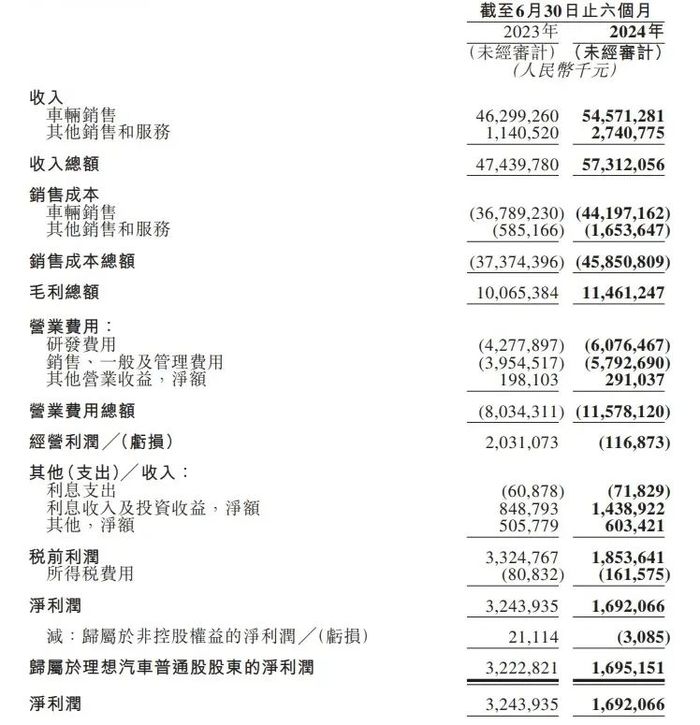

Wang Jianlin once recalled a “failed” investment on a TV show. He joked that, although the project made money, his investment was large. He could have earned more by lending the money out. This joke reflects reality in many tough industries. The automotive industry faces increasing challenges. Intense competition makes this low-margin sector even harder to profit in, even for the most successful companies. In the first half of this year, Li Auto sold over 180,000 vehicles. As a domestic mid-to-high-end new energy car company, it currently has no rivals close to its performance, aside from Aito. However, the harsh truth is that even such a top performer struggles to make money. In the first half of the year, Li Auto’s operating profit turned into a loss of 116 million yuan. Fortunately, it relied on “financial income” to achieve a net profit of 1.692 billion yuan, aided by nearly 100 billion yuan in cash on hand.

After six months of hard work selling cars, the leading new force in the industry finally achieved profitability through investment returns. The brutality of the car market has reached exaggerated levels. 01 Selling cars costs too much After the MEGA setback, Li Auto quickly found its lifeline: the L6. This vehicle, delivered in late April, saved Li Auto’s revenue growth in the second quarter. In the first half of the year, Li Auto’s deliveries grew 35.8% year-on-year, reaching 188,900 units. By July in the third quarter, Li Auto surged further, with sales hitting 51,000 units, a 49.4% increase year-on-year. However, the L6’s relatively low price dragged down the company’s average. In the first half of the year, Li Auto’s revenue per vehicle fell to 303,200 yuan (42670$). In 2023, the average selling price per vehicle was still as high as 320,000 yuan (45030$). Consequently, the gross margin dropped from 20.5% last year to 19%.

R&D costs keep rising. In the first half of the year, Li Auto’s R&D expenses grew from 4.3 billion yuan last year to 6.1 billion yuan this year, a 42% increase. As end-to-end autonomous driving becomes mainstream, its influence on consumer purchasing decisions grows stronger. Li Auto had to raise its R&D expenses to over twice that of XPeng during the same period. Li Auto’s R&D expenses increased by about 1.8 billion yuan. This amount nearly matches last year’s operating profit. After excluding this figure, Li Auto’s net profit for the first half is around 3.5 billion yuan, surpassing last year’s 3.243 billion yuan.

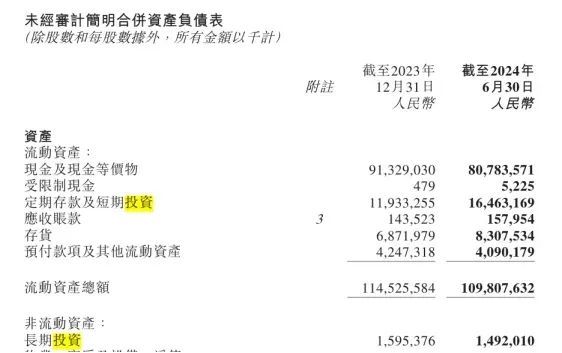

But there’s no choice. This is the necessary investment for high-end new forces at the table. Ultimately, high costs and falling prices misaligned Ideal’s financial numbers with sales figures. Revenue growth hit 20.8%, significantly lower than delivery growth. Operating profit turned into a loss, dropping from a profit of 2.031 billion yuan last year to a loss of 1.168 billion yuan. Net profit fell 47.8% year-on-year. Non-GAAP net profit declined 32.9% year-on-year. Of course, Ideal doesn’t face cash issues. Despite a 6.2% drop in cash in the first half of the year, they still hold 97.3 billion yuan, enough to support a long competition. 02 Financial Management Outearns Car Sales Regardless, Ideal made a profit, but not from car sales. They relied on “financial management.” According to the first half of 2024 financial report, Ideal generated 1.439 billion yuan from interest and investment income. This “financial management” covered the 117 million yuan operating loss, boosting net profit to 1.692 billion yuan. This income accounted for 85% of Ideal’s net profit in the first half of 2024. After tasting the benefits of financial management, Ideal increased their investment efforts. The consolidated balance sheet as of mid-2024 shows a significant cash decrease. Cash dropped from 91.329 billion yuan at the end of 2023 to 80.784 billion yuan, a reduction of 10.545 billion yuan. Meanwhile, time deposits and short-term investments rose from 11.933 billion yuan to 16.463 billion yuan, an increase of 4.53 billion yuan.

In other words, of the 10.545 billion yuan in cash assets that Li Auto “lost,” 4.53 billion yuan went into fixed deposits and short-term investments, waiting for future interest and investment income. Using wealth management income to boost net profit is not an isolated case in this competitive era. Geely Auto will dilute its stake in its subsidiary, Aurora Bay, from 100% to 33% after completing the transaction on May 31, 2024. According to Hong Kong financial rules, this transaction counts as selling 67% of Aurora Bay. The equity consideration will appear in Geely’s profit statement, bringing in 7.66 billion yuan. This revenue alone raised Geely’s net profit to 10.6 billion yuan. Since the delivery of L6, Li Auto has repeatedly topped weekly sales charts. Although it releases these lists itself, they still show the company’s strength in the market. However, the fierce competition in the auto industry, unclear product differentiation, a prolonged price war, and a saturated market have made prospects dim for this once-promising sector. Since the beginning of the year, Li Auto’s stock price has dropped by 43.31%, nearing a 50% decline. Its price-to-earnings ratio has reached 13.78. Xpeng and NIO have also faced long downturns in the past 1-2 years, and Zeekr’s stock has fallen since its IPO. For the “top student” Li Auto, sales are strong enough. A single vehicle income of 300,000 yuan (42220$) is already “luxurious.” The industry struggles to criticize this luxury brand, which has achieved monthly sales of 50,000 units. Before it can deliver significant volumes in overseas markets, autonomous driving is the only way for automakers to escape the “quagmire.” This software service can enhance vehicle appeal and save costs through high-margin subscription fees. For Li Auto, an ownership of over 800,000 vehicles is the highest among domestic high-end new forces. In this end-to-end era, data will directly impact the intelligence of autonomous driving systems, possibly giving Li Auto its biggest advantage in this phase of competition. Thus, it is easy to understand Li Auto’s high investment in R&D. If it cannot optimize its business model through autonomous driving, selling cars may be less profitable than simply earning interest on deposits.