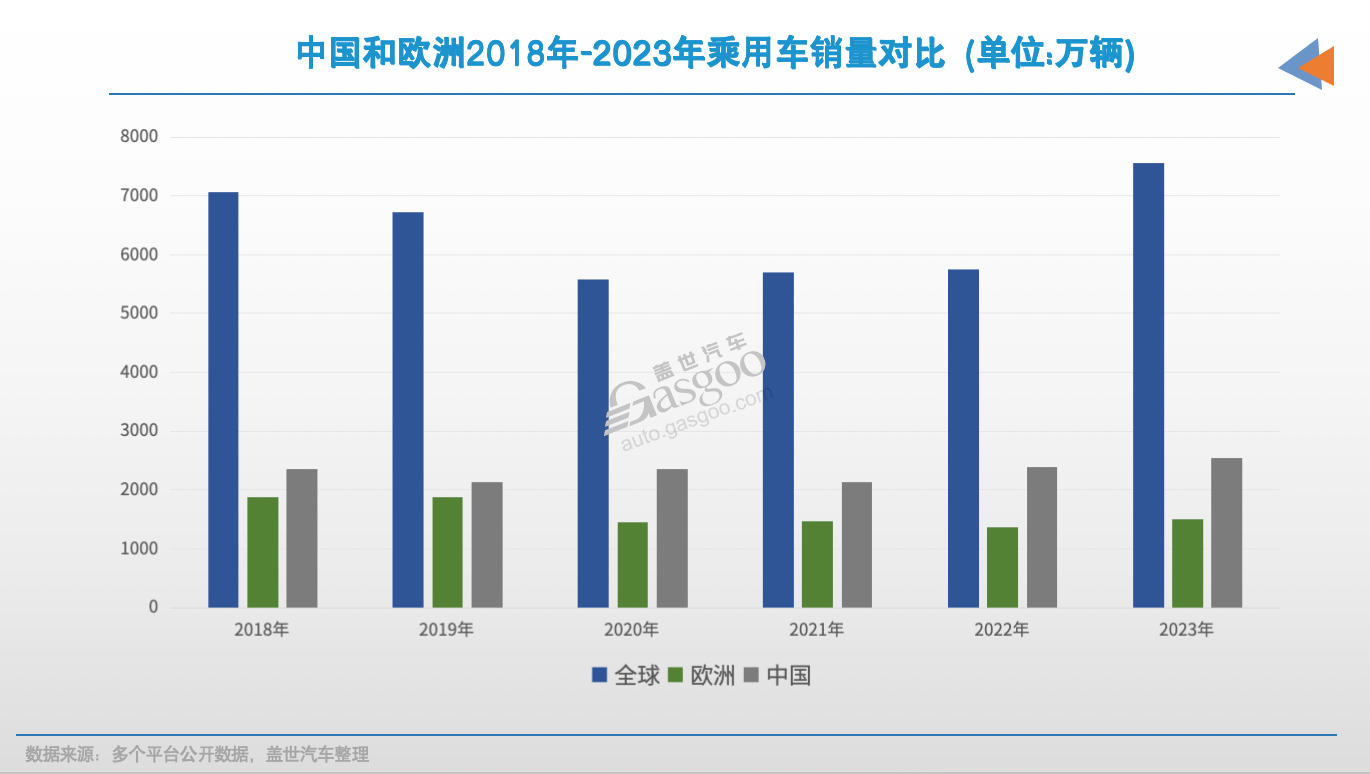

The European car market is highly sought after. Everyone knows this. However, a “tariff mountain” now blocks the way. On October 4, EU member states voted to impose import tariffs of up to 45.3% on Chinese electric vehicles for five years. Chinese car companies face a dilemma: push forward or retreat. They have recognized strengths and even advantages. “European car sales are declining. Meanwhile, new competitors from Asia are entering the market strongly,” said the CFO of Volkswagen Group. His statement highlights the multiple challenges local car manufacturers face and acknowledges the competitiveness of Chinese brands. Opinions vary in the industry. Some argue that when the enemy is weak, it is the best time to attack. Others believe that uncertain tariff policies greatly reduce China’s export advantages for electric vehicles. This leads to an unfair competition where the outcome is hard to predict. However, the increasing number of Chinese car companies at the Paris Auto Show shows that they are determined to enter the European market.

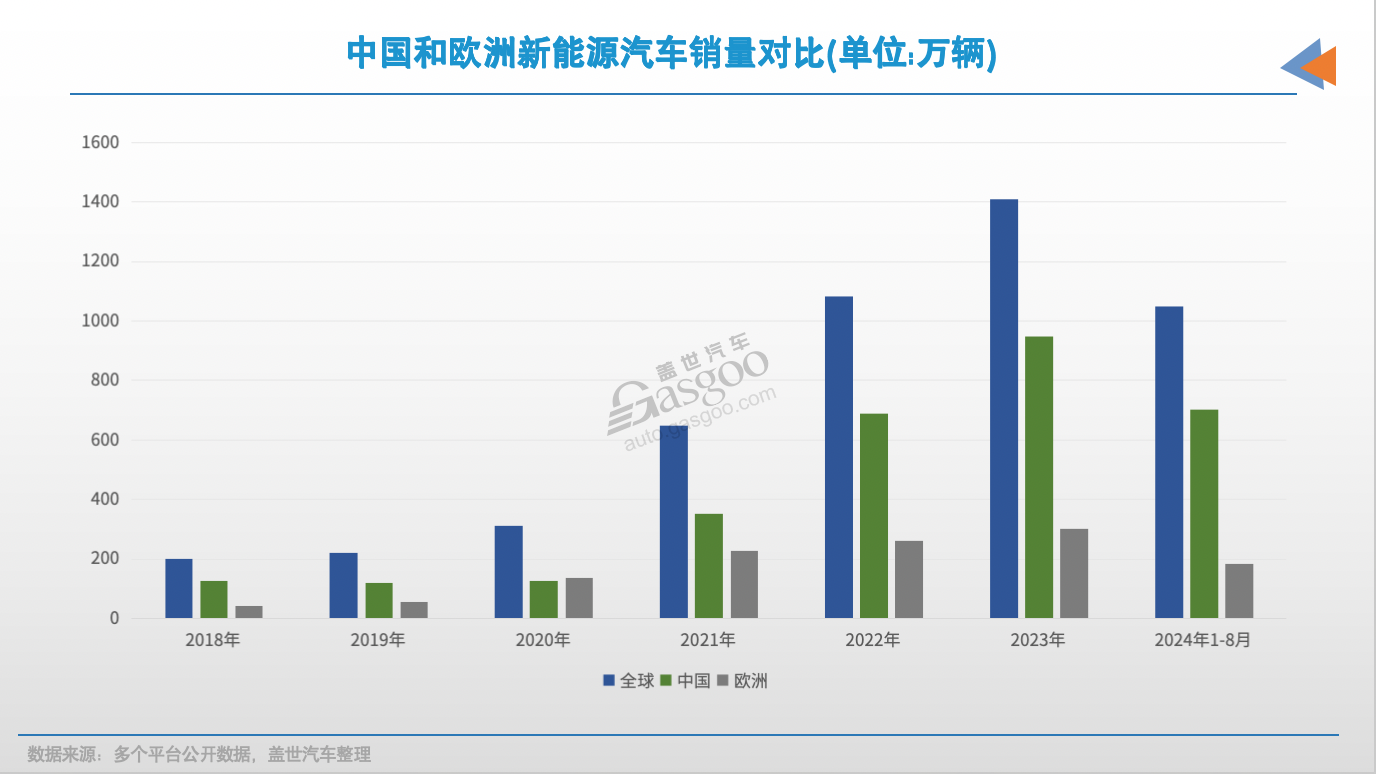

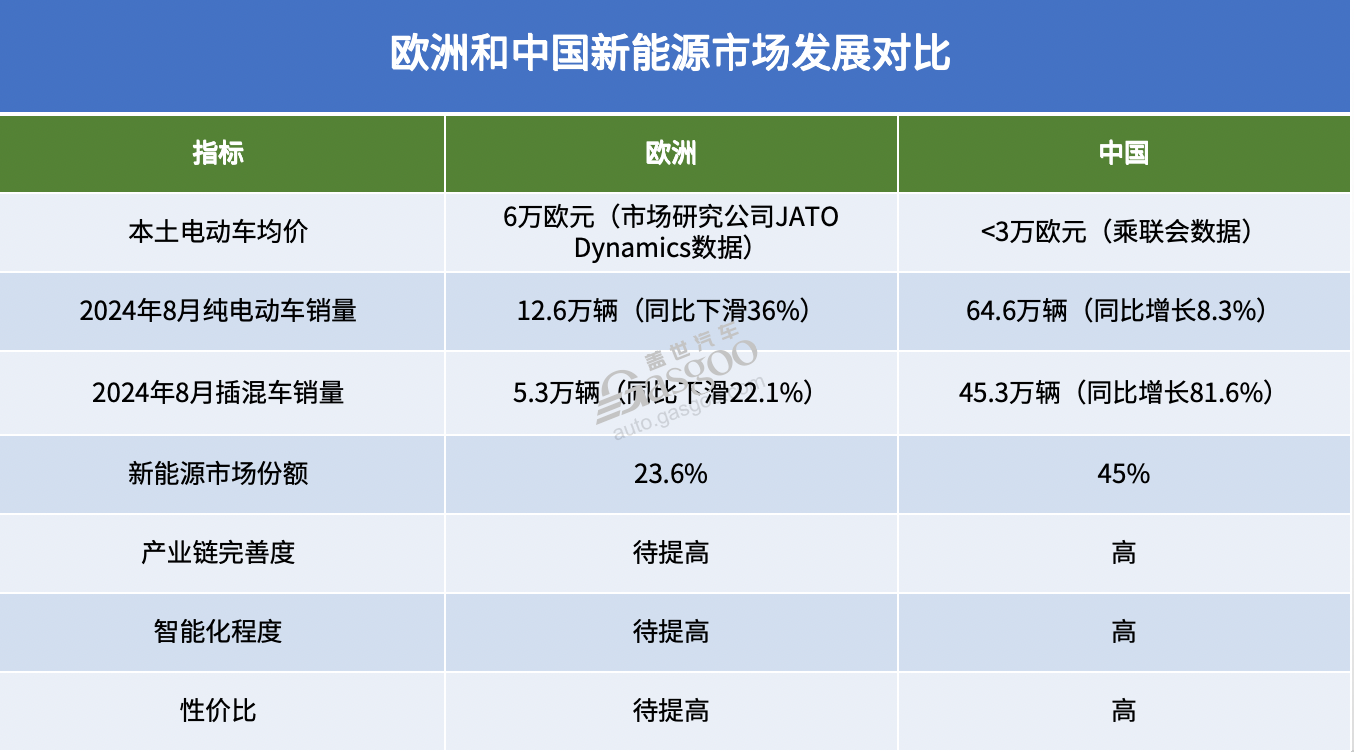

The final goal of the tariff increase The EU firmly imposes a five-year import tariff on Chinese electric vehicles. This decision stems from multiple factors. The primary goal is to protect the local electric vehicle industry. Europe was an early advocate for electrification, but progress has lagged. The overall penetration rate is only about 20%. Electric vehicles struggle in the European market due to high prices. Market research firm JATO Dynamics reports that the average price of electric vehicles in Europe is around €60,000, significantly higher than comparable gasoline cars. According to Eurostat, the average annual salary for EU workers is about €33,000. The EU also aims to counter the competitive advantage of Chinese car manufacturers. Economic downturns in recent years have slowed the growth of electric vehicles in Europe. In August, electric vehicle sales in Europe plummeted by over 20%, with a market share of only 23%.

China’s new energy vehicle market thrives. Its penetration rate reaches 45%. The industry boasts a complete supply chain, high intelligence, and strong cost performance. Some Chinese brands launch electric cars in Europe priced below 30,000 euros. They combine product strength and competitive pricing, driving rapid sales growth. In France, one in three electric vehicles sold last year was produced in China. These trends show China has surpassed in smart electric technology. If the 10% basic tariff policy continues, European automakers may face increased disadvantages in market competition. Last year, the European Commission warned that Chinese-made cars hold an 8% share of the European electric vehicle market, which could rise to 15% by 2025. Job stability is also at risk. The EU automotive industry directly and indirectly employs about 13 million people, making up 6% of total EU employment. If Chinese electric vehicles continue to flood in under the 10% tariff, local European automakers will suffer greatly, impacting local jobs. This move may also aim to avoid repeating the photovoltaic industry’s mistakes. Europe once led in photovoltaics, but China reduced production costs through large-scale production and a complete supply chain management system, achieving a lead.

In 2013, the EU planned to impose tariffs on Chinese solar panels. After negotiations, the EU accepted price commitments from Chinese exporters. By 2023, the EU produced only 3% of its solar panels. Most panels came from China. This reliance caused several European solar companies to shut down. After implementing the tariff policy, China’s electric vehicle sales dropped 48% year-on-year in August. This policy slowed Chinese EVs’ entry into Europe. It gave European automakers time to catch up in the electric transition. If Chinese automakers care about the European market, they will seek new paths. This is another key goal of the policy: to attract Chinese investment in Europe. The strategy aims for a win-win-win situation: It helps Chinese automakers integrate into the local market and speeds up product launches. It gives European automakers a two to three-year buffer to accelerate their electric transition. It boosts local economic development, increases employment, and strengthens Europe’s global automotive position. Chinese automakers may act as “firefighters.” European automakers face challenges. They prioritize profitability due to management philosophies and shareholder pressures. Compared to the US and China, Europe has weaker software technology. This hampers their shift to smart electrification. When EV demand weakens, many European automakers slow their transition, like Volkswagen, which plans to cut production and software investments.

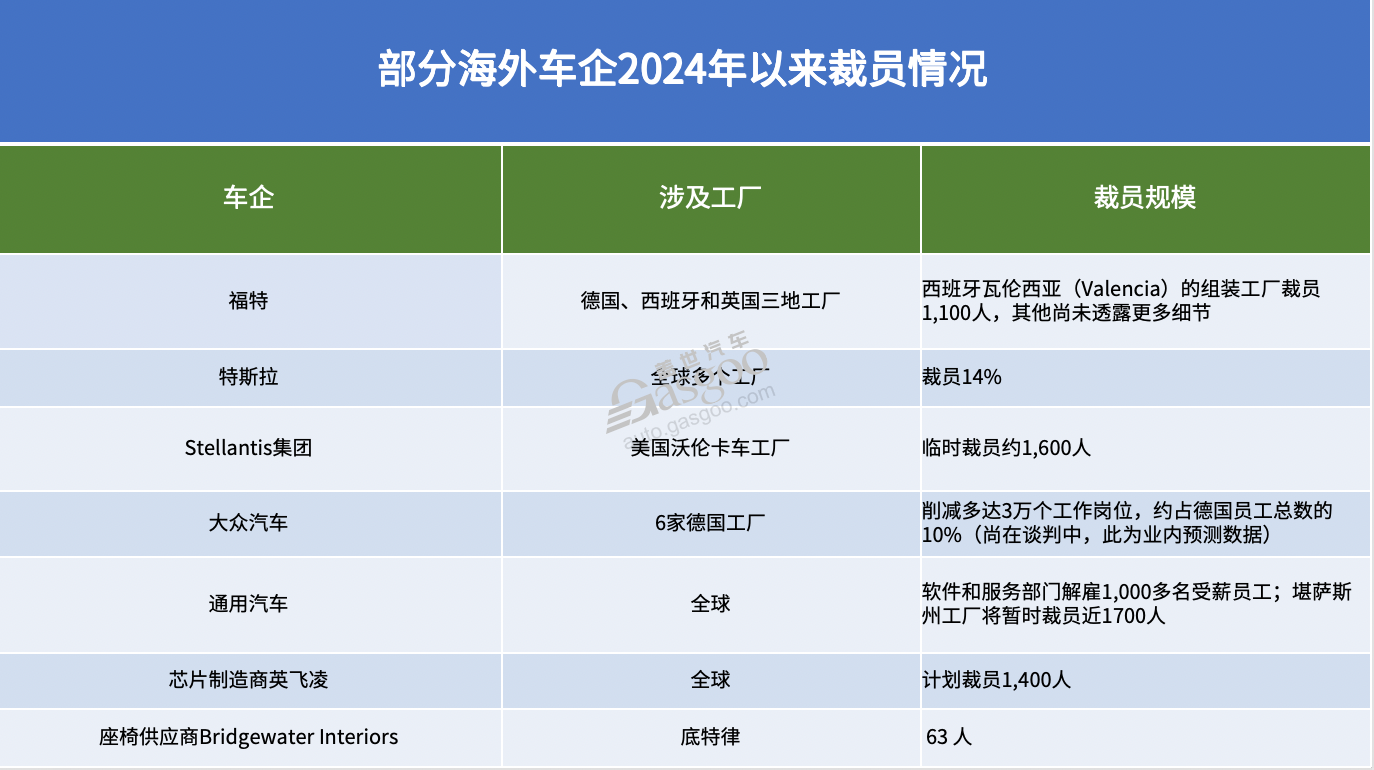

To ensure profitability and reduce costs, European and American car companies cut production and lay off workers in Europe. Incomplete statistics show that multinational companies like Ford, Tesla, and Volkswagen announced layoffs affecting tens of thousands. For example, Volkswagen plans to lay off over 30,000 workers due to a reduction of more than 500,000 units at its German factories. Stellantis also laid off nearly 20,000 workers in Europe between 2021 and 2023.

China has surpassed Europe in the global automotive industry. According to data from the China Passenger Car Association, China holds 67% of the global new energy vehicle market. This situation suggests that Europe may need Chinese automakers to accelerate its local automotive transformation and stimulate the economy while stabilizing employment. However, the EU’s decision to impose high tariffs on Chinese electric vehicles complicates this role. Should Chinese automakers act as “firefighters”? The industry is divided on this issue. Cui Dongshu, secretary-general of the China Passenger Car Association, believes it is an opportunity for Chinese companies to enter the European market. He says they should take advantage of the current downturn. Analysts from the Gaishi Automotive Research Institute share this view. They note that Chinese companies currently have a leading edge in the new energy vehicle sector in Europe. They also point out that Europe’s electrification and intelligent supply chains are weak. They see this as a valuable window of opportunity. Additionally, Europe’s economy is in a recovery phase. Inflation and unemployment rates stand at 2.4% and 6.4%, respectively. This indicates that local consumer purchasing power is recovering. Cui Dongshu advises Chinese companies to adopt a strategy of “endurance” in response to the EU’s tariffs.

The EU’s decision raises China’s electric vehicle export costs by 7.8% to 35.3%. Chinese automakers face a choice: absorb the tariffs or raise prices. Some companies, like SAIC MG and BYD, state they won’t adjust prices in France and Italy this year. Senior automotive analyst Zhong Shi takes a cautious stance. He calls this the “most sensitive and uncertain period.” He advises against exporting pure electric vehicles to Europe. Instead, he suggests exploring routes for plug-in hybrids, which can avoid policy barriers. The European plug-in market holds only a 7% share, showing significant growth potential. Zhong emphasizes learning from the lessons of exporting electric vehicles. He urges steady progress to avoid alarming local markets. He also recommends negotiating with the EU about tariffs on plug-in hybrids in advance. Building factories, forming joint ventures, or outsourcing? A “win-win” solution appears to emerge. Chinese automakers can invest in Europe, achieving local production and sales. This strategy can bypass trade barriers and create jobs, boosting local economies. As Chery Group Chairman Yin Tongyue states, “We are not here to plunder their market; we aim to contribute to the local society.” So, should they build factories, form joint ventures, or outsource? This is the strategic choice for Chinese automakers expanding in Europe. Analysts note that the chosen model should depend on the company’s strength and strategic intent.

Top car companies like SAIC Motor and BYD currently aim for sales of over 200,000 units in Europe. This volume supports local factory construction. It also shows their strategic intent to establish a foothold in the European market. BYD plans to build electric vehicle factories in Hungary and Turkey. SAIC Motor considers establishing its first European electric vehicle factory in Spain or another region. These actions reflect the long-term commitment of leading companies in the European market. NIO previously faced rumors about acquiring Audi’s factory in Belgium. Founder Li Bin denied this, stating, “That would be digging a pit for us. If Audi can’t sustain the factory, how can we?” Analysts at Gaishi Automotive see companies like NIO and Leap Motor as product leaders with specific advantages but currently smaller in scale. They suggest that these companies should adopt contract manufacturing or joint ventures as a lighter asset model. For instance, Leap Motor has partnered with local carmaker Stellantis to form Leap International. This company handles sales and channel development for Leap products in Europe and overseas. Leap International has begun exporting its first models to Europe. Reports indicate that Leap’s vehicles will assemble at Stellantis’s factory in Poland, with plans for localizing parts supply to avoid EU tariff barriers. Chery chose a joint venture model with a local company. In April, Chery signed a joint venture agreement with Spanish firm EV Motors. They plan to repurpose a former Nissan factory to produce Omoda brand electric vehicles. The project will unfold in two phases, with an annual capacity of 150,000 units.

This cooperation will provide jobs for 1,250 employees affected by the Nissan plant closure. It shows the positive impact of Chinese car companies’ investments in Europe on the local economy and employment. Hungary, a friendly country to China, attracted 7.6 billion euros in direct investment from Chinese companies in 2023, accounting for over half of its total foreign investment. Brands with deep ties to European car companies, like Lynk & Co and Lantu, can initially choose contract manufacturing or joint ventures. Lynk & Co’s parent company, Geely Group, owns a stake in Volvo. It can leverage Volvo’s factories in Europe for production. Lantu’s parent, Dongfeng Group, has joint ventures with Stellantis and Renault, providing strong support for its entry into the European market. Timing for entering the European market requires careful consideration. Magna executives believe that the earlier Chinese electric vehicle brands enter, the better their chances. “Chinese manufacturers currently lead, but traditional European manufacturers are catching up. The window is short.” However, some companies, like Dongfeng Group, remain cautious. They will decide on local production based on the European car sales outlook. Great Wall halted operations at its European headquarters due to uncertainties from policies. Regardless of the strategy, product strength remains the key to success. Even under pressure from European tariffs, strong brands or products can still attract consumers. For example, BYD and Chery’s Omoda saw sales rise in Europe in August, reaching 30th and 37th in brand sales, respectively. This supports the foreign media’s view: “As long as it’s a good car, many owners don’t care where it’s made.”