Reporter: Zhang Qiaoyu Recently, New Giao RV Co., Ltd. submitted its prospectus to the Hong Kong Stock Exchange for the second time. Huatai International serves as the sole sponsor. New Giao first submitted its prospectus on May 28 this year. The prospectus expired after six months due to failure to pass the hearing. According to Frost & Sullivan, New Giao ranks second in market share in the RV industry in Australia and New Zealand for 2023, based on revenue and sales. If successful, New Giao will become the first stock in the RV market. The global RV market reached 260 billion yuan in 2023, with a compound annual growth rate of 4.9% since 2019. Founder Miao Xuezhong aims to lead in the Australia-New Zealand market. However, New Giao holds only 6.8% market share, far behind the leader at 31.5%. Additionally, New Giao collaborates with related parties for procurement, sourcing RV parts from companies like Shangqiu Jishun. Both related companies and New Giao are under Miao Xuezhong’s control. New Giao RV established Regent Company in September and acquired the Regent brand. It manufactures and assembles trailer RVs for export to Australia through Daidelongcui. Miao Xuezhong, despite New Giao being new, has extensive experience in the automotive industry.

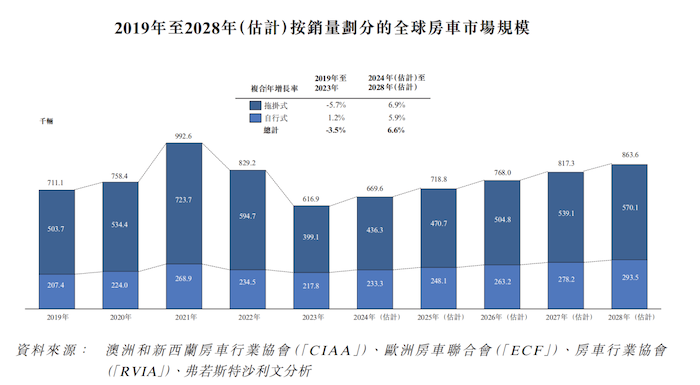

From October 1999 to June 2002, Miao Xuezhong worked at Geely Auto Group. He rose to the position of president at Zhejiang Geely Automobile Co., Ltd. He achieved sales of over 30,000 vehicles during Geely’s early days. This earned him the nickname “Geely’s Young Marshal.” In 2003, Miao Xuezhong left Geely and returned to his hometown to establish Zhejiang Giao Automobile Group Co., Ltd. He launched SUV and pickup products in just 200 days. However, Giao faced financial difficulties after a brief period of success. Eventually, GAC Group acquired a 51% stake, transferring operational control to them. The birth of New Giao marked Miao Xuezhong’s new venture in the automotive field, this time in the RV sector. After acquiring the Regent brand in 2014, New Giao introduced the Snowy River brand in 2015 and the NEWGEN semi-off-road RV brand in partnership with Green RV in 2019. These three brands became New Giao’s main revenue sources. Miao Xuezhong maintained his decisive style, delivering over 1,000 RVs in 2021. Before the IPO, the Miao family held control over New Giao, making it a true family business. As of November 24, 2024, Miao Xuezhong, his wife Wang Danhong, and their daughter Miao Wanyi hold about 99.17% of Xinjiao’s issued capital through entities like Snowy Limited, M.X.Z Holdings, Miao Wanyi Holdings, Miao Wanyi Trust, WDH Holdings, and MWY Holdings. This further strengthens the Miao family’s absolute control over the company. The founder aims for first place, but the market share remains low. RVs divide into towable and motorized types. Towable RVs include standard RVs, pop-up campers, and camping trailers. Xinjiao focuses on towable RVs. Unlike motorized RVs, towable RVs lack engines and driver cabins. They rely on the power of tow vehicles, making them cheaper. Reports indicate that motorized RVs often sell for 3-4 times the price of towable ones. North America, Europe, Australia, and New Zealand rank as the top three RV markets globally. In 2023, these markets accounted for about 97% of the world’s RVs. Australia and New Zealand follow North America and Europe as the third-largest market. From 2019 to 2023, global RV sales fluctuated. In 2021, the pandemic prompted more people to choose RV travel. Sales reached 992,600 units during this period, leading to early market demand exhaustion. Global RV sales and revenue declined from 2022 to 2023. In 2023, sales reached 616,900 units. The compound annual growth rate from 2019 to 2023 was -3.5%. For towable RVs, the compound annual growth rate was -5.7%.

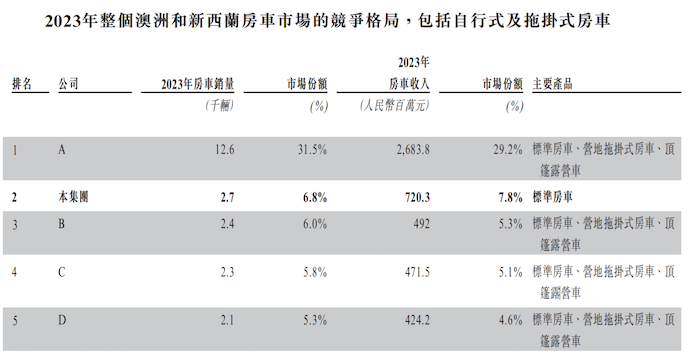

Australia and New Zealand’s markets remain stable. In 2023, the number of RVs in use reached 895,400. From 2019 to 2023, the compound annual growth rate was 3.9%. This growth indicates that the RV markets in Australia and New Zealand have matured. Xinjiao’s performance remained unaffected. From 2021 to 2023 and in the first half of 2024, the company’s revenues were 300 million yuan, 499 million yuan, 720 million yuan, and 422 million yuan, respectively. The net profits were 25.08 million yuan, 32.96 million yuan, 78.77 million yuan, and 40.43 million yuan. Since its inception, Xinjiao has targeted this mature market. According to the prospectus, all of Xinjiao’s revenue comes from these two markets. Based on 2023 sales, the company ranks second in the RV industry in Australia and New Zealand, holding 6.8% of the market share. However, it lags behind the leader, which has 31.5% market share.

The founder, Miao Xuezhong, holds a grand vision. On May 28 this year, he boldly declared at the New Giao RV Global Value Chain Conference and RV New Product Launch that the company aims to lead the Australia-New Zealand market in the next decade and to rank among the top in Europe and America. A standard RV sells for 260,000. The main suppliers are also controlled by the actual controller. Does the RV business make money? In 2023, standard RVs dominated the Australia and New Zealand markets, holding about 72.1% market share. The average price of a standard towed RV is 78,000 AUD, significantly higher than that of rooftop campers and camping trailers. New Giao sold 2,694 RVs in 2023, with an average price of 56,200 AUD and a gross margin of 25.3%. In the first half of 2024, the gross margin reached 32.2%. This increase stems from higher sales of premium RV products. New Giao also shifted from selling to dealers to selling through self-operated and joint venture stores. During the reporting period, one of New Giao’s main operating entities, Dadelong Cui, focused on the production, assembly, and export of towed RVs. Notably, Dadelong Cui, one of New Giao’s top five suppliers in 2021 and 2022, has a close relationship with the company. Dadelong Cui, established in 2010, is also controlled by Miao Xuezhong. In 2021 and 2022, New Giao centralized procurement of raw materials through Dadelong Cui, including raw materials, electrical components, and interior and exterior decorations. The amounts were 52.093 million and 14.735 million, accounting for 20.6% and 5.0% of total procurement, respectively. This centralized procurement arrangement ended in 2023.

New Ji’ao continues to purchase from related parties. In the first half of 2024, Shangqiu Jishun became New Ji’ao’s third-largest supplier. It provided door and window products worth 6.831 million yuan, accounting for 3.7% of purchases. Shangqiu Jishun, established in 2021, is an indirect subsidiary of Dailongcui and also a related party of New Ji’ao. It mainly manufactures RV parts. Miao Xuezhong controls Shangqiu Jishun. New Ji’ao began related-party purchases in 2022. The company stated, “We aim to balance our RV production needs and avoid over-reliance on a single supplier.”