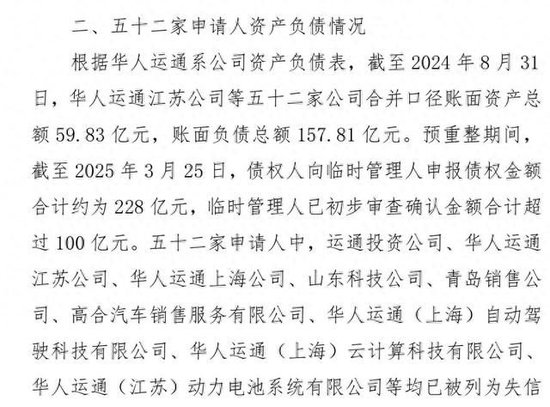

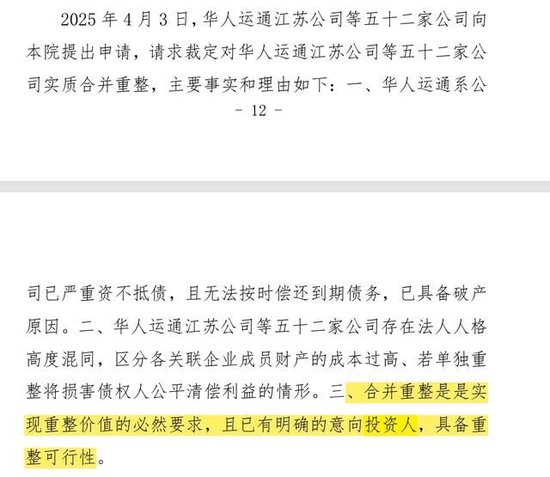

Recently, the Yancheng Economic and Technological Development Zone People’s Court announced the merger and reorganization ruling for 52 companies under Huaren Yuntong. This ruling revealed the asset and liability situation of Huaren Yuntong and information about the investors in the common benefit debt. The total book assets of the 52 companies amount to 5.983 billion yuan. Their total book liabilities reach 15.781 billion yuan. During the pre-reorganization period, creditors declared claims totaling approximately 22.8 billion yuan. The interim manager has preliminarily reviewed and confirmed claims exceeding 10 billion yuan.

Jiangsu Yueda Automotive Group Co., Ltd. and Yancheng Dongfang Investment Development Group Co., Ltd. became common benefit debt investors in Huaren Yuntong’s bankruptcy restructuring. Huaren Yuntong’s fifty-two companies stated in their merger restructuring application, “The company has clear intended investors and possesses restructuring feasibility.”

Two investors in the benefit bonds are local state-owned enterprises controlled by Yancheng’s state assets. Huaren Yuntong holds 15% of the equity in Jiangsu Yueda Automobile Group Co., Ltd., an investor in the benefit bonds. Starting in August 2024, Jiangsu Yueda Automobile Group Co., Ltd. will purchase HiPhi auto parts through its wholly-owned subsidiary, Shanghai Yueda Zhixing Automobile Service Co., Ltd. This will support HiPhi’s after-sales service.

Jiangsu Yueda Automobile Group is a shareholder in the Sino-Korean joint venture Dongfeng Yueda Kia. It holds 45.7% of Jiangsu Yueda Kia Automobile Co., Ltd. Since 2019, Dongfeng Yueda Kia’s Yancheng plant has stopped producing joint venture brand vehicles. It now leases the facility to Huaren Yuntong for producing high-end vehicles. “Common benefit debt investment” refers to a method where a debtor or manager borrows funds from investors during bankruptcy proceedings. This funding supports the ongoing operations of the indebted company. The company repays investors through production income, either via common benefit debt or other priority repayment methods. According to the ruling, Jiangsu Yueda Group, the major shareholder of Jiangsu Yueda Automobile Group, provided loans to Huaren Yuntong Jiangsu. Another common benefit debt investor, Yancheng Dongfang Investment Development Group, guaranteed this loan. Yancheng Dongfang Investment Development Group also invested in the Huaren Yuntong Automotive Industry Investment Fund in the Yancheng Economic and Technological Development Zone. Huaren Yuntong holds a 42% stake in the fund, while Yancheng Dongfang Investment Development Group holds 35%. Previously, Jiupai Finance reported that after High-end Auto halted operations in February 2024, it entered bankruptcy pre-restructuring in August 2024. On August 20, 2024, Huaren Yuntong’s temporary administrator announced that two institutions had signed up as common benefit debt investors. They expect to raise no more than 300 million yuan. In December 2024, several former employees of High-end Auto told Jiupai Finance that the company had begun paying the settlement amounts agreed upon in their severance agreements. Reportedly, employees who left voluntarily received 50% of unpaid wages as settlement. Those who left involuntarily had to forfeit compensation and notice pay, receiving only the unpaid wages as settlement.