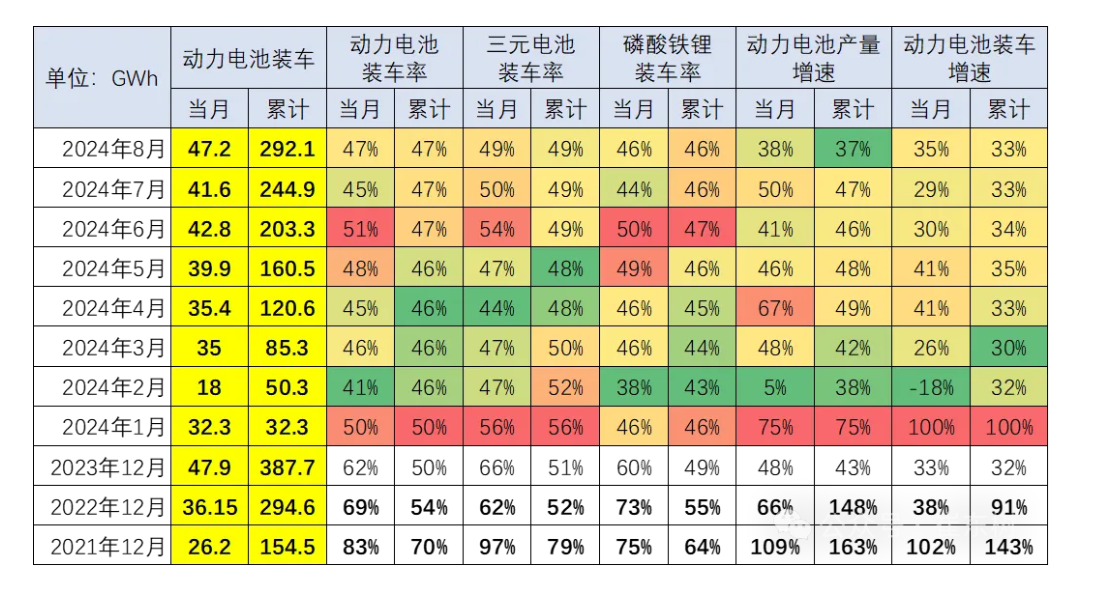

New energy electric vehicles dominate the market. However, their supporting power batteries face a different fate. In July, retail sales of new energy passenger cars in China reached 878,000 units. This marks a 36.9% year-on-year increase. The penetration rate surpassed 50% for the first time, hitting 51.1%. In August, the penetration rate rose to 53.9%, exceeding 50% for two consecutive months. Meanwhile, a noteworthy trend emerges. As new energy vehicles rapidly penetrate the market, the installation volume of power batteries declines. On September 22, Cui Dongshu, secretary-general of the China Passenger Car Association, reported that the proportion of installed power batteries is decreasing. Cui noted that in 2021, the installation rate of power batteries reached 70%. In 2022, it dropped to 54%. In 2023, it fell to 50%. From January to August 2024, the installation rate dropped further to 47%. The installation rate for ternary lithium batteries stands at 49%, while lithium iron phosphate batteries sit at 46%.

Notably, today’s market differs from the past. The data reveals a brewing crisis for lower-tier battery manufacturers. In a “buyer’s market,” some battery makers may face clearance issues. The economic landscape shifts unpredictably. Capital influences fluctuate. During the peak of the “seller’s market,” battery manufacturers thrived. Now, the “buyer’s market” prevails. Companies in the midstream of the battery supply chain struggle with capacity pressures. A clear polarization emerges. In summary, excessive profits are a thing of the past. Leading manufacturers maintain their profit margins. However, smaller firms face losses and struggle to survive. Reviewing the first half of 2024, we see four categories of battery manufacturers based on their financial reports. One group, led by Guoxuan High-Tech, shows revenue and net profit growth. Another, represented by CATL, sees revenue decline but net profit rise. A third group, led by Yiwei Lithium Energy, experiences declines in both revenue and net profit. The last group, represented by Aulton Technology, reports revenue decline and losses. Focusing on the extremes of these categories, Guoxuan High-Tech achieved revenue of 16.794 billion yuan, a 10.2% increase. Their net profit reached 271 million yuan, a 29.69% increase. In contrast, Aulton Technology reported revenue of 6.974 billion yuan, a 0.15% decrease, and a net loss of 190 million yuan, compared to a loss of 797 million yuan the previous year. Overall, the undeniable fact remains: the “prosperity” of battery manufacturers’ financial reports has passed. Since lithium carbonate prices have dropped from nearly 600,000 yuan (85400$) per ton, the profitability of battery manufacturers has drawn significant attention. At that time, most domestic power battery companies still saw positive net profit growth. In short, they were still making money, just not as much. Now, the situation is less optimistic. The power battery market is slowly “abandoning” some companies. Recently, Yang Hongxin, chairman of Hive Energy, stated, “The elimination in the lithium battery market is accelerating this year. Energy storage companies may see a 50% elimination rate. By the end of this year, the number of power battery companies may not exceed 40, and the elimination will continue next year.” Yang also noted that 2024 marks the beginning of a deep adjustment in the lithium battery industry. Issues like overcapacity, poor financing, price competition, and operational obstacles are all evident this year. In other words, this year may be a critical year for power battery manufacturers to seek change. Currently, midstream and upstream companies in the power battery supply chain face slightly different dilemmas. Leading manufacturers need to think about how to “turn around in time” and find new growth curves. Smaller companies feel more “nervous” and need to quickly adjust their strategies and business layouts to “stop losses in time.” However, regardless of size, both large and small manufacturers face the same question under the cloud of “high profits are gone”: how to seek change. Leading companies push the “domino effect” with production cuts and shutdowns, which only treats symptoms, not the root cause. The methods for change fall into two categories. First, companies can adjust their production pace to alleviate supply-demand imbalance and shift the market towards a “seller’s market.” Second, they can expand into overseas markets or broaden their business scope. If the vehicle market is saturated, they should look into other new energy markets. According to reports, power battery manufacturers are currently practicing these methods. However, controlling the production pace at the root level seems to only treat symptoms. The key issue in the power battery industry is that it has entered a “buyer’s market” characterized by oversupply. China’s Automotive Power Battery Industry Innovation Alliance reports that from January to June this year, China’s power battery and other battery production reached 430.0 GWh, a year-on-year increase of 36.9%. The cumulative installation volume hit 203.3 GWh, growing 33.7% year-on-year. Despite increases in production and installation, the installation volume now accounts for less than 50% of production. The industry faces significant inventory pressure. Reducing the number of power battery products entering the market could ease the supply-demand imbalance. However, adjusting production rhythms across the industry is challenging. Even leading battery manufacturers have limited “domino effects” that cannot sustain long-term change. Recently, on September 11, Gaishi Auto reported that UBS’s Sky Han released a research report titled “China Lithium Prices Hit Bottom.” The report stated that, according to internal sources, CATL decided to suspend its lithium mica operations in Jiangxi on September 10. UBS noted that CATL’s lithium business cash cost stands at $10,968 per ton, or 89,000 yuan (12670$) per ton. This means that since mid-July, lithium carbonate spot prices have remained below CATL’s cost line. CATL’s suspension of operations in Jiangxi will reduce China’s monthly lithium carbonate production by 8%, equivalent to a decrease of 5,000 to 6,000 tons per month, helping to rebalance supply and demand. On the same day, industry media confirmed with a source from a large lithium mica company in Yichun that CATL has indeed halted production at its mine in Yichun. A person close to CATL also confirmed this to the media. Additionally, a local lithium battery industry insider informed reporters that CATL’s mining, selection, and smelting operations in Yichun will fully cease after September. In response to these rumors, CATL told another financial media outlet that it plans to adjust its lithium carbonate production arrangements in Yichun based on recent market conditions.

The truth remains, regardless of the rumors about CATL’s mine shutdown in Yichun. The news has affected lithium carbonate prices and lithium mining stocks. On September 11, lithium carbonate futures surged. They closed up 7.93%, reaching 78,300 yuan (11140$) per ton. On September 12, Shanghai Steel Union reported that battery-grade lithium carbonate prices rose by 1,000 yuan (140$), averaging 73,500 yuan (10460$) per ton. Meanwhile, the sluggish A-share lithium mining sector rebounded. Stocks in the sector reported gains. The lithium mining index increased by 5.39%. Companies like Ganfeng Lithium, Tianqi Lithium, and Yongshan Lithium hit their upper limits. JPMorgan noted market speculation about CATL’s production halt. Lithium stocks rose by 10% to 14%. However, they pointed out that similar speculation occurred in February. Lithium prices surged about 30% to 120,000 yuan (17080$) per ton in two weeks but quickly fell due to stagnant fundamentals. JPMorgan believes this rise mirrors the previous situation and expects a brief uptrend. They maintain a “reduce” rating for Ganfeng Lithium and Tianqi Lithium, lowering target prices to 13.5 HKD and 16 HKD, indicating a potential decline of 20% to 24%. Goldman analysts Trina Chen and Joy Zhang also stated that CATL’s production cut might create a “short-term” bottom for lithium prices, easing supply concerns. However, the overall outlook for the lithium cycle remains very negative. Goldman Sachs analysts predict a 26% oversupply in the global integrated lithium carbonate market in 2024, rising to 57% in 2025. They believe that recent production cuts will not change the negative supply-demand balance. In other words, analysts agree that battery factories cannot maintain production cuts to ease supply-demand issues. The short-term impact will be limited. Commercial vehicles can address urgent needs. Battery factories can seize significant opportunities. Many power battery manufacturers are exploring new business areas. The new energy commercial vehicle market is thriving. This year, companies like CATL, Eve Energy, Ruipu Lanjun, Lanjun New Energy, Lishen Battery, Guoxuan High-Tech, Fudi Battery, and Zhongchuang Xinhang have increased their focus on the new energy commercial vehicle market. Looking at market potential, commercial vehicles account for only 12% of total vehicle ownership in China but contribute over 55% of carbon emissions. By 2060, the number of commercial vehicles is expected to grow from about 31 million to 40-52 million, increasing decarbonization pressure. Data from the National New Energy Commercial Vehicle Market Information Joint Conference shows that from January to August this year, new energy commercial vehicle sales grew 75.3% year-on-year, with a penetration rate of 17%, up 7.7 percentage points from last year. By vehicle type, the penetration rate for new energy light vans reached 53.3%, an 18.1 percentage point increase from last year. The penetration rate for new energy minibuses was 12.3%. New energy heavy trucks had a penetration rate of 10.5%, while light trucks reached 14.6%. In August, the penetration rate for new energy light trucks rose to 20.5%, and for light vans, it reached 60.6%. Senior analysts in the automotive industry note that the growth of pure electric passenger vehicles has slowed. The penetration rate of electric commercial vehicles remains low, indicating significant growth potential. What differentiated performance do power battery products need for the new energy commercial vehicle market? Compared to passenger vehicles, commercial vehicles have more stringent battery technology requirements. First, commercial vehicles face higher intensity and frequency in transportation. This demands high energy density in batteries to ensure stable performance during long hauls and intense work scenarios. Second, the unique usage scenarios of commercial vehicles may lead to more frequent battery replacements. Therefore, efficient fast-charging capability becomes essential to reduce downtime. Additionally, commercial vehicles often operate in harsher environments, requiring batteries to have higher durability and stability. Finally, commercial vehicle users are more cost-sensitive. The purchase and maintenance costs of batteries directly impact operational profits. Thus, cost-effectiveness and ease of maintenance are crucial considerations. Can battery manufacturers meet the demands of the new energy commercial vehicle market and launch timely products? Currently, information indicates that at the 2024 Hannover International Transport Exhibition in Germany, CATL will unveil the Tianxing battery series for the heavy truck market. This series supports a vehicle range of 500 km. The long-life version lasts 15 years or 2.8 million kilometers, while the supercharging version can charge to 70% in 15 minutes. Akin Li, President of CATL’s overseas business, states that the company has partnered with several European manufacturers, including Daimler Trucks, Volkswagen Commercial Vehicles, and Volvo Cars. CATL’s CTO, Gao Huan, revealed that the company’s Tianxing power battery for buses has confirmed mass production in 80 models across 13 automakers.

At the 2024 IAA exhibition, Ruipulan Jun launched its commercial vehicle battery system, “BIG BANK.” This system boasts an energy density exceeding 210Wh/kg. The 500kWh system supports heavy-duty trucks with a range over 500km, and it can reach up to 600km. It features 2C fast charging, allowing a 10%-80% charge in just 18 minutes. It includes active safety monitoring to prevent thermal runaway. It operates stably at -35℃. Its cycle life exceeds 5000 times, and its lifespan surpasses 10 years. Additionally, Guoxuan High-Tech released the latest generation of its G-series hybrid heavy truck standard battery. Yiwei Lithium Energy introduced its commercial vehicle supercharging battery, the open-source battery, suitable for various commercial models. Zhongxin Chuangxin launched its “Zhiyuan” series for commercial vehicles, which includes high-capacity batteries for light trucks and standard battery systems for heavy trucks. In summary, whether for passenger or commercial vehicles, the new energy vehicle market continues to grow. Battery manufacturers will always find business opportunities. However, the industry may experience reshuffling at any moment. When a specific business area faces a turning point, battery manufacturers must adapt and seek new avenues. Finding these avenues does not guarantee an easy path. In any field, product strength is crucial for battery manufacturers to establish a foothold.