According to data from the China Passenger Car Association, the domestic SUV market sold 889,000 units in January 2025. This figure dropped about 34% month-on-month and 14.4% year-on-year. During the same period, Car Quality Network received 5,403 valid complaints from SUV owners. The complaints fell 20.2% month-on-month and 13.3% year-on-year due to the Spring Festival holiday. After removing voluntary withdrawal requests, the complaint rankings for the top 30 SUV sales in January 2025 are as follows:

Domestic brands continue to lose market share. Small SUVs again miss the list. In January 2025, SUV sales fell both month-on-month and year-on-year. The decline in SUVs exceeded that of sedans. Most models on the list saw a drop in sales. Only five models experienced growth, four of which were domestic brands. Geely Boyue L stood out with a sales increase that doubled month-on-month, leading the gains. In contrast, Japanese brands saw all listed models decline in sales. Overall performance was poor. The Corolla Ruifang had the largest month-on-month drop, nearly falling below ten thousand units, with a decrease of 55.5%.

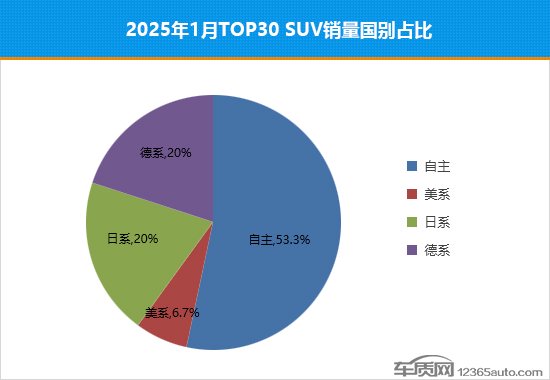

This month, the share of domestic brands continued to decline. It dropped to its lowest level in nearly six months, down 3.4 percentage points from last month. Meanwhile, German brands saw a rebound. Their share increased to one-fifth of the total, matching Japanese brands.

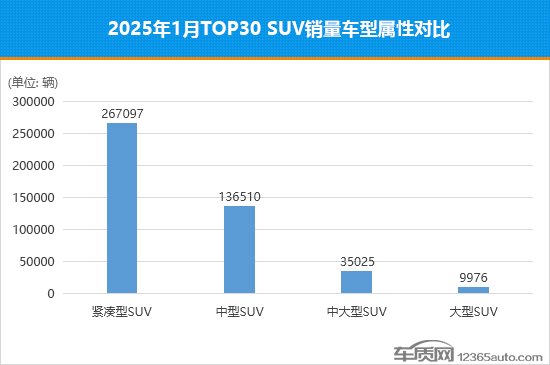

In the first month of the year, compact SUVs stand out. Their sales dipped slightly but remain far ahead of other vehicle types. Their market share increased by 6.5 percentage points compared to last year. In contrast, small SUVs performed poorly this month and fell off the list for the first time in nine months. Large SUVs saw the smallest decline, maintaining nearly 10,000 units. Quality issues dominate complaints. Domestic brands improve their reputations. Most models on this month’s list saw a decline in complaints. Four models experienced drops exceeding 60%. Geely Galaxy E5 excelled, leading the list with the largest decline and showing short-term reputation improvement. Notably, only one domestic brand model saw an increase in complaints, outperforming other national brands. Only five models on the list reported an increase in complaints. Two of these belong to Japanese brands. The complaint volume for Brilliance BMW X5 and Buick Envision rose significantly. However, considering sales changes, their levels remain reasonable.

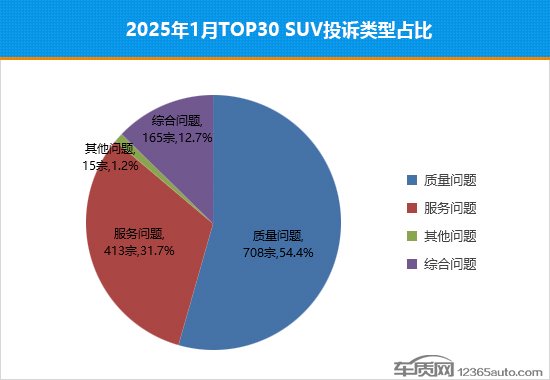

In January, quality issues dominated complaints. The total number of complaints slightly decreased, but the proportion remained stable. Notably, complaints about “engine/motor power deficiency” and “brake failure” doubled, becoming new growth points. The first issue mainly affected certain self-owned brand new energy vehicles. The second issue related to a specific self-owned brand electric SUV. In contrast, complaints about comprehensive issues saw a slight increase, raising their proportion to double digits. The complaint-to-sales ratio for 21 models performed better than their peers. According to the complaint-to-sales ratio rules, the total complaints included all valid complaints for the month. In January, the average complaint-to-sales ratio for SUVs was 36.5 per ten thousand, a slight increase from 32.4 in December 2024. Overall, the complaint-to-sales ratio continued to decline. On the list, 21 models had a complaint-to-sales ratio below the SUV average for January, with fuel vehicles accounting for over 70%. More than one-third of the models saw a decrease in their complaint-to-sales ratio. Models like Geely Galaxy E5 and Geely Boyue L showed significant declines, performing better than the previous month.