On May 20, China’s leading power battery company, CATL, successfully listed on the Hong Kong Stock Exchange. It closed its first day at HKD 306.2, up 16.43% from the issue price. The total market value reached HKD 1.38 trillion.

Ningde Times makes another major move in the capital market after its A-share listing. This IPO becomes the largest globally this year, raising over 35.6 billion HKD. Ningde Times takes just over three months from application to listing, setting a record for large companies on the Hong Kong Stock Exchange. According to the allocation announcement, the global offering includes 135,578,600 H shares priced at 263 HKD. After expenses, the net fundraising amounts to 35.33 billion HKD. If the overallotment option is fully exercised, the issue size will increase to 156 million shares. The total fundraising could reach 41.006 billion HKD. This IPO receives strong international interest. The international portion sees a 15.17 times oversubscription, attracting 428 investors. The Hong Kong public offering is oversubscribed by more than 0.15 times, receiving 310,800 valid applications. The IPO attracts 23 cornerstone investors, including Sinopec, the Kuwait Investment Authority, Hillhouse Capital, Gao Yi Asset Management, UBS, and Oak Tree Capital. Their total subscription amounts to 20.371 billion HKD. Ningde Times states that the H share fundraising will mainly support overseas capacity construction, especially the factory project in Debrecen, Hungary. The total planned capacity for this base is 100 GWh, with construction progressing in three phases. The total investment is expected to be no more than 7.3 billion euros. As of December 31, 2024, Ningde Times has invested about 700 million euros in this project. The factory will support European car companies like BMW and Mercedes after it starts production. This will enhance CATL’s penetration in the European market. Local production capacity is key for Chinese new energy companies to break into international markets amid carbon neutrality goals and Europe’s carbon tariff policies. CATL’s move helps it avoid geopolitical risks and solidifies its leading position in the global electric vehicle supply chain. Despite market fluctuations, CATL delivered a solid financial report for 2024. Last year, the company generated revenue of 362.01 billion yuan, a 9.7% decline year-on-year. However, net profit attributable to shareholders rose to 50.745 billion yuan, a 15.01% increase. In the power battery system sector, total lithium battery sales reached 475 GWh, with power battery systems accounting for 381 GWh, an 18.85% year-on-year increase. Energy storage battery system sales hit 93 GWh, up 34.32%. Additionally, CATL launched its second-generation supercharging battery last month. It enables charging in 5 minutes for a range of over 520 kilometers, reinforcing its technological leadership. This breakthrough not only strengthens its market position but also attracts more attention from downstream car companies. Notably, CATL’s first-day performance on the Hong Kong stock exchange broke the common “Hong Kong discount” trend seen in A/H shares. By the close, the Hong Kong stock price was 306.2 HKD, about 282.22 yuan (0$), significantly higher than the A-share close of 263 yuan (40$).

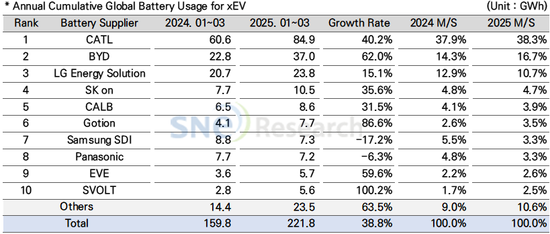

This “inverted” phenomenon shows strong international recognition of the company’s growth prospects. It highlights the company’s rarity in the global new energy sector. Institutions remain optimistic about CATL. Recently, Fitch, Moody’s, and S&P upgraded CATL’s ratings. S&P announced on May 7 that it raised CATL’s long-term issuer credit rating and the long-term debt rating of senior unsecured bonds guaranteed by CATL from “BBB+” to “A-,” with a “stable” outlook. Jeffrey’s head of China industrial research, Yun Junchen, noted in a foreign media interview that CATL’s current price-to-earnings ratio is about 17 times. Strong earnings and attractive valuations could allow its Hong Kong stock to rise by 50%. CATL currently serves as a core battery supplier for major global automakers like Tesla, Volkswagen, Ford, and Mercedes-Benz. According to SNE Research, CATL’s market share for power batteries reached 38.3% in the first quarter of 2025, far exceeding the second-ranked BYD.

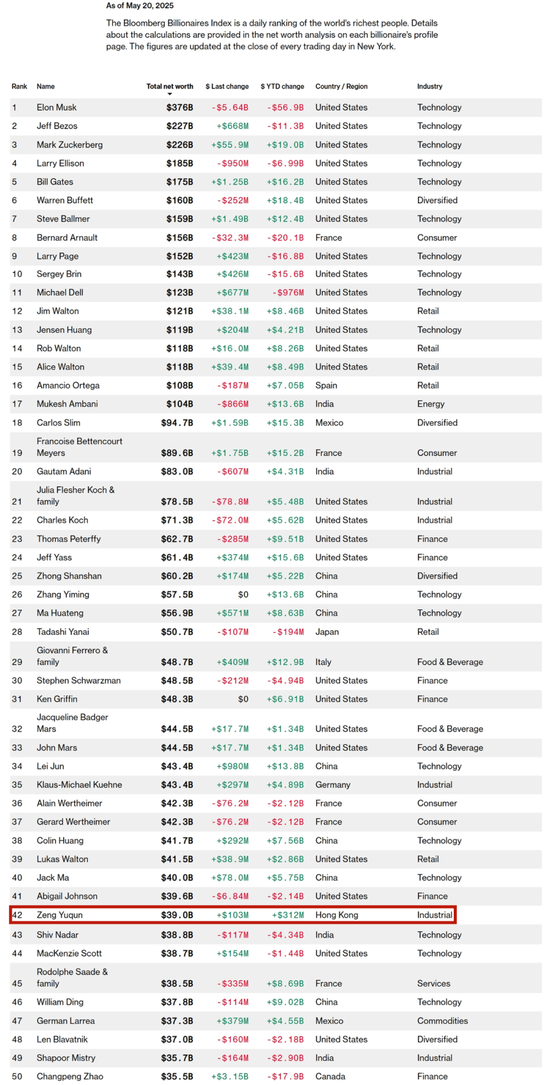

A strong customer base and technical capabilities directly boost the wealth of the company’s founder and team. According to a billionaire real-time ranking, after the Hong Kong stock listing, CATL Chairman Zeng Yuqun’s wealth increased by $103 million in one day. His total wealth reached $39 billion, ranking him 42nd in the world.

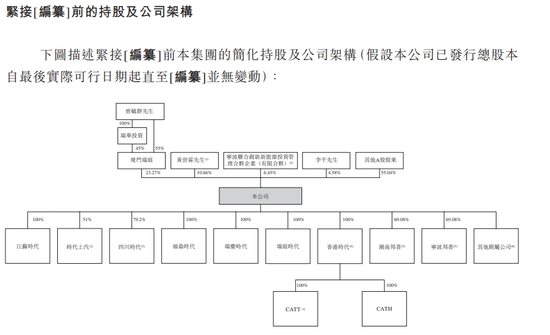

Ningde Times’ former vice chairman Huang Shilin saw his wealth rise to $18.3 billion. He ranks 120th globally. Ningbo United Innovation’s actual controller Pei Zhenhua’s wealth increased to $9.85 billion, placing him 319th. Ningde Times’ vice chairman Li Ping’s wealth reached $6.63 billion, ranking him 500th. According to the prospectus, before the Hong Kong stock listing, the largest shareholder of Ningde Times was Xiamen Ruiting, controlled by Zeng Yuqun, with a 23.27% stake. Huang Shilin held 10.66%, Pei Zhenhua 6.45%, Li Ping 4.58%, and other A-share shareholders 55.04%.

After the H-share issuance, the shareholders’ equity will dilute to 22.58%, 10.35%, 6.26%, 4.44%, and 53.39%. H-share shareholders will hold a total of 2.99%. Hong Kong’s Financial Secretary Paul Chan attended the listing ceremony for CATL today. He noted that CATL is the largest IPO globally since 2025 and a significant milestone for Hong Kong’s capital market.

Hong Kong Financial Secretary Paul Chan attended the listing ceremony for CATL, with Zeng Yuqun beside him. HKEX CEO Charles Li attended the ceremony. He said the A+H share listing and the return of Chinese concept stocks are key themes in this year’s IPO market. He revealed that over 40 A+H companies plan to list in Hong Kong or have submitted applications. In a complex international political environment and rising difficulties in overseas financing, CATL’s successful listing holds significant meaning. Earlier this year, the company faced inclusion on the U.S. military-related enterprise blacklist and various political pressures. However, several international investment banks continue to push its listing process, reflecting strong market recognition of its fundamentals. For the global new energy industry, CATL’s overseas expansion involves more than just one company’s growth. It symbolizes China’s high-end manufacturing overcoming trade barriers and reshaping the global supply chain. As Zeng Yuqun stated at the listing event, “CATL is not just a battery component manufacturer. We are a system solution provider and aim to become a zero-carbon technology company.” He added, “In the global new energy revolution, the zero-carbon economy is rising rapidly. CATL will become a pioneer in the global zero-carbon economy.” Did you participate in such a large IPO project?