The public opinion in the new energy vehicle sector has calmed, but recent events stirred the waters. On April 14, reports emerged that Xiaopeng Motors will mass produce its self-developed AI driving chip in the second quarter of this year. This chip will debut in Xiaopeng’s new model. In late March, NIO announced that its self-developed chip, Shenji NX9031, might feature in the ET9. This indicates that new players continue to accelerate in the smart driving arena. The trend of smart driving has not halted despite accidents involving leading car manufacturers. However, concerns about safety remain. This contradiction raises questions about how to view current smart driving, especially for companies that emphasize it as a key selling point. On January 25, 2025, Lei Jun hosted a live stream to mark the end of the Year of the Dragon. At 1:48 PM, his Douyin live stream suddenly faced a ban. Two days later, Yu Chengdong’s live stream, where he drove home to Anhui for the New Year, also got banned. Rumors circulated that Douyin cut the live stream due to violations of “driving while live streaming.” However, speculation suggests a more direct cause: during previous live streams, both leaders drove aggressively to test smart driving features, influencing many ordinary consumers. This level of backlash, however, seems insufficient to prompt companies to reconsider the importance of safety. Traffic and differentiated premiums drive many car companies to take risks. Car companies use many unofficial terms in their promotions, like “quasi-L3” and “L2.9.” They often mislead consumers. Companies like Xpeng heavily market concepts such as “zero takeover.” Meanwhile, incidents from video releases and rising safety data seem to serve as strong evidence for these firms. In immature tech fields, marketing resources pile up. Competing car companies create an impossible triangle of marketing traffic, safety, and tech maturity. They face delivery pressures and fierce competition. Whether they can escape this vortex remains uncertain. 01 Radicals leverage “smart driving” as a selling point. In April 2025, Li Xiang, CEO of Li Auto, shared a post calling for unified Chinese terminology for autonomous driving. He stated that users don’t understand L2 and L3; they are technical terms. He suggested standard names: L2 = assisted driving; L3 = automated assisted driving; L4 = automated driving; L5 = unmanned driving. He advised against exaggerated promotions to avoid user misunderstandings. He emphasized restraint in marketing and investment in technology for long-term benefits to users, the industry, and companies.

This may be the first time car brands struggle with exaggerated smart driving marketing. From a consumer’s perspective, understanding smart driving has become a challenge. As Li Xiang stated, car companies use various terms beyond L1 to L5 to complicate smart driving. Terms like urban NGP, urban NOA, full scene end-to-end, FSD, admax, end-to-end + VLM, MINDVLA, and ADS 3.0 appear alongside names like “Eye of the God” and “Vastness.” These terms make the simple introduction of smart driving features increasingly complex. The main reason lies in the immaturity of smart driving technology, which limits differentiation in the industry. Without packaging concepts, it’s hard to gain trust. Many examples exist, such as Xiaopeng, once known as the leader in smart driving. Xiaopeng was one of the first Chinese companies to implement urban NOA. In October 2022, it launched NOA in Guangzhou. By January 2024, Xiaopeng had the most cities in operation. However, by the second half of 2024, the situation reversed. “End-to-end” became the mainstream smart driving solution, and Xiaopeng’s advantage diminished. He Xiaopeng admitted, “By the end of Q1 2023, I realized that the path of urban NOA based on high-precision maps and rules was unfeasible. I felt we should pivot.” While the technology remains unstable, Xiaopeng continues to promote smart driving as its core focus. In a recent report, an employee stated, “Smart driving is like Xiaopeng’s favored child; it can’t be criticized or struck, only praised for being far ahead.” Facing rapid technological changes, He Xiaopeng said, “I must make the judgment. I take the gamble; if I err, I bear the consequences.” We cannot blame companies for their decisions amid technological shifts and fierce market competition. However, we must question whether such a rapidly changing technology is truly mature enough for widespread adoption. Xpeng claims its new generation of high-speed NGP has only 0.5 passive takeover instances per thousand kilometers since launch. It also states that the average speed has improved by 13% compared to the previous generation. According to Xpeng Labs’ 2023 data, the accident rate for smart driving is only one-tenth of that for manual driving. Xpeng faced a challenging transformation period. Maintaining core values became crucial. However, the instability of smart driving amplified under aggressive company strategies. As traffic increased, conflicts likely escalated into greater dangers. Similarly, Huawei’s HarmonyOS has a confusing stance on smart driving. Yu Chengdong recently stated, “Smart driving that is usable and safe is a different level. Having a network for calls is one thing; needing 5G for the internet is another. This is why many say Huawei’s HarmonyOS is leading the way.” Such statements can create the illusion that smart driving is highly mature. However, industry experts note that while smart driving technology varies, overall differences remain minimal. “In most scenarios, price does not significantly affect the experience of smart driving,” said Chen Xiaozhi, CTO of Zhuoyue Technology, during the China Electric Vehicle Hundred Forum. In this context, Lei Jun has quietly claimed that Xiaomi’s smart driving has made significant strides in a year. “In the past year, we moved from highway NOA to urban NOA, then to map-free NOA, and finally to end-to-end models, from parking spot to parking spot, including VLM.” Smart driving has become a shortcut for radicals to claim technological leadership. Meanwhile, calmer voices seem lonely. Wei Jianjun, CEO of Great Wall Motors, stated, “Smart driving is not a show. Practice brings true knowledge.” He emphasized that real smart driving technology affects every user’s travel experience and safety, meeting users’ frequent travel needs. Lantu Motors CEO Lu Fang repeatedly emphasizes the issue of “missing standards in intelligent driving.” He insists on clearly explaining intelligent driving to users. He urges for clear judgment and serious analysis. He believes users must have the right to make informed decisions. However, it seems no one remembers their statements. The Impossible Triangle of Traffic, Intelligent Driving, and Safety Intelligent driving, a rapidly advancing technology, gains new momentum in 2024 with the success of Xiaomi’s SU7. This marks the first time new energy vehicle companies see the power of a top-tier founder’s influence. Lei Jun, the focus of traffic, becomes a driving force for Xiaomi. His content, from video clips to memorable quotes, becomes excellent material for the internet. For example, his one-handed driving while other cars cut in becomes a widely shared example of intelligent vehicle avoidance. Under this traffic boost, Lei Jun’s influence on user perception is immense. In early 2025, a Douyin live stream featuring Lei Jun and Yu Chengdong gets banned for “live streaming while driving.” This appears to enforce platform rules but reveals the risks of aggressive marketing using top-tier influencers. Lei Jun’s personal traffic brings over 300,000 orders to Xiaomi cars. However, it also leads users to overtrust intelligent driving technology. This misplaced trust spreads from Xiaomi to other brands through social media. On platforms like Xiaohongshu and Douyin, users frequently showcase automatic driving with water bottles. Despite repeated warnings from the platforms, a radical attempt at intelligent driving quietly unfolds. Numerous cases show users unconsciously confuse “assisted driving” with L4-level autonomous driving. Meanwhile, car companies still aim to stoke the fire in this intelligent driving traffic pool. In early 2025, BYD announces that all its models will feature advanced intelligent driving technology, making widespread intelligent driving possible. The first batch of 21 models with the “Eye of God C” technology covers price ranges from 70,000 to 200,000 yuan (27580$), including the affordable Seagull model.

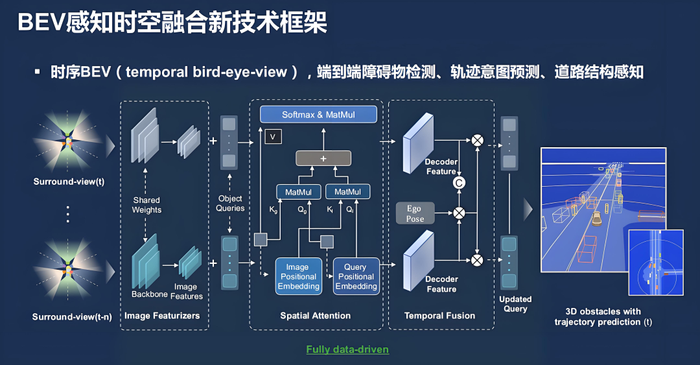

He Xiaopeng pointed out at the Automotive Hundred Forum that smart assisted driving has not become a key factor in customers’ car-buying decisions because it is too expensive. “We see that high-level smart assisted driving costs about 50,000 yuan (6900$) more than basic systems that only provide ACC. If the difference were only 10,000 or 20,000 yuan (2760$), we believe high-level smart assisted driving, even driverless technology, would quickly capture this market.” Expanding the user base for smart driving undoubtedly helps car companies win market share. However, many founders promote so-called “high-level intelligent driving,” yet its functions still do not reach L3 level. Thus, it remains “assisted driving.” Such marketing may only slow down if car companies clarify or intervene. Clearly, car companies do not want to halt this rapidly developing trend. Even amid the public relations crisis following a Xiaomi car accident, recent developments in smart driving continue to accelerate. New chips, lower prices, and increased traffic still fuel this field. Yet, no one seems willing to make higher safety commitments. 03 How to Escape the “Safety Pit” Under the worship of technology and an arms race, smart driving is sliding into a safety pit. To escape this pit, car companies, the industry, and regulatory bodies must work together. Currently, car companies aggressively develop smart driving technology. They rush to seize market opportunities by speeding up technology iterations and product launches. However, this rapid progress often neglects safety and maturity. Smart driving technology is a complex system. It involves sensors, chips, algorithms, and data. Any immature aspect can lead to safety accidents. From the perspective of car companies and users, exaggerated marketing and misuse accelerate the push towards danger. In the analysis of the Xiaomi SU7 traffic accident, several industry experts informed the media that the scenarios encountered by Xiaomi’s smart driving system are challenges faced by every car company’s smart driving team. In the pure visual perception phase, technologies like BEV perception and OCC, popularized by Tesla in recent years, are common in the industry. Experts note that on highways, BEV can typically detect objects only about 100 meters away. Beyond 60 meters, accuracy diminishes. “At 100 km/h, the smart driving system’s reaction time is about 3.6 seconds.” Detecting distant stationary obstacles is challenging. Having LiDAR definitely improves detection, allowing for earlier obstacle recognition.

Another senior expert in the autonomous driving industry stated, “In poor road conditions, stopping from 100 km/h to a complete halt poses significant technical challenges. However, slowing down to around 60 km/h is relatively easy.” After the Xiaomi incident, many car companies have started to reduce the use of terms like “zero takeover.” However, this progress remains insufficient. In an interview with 36Kr, an industry insider revealed that although car companies list many precautions, “it’s merely a disclaimer. Users find it hard to remember when AEB will activate while driving.” In other words, achieving real safety requires a broader consensus. The autonomous driving industry faces dual pressures: rapid development and safety assurance. While companies accelerate on the autonomous driving track, developing self-researched chips and adopting low-price strategies, safety remains the bottom line. Only by abandoning aggressive development models and focusing on robust technology research can companies improve. The industry must establish unified norms and standards to eliminate exaggerated claims. User education must strengthen to enhance safety awareness. Regulatory bodies need to improve systems and increase oversight. This approach can help the autonomous driving industry escape the “safety trap” and achieve true sustainable development. In this race for autonomous driving, speed is important, but safety is the only ticket to the finish line.