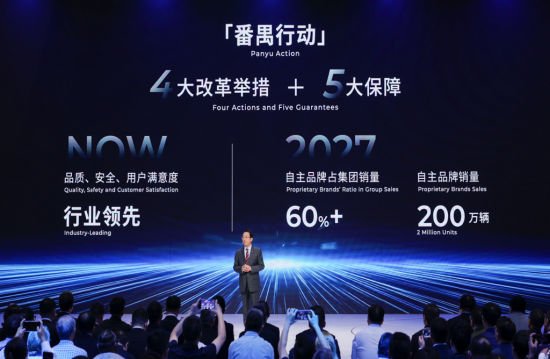

The Panyu Action sets the direction for GAC Group over the next three years. This three-year initiative aims to achieve 2 million units of self-owned brand sales by 2027, accounting for over 60% of total sales. However, GAC Group has not disclosed its overall sales target. The reason is simple. GAC Group’s reliance on the joint venture model has become unreliable. This issue did not arise this year; rather, pressure has reached a critical point. Without change, maintaining operational continuity becomes difficult. On the night of October 30, GAC Group released its Q3 2024 financial report. The group reported revenue of 28.5 billion yuan, a 21% year-on-year decline. It posted a net loss of 1.4 billion yuan, with a non-recurring loss of 1.5 billion yuan. The net profit margin stood at -0.67%, and inventory levels reached 67 days. The only positive note was a debt-to-asset ratio of 45%, which remains manageable. However, the current ratio dropped to 1.25, the lowest since early 2023. In short, the core business framework remains, but profitability has worsened. Overall, the company is losing money on vehicle sales. This situation is dire for a mature state-owned enterprise with a complete product lineup. The profit contribution from “Two Fields” fell from 7.07 billion yuan last year to 2.26 billion yuan this year. Although losses in the self-owned segment decreased, the joint venture’s cash cow shrank by nearly 5 billion yuan, leading to an overall loss. Due to settlement practices, Q4 earnings will concentrate. While the company may not incur an annual loss, the declining trend in quarterly profits indicates that the current business model no longer suits the competitive market landscape. This serves as a crucial motivator for GAC Group’s management to initiate unprecedented reforms, a trend visible throughout the industry.

Misjudgment of Huawei is not the main cause. GAC’s performance this year is disappointing. Some criticize GAC for misjudging its partnership with Huawei. GAC indirectly admits this misjudgment through its renewed collaboration with Huawei. However, partnering with Huawei may not solve current difficulties. A strategic dilemma cannot resolve with a single tactical move. Only companies like Seres, which fully entrust their business to Huawei, can succeed with the smart selection car model. No state-owned enterprise could do this at that time, especially GAC, which was strong in 2021. Huawei’s car business unit faces a significant obstacle in expanding due to challenges in negotiating with strong OEM partners. This applies to both SAIC and GAC. They decide actions based on their current strengths, often overlooking future changes. Huawei’s collaboration style is assertive. All companies working with Huawei recognize this. OEMs cannot treat Huawei like a supplier, which creates discomfort for them. This makes it difficult for Huawei to open new business opportunities through partnerships with leading OEMs. Who could foresee in 2021 that Huawei’s smart driving would become an industry leader? Such foresight embodies the “strategic vision” praised by the State-owned Assets Supervision and Administration Commission. In reality, this is very challenging. Thus, criticizing GAC for lacking vision at that time is somewhat harsh.

Group Main Battle Reform includes short-term and long-term measures. The short-term measure involves relocating the headquarters from Guangzhou to Panyu. This move aligns with the production lines of its brands and took just one month. The management switched from suits to work uniforms, signaling strategic determination. The message is clear: the group will take charge of specific operations. This is not mere show. The long-term measure shifts from strategic control to operational control. It implements integrated operations for self-owned brands and coordinates research, production, supply, and sales. What is “strategic control”? Previously, each self-owned brand had its management team and separate functions for research, production, sales, and service. Some resource duplication existed, but it wasn’t entirely negative. It clarified responsibilities and rights, fostering strong motivation and internal competition. The group did not directly manage brands. It used strategic planning to indirectly control operations. It evaluated executives based on KPIs, but this was retrospective. Under this system, the group struggled to guide specific operations unless brands requested leadership involvement to coordinate key resources. “Operational control” means the group management directly engages in the brand value chain and every operational aspect. Direct management may dilute brand leadership. To address this, one could separate daily operations from major decision-making, but this could create new issues with unclear boundaries of responsibility. It is clear that GAC Group has decided to unify the scheduling of self-owned brands’ research, production, sales, and service, pushing resources to the front line.

Recent Reforms Did GAC Group enhance or weaken the independence of its brands, Trumpchi and Aion? The control over resources has weakened. Many powers returned to headquarters. Brand management authority shifted to the front office and headquarters. Logistics, procurement, R&D, and finance lost authority. GAC plans to merge the functional departments of GAC Research Institute, Trumpchi, and Aion with some departments of GAC International. This aims for centralized resource management. Aion’s departments will integrate as much as possible while ensuring independence. Departments unrelated to Aion’s operations will likely merge into the group, leaving only the “frontline teams.” To strengthen Aion’s technical assets, GAC invested nearly 1 billion yuan in Aion. This funding supports new projects under Aion, theoretically under Aion’s management. This clearly shows that, despite losing supply chain and backend operations, Aion’s independence remains intact, with increased financial control. However, Aion seeks to go public. It postponed its IPO from 2023 to 2024. With only five weeks left in 2024, it has not disclosed any IPO progress. Once Aion lists, its independence will be hard to question. The current group reform needs a delicate balance with Aion’s strategic goals. It is too early to assess the effectiveness of this balance. GAC Research Institute should be a key focus of the reform. Previously, task demands originated from the research institute, but brand marketing had the clearest market perception. Inconsistencies in perception and decision-making must change. This is why GAC Group established the “Product Division” to streamline the entire process from product definition to market launch. The research institute controls R&D teams and resources, but decision-making should shift to the Product Division. It remains unclear which lines form the Product Division. If it follows a committee system, executives from the group, brands, and research institute would participate, with decisions theoretically made by the group. In reality, the group may not engage in such specific and professional matters. The identity of the product manager will reveal who holds actual decision-making power.

In October, the first inspection team from the Guangzhou Municipal Discipline Inspection Commission entered GAC Group. By the end of the month, the team reported issues found within the GAC Group Party Committee. They highlighted concerns about a lack of urgency, weak second entrepreneurial spirit, and gaps in promoting high-quality development. The team noted insufficient strategic foresight and inadequate efforts to resolve difficulties. They also pointed out a decline in the role of manufacturing in the city’s economy. Terms like “resolving difficulties,” “second entrepreneurship,” and “strategic foresight” all emphasize one point: GAC must make significant strategic adjustments. As a state-owned enterprise under the Guangzhou State-owned Assets Supervision and Administration Commission, GAC cannot ignore this clear and motivating oversight. The inspection team’s pressure creates momentum. At this moment, management’s compliance will improve. In other words, resistance to reform will decrease. Any reform disrupts existing interest structures. The essence of reform involves reallocating power and resources. This is undoubtedly the true goal of the “Panyu Action.” The “Panyu Action” implements a second round of mixed ownership reform within the group. It redistributes resources and restructures management. The outcome will be clear in three years. The gold standard will be whether GAC can break free from reliance on joint venture profits. To facilitate communication with the outside world, the “Panyu Action” includes tangible data on sales and technological development. While nearly every major automaker releases future plans, GAC’s actions differ. They represent a comprehensive self-reform decision made under immense operational pressure. Amid the traditional automotive industry’s joint venture crisis, GAC stands out by raising a revolutionary banner. It is clear that GAC will not have another chance for a strategic shift.