On September 10, the China Automobile Association released August’s automotive market data. Notable figures include: high-end passenger car sales reached 384,000 units, up 0.9% month-on-month, but down 7.8% year-on-year. Overall passenger car sales totaled 2.181 million units, up 9.4% month-on-month, but down 4% year-on-year. Historically, August marks the end of the slow season and begins a rising phase. However, the upward trend in August this year was not clear. High-end products showed relative weakness compared to the overall market.

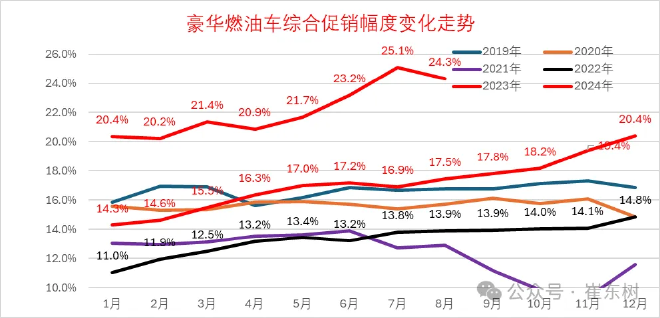

Price War Stalemate The luxury market faces a price war in its later stages this year. Unlike the segment below 200,000, the luxury market typically sees a surge in sales at year-end. However, this year may be different. Companies seem to be hitting a wall. According to the China Passenger Car Association, luxury brands held market shares of 13.2%, 13.2%, and 13.7% from 2021 to 2023. In the first two quarters of 2024, the share remained at 13.6%, dipping just 0.1%. From this perspective, trading price for volume has proven successful. Promotions for luxury fuel vehicles increased steadily since the beginning of the year, peaked in July, then fell to 24.3% in August. The current level remains high, but the motivation for a new round of price cuts is fading. The reason lies in the diminishing returns of the price war. Retained market share cannot compensate for the loss of brand value. The former is tangible; the latter is hard to quantify. However, manufacturers can assess brand value through public opinion, residual value analysis, and third-party market research. Once manufacturers recognize that the price war is unworthy, they may opt to stabilize prices to protect their brand. This may lead to short-term volume losses, but in the long run, brand value dictates sales, especially in the luxury car market. This situation highlights the balance between short-term performance and long-term benefits.

Market psychology has shifted. Before 2020, luxury car brands in first and second tiers viewed market competition mainly through the lens of “maintaining market share.” They followed competitors closely, fearing that inaction would weaken their stance. In recent years, new players have increasingly challenged the mid-to-high-end market. The old “follow the leader” strategy has lost its significance. Brands must now focus on the luxury market as a whole. Multiple rounds of price wars have led to increased investment. The market shows signs of unsustainability, which explains why discount rates can no longer rise. Brand competitiveness changes little in the short term. It remains almost constant. Operations should aim for balance, but that balance must be dynamic. Even extreme measures cannot last long. Brands will soon need to adjust, creating a “pendulum” strategy. This process involves continuously optimizing across multiple dimensions. In simple terms, brands must find the optimal range between equilibrium prices and actual market prices, considering both short-term and long-term interests. In July, BMW was the first to announce a “reduction in quantity to stabilize prices.” Other brands followed, but with milder approaches. Multinational brands initially adopted similar strategies. They offered larger discounts on electric vehicles while keeping promotions for main products restrained. Now, they prefer to reduce supply in new energy vehicles to protect the pricing structure of their core products.

Since August, the luxury market has shifted its supply side. It now favors growth strategies aligned with brand value. This adjustment is subtle. However, market psychology often changes before actual conditions do. Maintaining brand strategy requires tactical channel methods. Prioritizing “long-term brand value” is a strategic realignment, but not everyone can manage it. Several prerequisites exist: no survival crisis, healthy cash flow and sales returns, and low pressure from shareholders and the board on short-term performance. With these “basic cards,” operators can distance themselves from price wars. They must gradually achieve strategic goals through tactical means. In the 400,000 yuan (56370$) product range, few sell at “guidance prices” amid fierce competition. The issue now is determining how much discount recovery is appropriate. This depends on the specific environment of the channel and balancing the interests of various channel models. Control over channels is lowest in agency models and highest in direct sales. This is why some new forces can implement “same price nationwide,” though this is loosening. On the operational level, a dealer’s invested store faces competition not only from other brand stores but also from other dealers of the same brand in the city. The former can leverage differentiation, while the latter engages in intense competition, making it hard to gain an advantage. Consumers today are savvy. They connect with multiple stores to negotiate prices. This strategy works only in a buyer’s market. Clearly, strengthening channel control is essential to avoid internal conflict. Channel control largely depends on whether dealers earn profits. This brings us back to the balance between short-term performance and brand value.

New forces choose direct sales, not just for advantages. They lack time and funds for large-scale channel expansion. Their product lines are short and do not support massive channel growth. Channel penetration reaches third, fourth, and fifth tiers, benefiting long-established joint venture brands. Multinational brands leverage their strengths against competitors’ weaknesses. By tightening wholesale price discounts and subsidy policies, they can reduce excessive internal competition and refocus on brand operations. Stabilizing expectations leads to stable returns. Maintaining brand value gives customers consistent expectations. Moving away from price wars builds dealer confidence. When consumers have stable expectations, channels can achieve steady profits, especially from key products. Without technological gaps, brands with clear images, rich histories, high recognition, and distinct personalities find short-term opportunities. This means long-term players can also gain mid-term benefits. Relying solely on “technology” is risky, as product capabilities often mirror suppliers’ abilities. Only by integrating technology into brand operations can it gain a unique identity. Previously, top luxury brands lacked tactics and relied on uniformity; now, second-tier brands differentiate themselves. Today, everyone emphasizes personality and brand culture. Promoting brand culture goes beyond advertising. All information accepted by consumers carries brand cultural elements, emphasizing a subtle influence.

Luxury brands, regardless of their product lines, target specific audiences. Different brand traits attract different groups. Stable prices boost potential purchasing power. They draw consumers who hesitate at the decision threshold. Price wars spread like wildfire. Cost-based pricing strategies become rare. Recently, signs of a return to “brand value operation” have emerged. Everyone knows that tactical retreats benefit long-term strategies. Yet, only a minority dares to act now. These brands may pay a price but avoid excessive erosion of brand value. This approach can lead to advantages in long-term competition.