In the first quarter of this year, domestic power battery installations and exports hit record highs. On April 11, the China Automotive Power Battery Industry Innovation Alliance released new data. In the first quarter, domestic power battery installations reached 130.2 GWh, a year-on-year increase of 52.8%. This marks the highest first quarter since the alliance began tracking this data in 2020. Zhang Jinhui, a senior researcher at Xinluo Information, told Jiemian News that the growth in domestic power battery installations mainly comes from the increased penetration of new energy vehicles. Data from the China Automobile Dealers Association shows that as of March, the domestic retail penetration rate for new energy vehicles rose to 51.1%. This increase results from policies supporting vehicle scrappage, trade-ins, and tax exemptions for new energy vehicles. “China’s electrification is irreversible. By 2025, the penetration rate for new energy vehicles is expected to exceed 55%,” Zhang Jinhui said.

In the first quarter, lithium iron phosphate (LFP) batteries reached a cumulative installation of 105.2 GWh. This amount represents 80.8% of total installations, with a year-on-year growth of 93.6%. In contrast, ternary batteries had a cumulative installation of 25 GWh, accounting for 19.2% of total installations, with a year-on-year decline of 19%. In the domestic power battery market, LFP battery market share first exceeded 80% in December last year. This year, LFP battery share has continued to rise. In February and March, the market share surpassed 80%, peaking at 82.3% in March, a historical high. LFP and ternary batteries are the two main routes for power batteries. LFP batteries gained market leadership over ternary batteries in July 2021 due to their safety and cost advantages. As global demand for new energy vehicles slows and cost-effectiveness becomes more important, the overseas power battery market shifts towards the more competitively priced LFP technology route. So far, many overseas automakers, including Tesla, Volkswagen, Mercedes-Benz, and BMW, plan to increase their LFP battery installation share. Leading overseas battery manufacturers like LG Energy Solution, Samsung SDI, SK On, and ACC are also investing in LFP batteries.

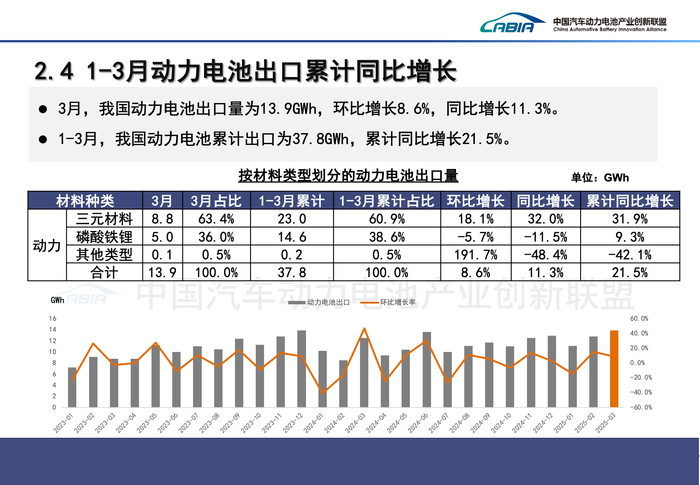

Current export data shows that overseas demand for power batteries favors the ternary technology route. The Power Battery Innovation Alliance reports that domestic power battery exports reached 37.8 GWh in the first quarter, a 21.5% increase year-on-year. This marks a new high for the first quarter since 2023. Ternary batteries accounted for 60.9% of the total, while lithium iron phosphate batteries made up 38.6%. The year-on-year growth for ternary batteries was 31.9%, significantly higher than the 9.3% for lithium iron phosphate batteries. CATL led in the domestic installation volumes for both lithium iron phosphate and ternary power batteries in the first quarter. Its installation volume for lithium iron phosphate batteries reached 40.48 GWh, capturing 38.49% of the market. This put it 9.16 percentage points ahead of the second-place BYD. Together, these two companies hold nearly 70% of the domestic lithium iron phosphate battery market. In the ternary battery sector, CATL’s installation volume of 17.04 GWh secured a 69.46% market share, dominating nearly 70% of the market on its own.

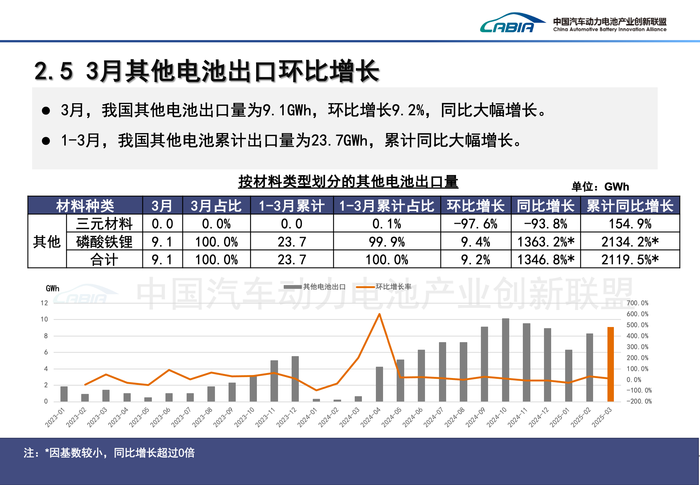

In the first quarter, CATL and BYD ranked first and second in domestic power battery installations. CATL’s market share reached 44.34%. BYD’s market share stood at 23.79%. The gap between them widened slightly to 20.55 percentage points from last year’s 20.34%. Unlike CATL, which supplies power batteries to car manufacturers, BYD mainly uses its batteries for its own electric vehicles. BYD continues to push for external battery supply. Its domestic clients now include FAW, FAW-Toyota, Changan, and Xiaomi. The third to fifth spots in battery installation rankings go to Zhongchuangxin Hang, Guoxuan High-Tech, and Yiwei Lithium Energy. The latter two swapped rankings compared to last year. Huangchao Energy, Xinwangda, Ruipu Lanjun, LG Energy, and Jidian New Energy ranked sixth to tenth. LG Energy, South Korea’s largest battery producer, fell out of the top 15 in January. However, it regained a spot in the top ten through rapid growth in February and March. Since 2020, LG Energy’s market share in China has declined. This decline relates to its technology choices. LG Energy previously dismissed lithium iron phosphate technology, believing it unsuitable for high-end vehicles. It focused mainly on ternary batteries, losing some market share in China. In the first quarter, LG Energy’s vehicle shipments in China came almost entirely from ternary batteries. The company also seeks to strengthen its position in lithium iron phosphate (LFP) batteries. In March, about 20 former employees of Jiewei Power began working at LG Energy’s Nanjing factory. They focus mainly on research and development. LG Energy plans to bring in a second and third batch of former Jiewei employees, but it has not set a timeline. The total size of the three batches will be around 200 people, covering R&D, production, sales, and other functions. LG Energy aims to enhance its LFP square battery technology. Beyond the power battery market, LFP batteries also dominate the energy storage sector. According to the Power Battery Innovation Alliance, domestic sales of other batteries reached 68.5 GWh in the first quarter. Of this, 99.9% were LFP batteries. Other batteries primarily refer to energy storage batteries, with a small amount used for low-power applications. Sales of other batteries accounted for 24% of total sales in the first quarter, up 9 percentage points from last year. Energy storage batteries are becoming a significant growth driver in the lithium battery market. Notably, the export volume of other batteries in the first quarter was 23.7 GWh, showing a year-on-year increase of 2119.5%. Again, 99.9% of these were LFP batteries. The chart from the Power Battery Innovation Alliance shows a significant year-on-year increase. The main reason is the sharp decline in export volume during the same period last year. The low base affects the comparison.

Since August 2023, exports of other domestic batteries have steadily increased, ignoring the unusual data from the first quarter of 2024. The global energy transition accelerates. Demand for energy storage continues to rise. In this context, Chinese battery manufacturers leverage their lead in lithium iron phosphate technology. They dominate the global energy storage battery market. According to a report from the High Industry Research Institute, global shipments of energy storage lithium batteries will grow over 55% year-on-year in 2024. Chinese companies will contribute over 90% of global production capacity and claim all top 10 spots for the first time. GGII reports that last year’s top five global energy storage lithium battery suppliers were CATL, EVE Energy, Hicharge, BYD, and Contemporary Amperex Technology. The bottom five were Ruipu Lanjun, Guoxuan High-Tech, Envision, Penghui Energy, and Chuangneng New Energy.