Tesla’s Shanghai energy storage super factory officially began production.

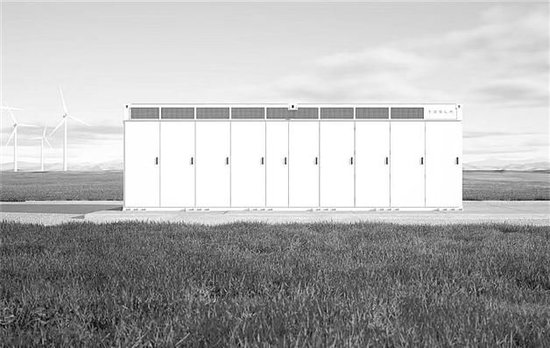

The Megapack looks like a white container and weighs over 38 tons. Tesla recently captured global attention with its energy storage business. On February 11, Tesla held a production ceremony for its Shanghai energy storage super factory. The first large-scale commercial electrochemical storage system, the Megapack, rolled off the line. This factory is Tesla’s second super factory in Shanghai. It is also the first energy storage super factory built outside the U.S. Construction began in May 2024 and finished in just seven months. This achievement highlights Tesla’s speed and Shanghai’s efficiency. Tesla expects its energy storage product installation capacity to grow by at least 50% in 2025. The launch of the Shanghai super energy storage factory marks a significant step in Tesla’s global strategy. It also plays a crucial role in the development of China’s new energy sector. Sources told the Securities Times that Tesla can significantly reduce Megapack production costs by leveraging China’s local supply chain. Additionally, the factory’s launch will attract upstream and downstream companies, enhancing the energy storage industry chain. Production capacity will increase this quarter. The Tesla Shanghai energy storage super factory spans about 200,000 square meters, equivalent to 30 standard football fields. The factory includes welding, painting, and assembly processes, equipped with advanced automation and management systems. The Megapack produced at the factory represents Tesla’s next-generation large-scale commercial electrochemical storage system. Each unit weighs about 30 tons, surpassing a standard container. This storage system functions like a “super power bank.” It changes the traditional power system by charging during low electricity demand and discharging during peak times. This approach supports renewable energy development and ensures stable power system operation. The newly built Tesla Shanghai energy storage super factory aims to produce 10,000 Megapacks annually, with a storage capacity of nearly 40 GWh. During the production ceremony, the first large-scale commercial electrochemical storage system, the Megapack, successfully rolled off the line at the Shanghai super factory. The Megapack resembles a white shipping container. It weighs over 38 tons and stores more than 3,900 kWh of electricity. This capacity equals that of 65 Model 3 rear-wheel-drive batteries. It also allows a Model 3 rear-wheel-drive to travel over 39,000 kilometers. During the production ceremony, Mike Snyder, Tesla’s Vice President of Energy and Charging, stated, “We aim to create energy products that work with electric vehicles to achieve our vision: accelerating the world’s transition to sustainable energy. Today, we celebrate the launch of the Shanghai Energy Super Factory. It will begin ramping up production this quarter, helping Tesla expand into more markets.” Lu Yu, director of the High-Tech Department of the Lingang New Area Administrative Committee, mentioned that Tesla’s second collaboration with Lingang reflects a deep recognition of the business environment there. In this project, Lingang actively participated in the process. They designed the entire construction plan and streamlined all steps from land acquisition to construction, achieving a new record for “Tesla speed.” Tesla has focused on the energy storage industry since its inception. In 2015, it launched Megapack and Powerwall in the U.S. for large-scale commercial and residential storage markets. By 2023, Tesla’s total energy storage installation reached 14.7 GWh, more than double that of 2022. The profit from the energy generation and storage business nearly quadrupled. Tesla’s latest financial data shows that in 2024, the company’s energy storage revenue reached $10.086 billion, a 67% increase year-over-year. This growth rate significantly exceeds the overall revenue growth, indicating that energy storage has become a key growth driver for Tesla. Additionally, the gross margin for Tesla’s energy storage business improved from 18.9% to 26.2% in 2024. Elon Musk, Tesla’s founder, previously stated that the future of renewable energy relies on large-scale storage. The Tesla Megapack storage system can support low-cost, high-density utility and commercial projects at a scale of up to gigawatt-hours. Flexibility is a key feature of the Megapack energy storage system. It integrates with battery modules, inverters, and temperature systems at any time. This integration helps stabilize and sustain the grid. Tesla has matched each battery module with a dedicated inverter. Each unit has undergone extensive testing. It includes an integrated safety system and professional monitoring software. These features significantly enhance energy efficiency and safety. Additionally, the Megapack battery can receive real-time updates through OTA upgrades, continuously optimizing its functions. Tesla’s Shanghai energy storage super factory is its first outside the U.S. Compared to Tesla’s U.S. facilities, the Shanghai factory has cost advantages. Its production may further propel Tesla’s energy storage business as a new growth driver. China’s energy storage supply chain is comprehensive and diverse. Tesla can choose the best partners and lower costs. Zhang Xiang, a researcher at the North China University of Technology, explained that Tesla supplies a significant volume of energy storage products to China. This creates economies of scale. Tesla has rich experience in this field, and its brand influence will help it thrive in the Chinese market. Leveraging local supply chains, Tesla expects to significantly reduce production costs for the Megapack, enhancing product competitiveness and profit margins. The launch of the Shanghai energy storage super factory marks a milestone for Tesla’s energy storage business and a new starting point for collaborative development in the supply chain. Tesla expressed hope that the Shanghai factory will encourage more upstream and downstream companies to establish roots in the area. It remains to be seen if the Shanghai energy storage factory can replicate the “catfish effect” of Tesla’s Shanghai super factory. However, it is clear that the energy storage factory will attract industry chain aggregation. Currently, the localization rate of components at Tesla’s Shanghai super factory exceeds 95%. More than 400 local first-tier suppliers have signed contracts, with over 60 entering Tesla’s global supply chain. The Shanghai super factory produces a vehicle every 30 seconds on average. Tesla’s rapid and efficient growth owes much to the involvement of the Chinese supply chain. Tesla’s success in China drives rapid development in the upstream and downstream supply chain. It promotes win-win cooperation. Zhang Jian, deputy secretary-general of the Energy Storage Branch of the China Battery Industry Association, notes that Tesla’s Shanghai Gigafactory leads the way. It exchanges market access for technology and boosts local industry chain development. The launch of Tesla’s Shanghai energy storage factory will encourage domestic companies to upgrade their technology. This process may adjust the price system for energy storage products. In the short term, some companies may feel the impact. However, in the long run, Tesla’s Shanghai factory positively influences the development of China’s energy storage industry chain. Competition in the energy storage market may intensify. The new energy storage industry and its applications continue to grow. The “China Energy Storage Battery Industry Development White Paper” shows that global energy storage battery shipments will reach 369.8 GWh in 2024, a 64.9% increase year-on-year. Chinese companies will account for 345.8 GWh, or 93.5% of global shipments, increasing their global market share by 2.6 percentage points. China maintains a leading position in the global energy storage industry. Reports highlight the advantages of China’s energy storage industry chain in manufacturing, cost, and market. Tesla builds its storage factory in Shanghai to leverage China’s large-scale manufacturing and quick response capabilities, addressing the Megapack production shortfall. It also benefits from China’s complete and low-cost energy storage system supply chain, reducing Megapack production costs. Jiang Han, a senior researcher at Pangu Think Tank, believes the Megapack project at the Shanghai factory will enhance Tesla’s competitiveness in the energy storage sector. Tesla’s electric vehicles sell well in China, creating a strong demand for charging. Megapack products can first be applied at Tesla’s own charging stations. Market analysis indicates fierce competition in the energy storage market. Companies compete across technology development, capacity expansion, market exploration, project execution, and business model innovation. Policy drives, technology advances, and costs drop. Market access lowers. More new entrants appear. Competition intensifies.