“Unlikely to see significant price reductions again” This is the prediction of Tesla’s future vehicle prices by industry analysts following the release of Tesla’s fourth quarter and full-year 2023 financial report. Analysts warn that Tesla may not be able to further reduce prices significantly. Morningstar Research analyst Seth Goldstein said in an interview: “The signal from Tesla is that the company will not see a 50% year-on-year sales growth in 2024, or even 30% to 40%. At a certain point, you can’t reduce prices anymore.” The analyst’s comments are largely based on the recent financial data released by Tesla. In 2023, Tesla’s annual gross profit was $17.66 billion, a 15% year-on-year decrease; the gross margin was 18.2%, lower than 25.6% in 2022; operating profit decreased by 35% year-on-year to $8.891 billion. The disappointing financial data from Tesla is related to the price reduction measures the company took to drive sales growth. There are differing opinions within the industry about whether Tesla will continue to wage a “price war”. The conclusion is not yet known, but it is clear that Tesla’s ability to control costs will determine whether it can continue to promote sales with low prices. However, it now appears that the “butterfly effect” brought about by Tesla’s cost reduction demands is not only expanding from the original equipment manufacturers to first-tier suppliers, but is also spreading to second-tier suppliers, quietly bringing changes to the entire industry. “Cost Issue” is Inescapable As the “instigator” of the price war, Tesla’s cost reduction demand has become a microcosm of the vast majority of car companies. According to the “Announcement of the Ministry of Finance, State Administration of Taxation, and Ministry of Industry and Information Technology on the Continuation and Optimization of the Policy of Exemption of Vehicle Purchase Tax for New Energy Vehicles” issued in mid-2023, starting from 2024, new energy passenger cars with a pre-tax price of less than 300,000 yuan (41710$) can continue to enjoy the tax exemption policy; while new energy passenger cars with a pre-tax price exceeding 300,000 yuan (41710$) can only enjoy a 30,000 yuan (4170$) discount, and the part exceeding the tax exemption limit also needs to pay the purchase tax according to the corresponding policy. Therefore, in the second half of 2023, many models with a starting price above 300,000 yuan (41710$) at the main factory have already begun to indirectly reduce prices through various means, lowering the starting price of some models to below 300,000 yuan (41710$). For example, Tesla’s Model 3 and Model Y have both started to offer substantial discounts, with the highest reduction reaching 15,500 yuan (2160$). After the price adjustment, only the high-performance version of Model Y remains priced above 300,000 yuan (41710$). Domestic new energy car companies also quickly followed suit. The 2024 model of the Xiaopeng G9, which was launched in September 2023, has reduced its starting price to 263,900 yuan (36690$), a reduction of up to 66,000 yuan (9180$) compared to the old model with the same configuration. The price of the Lantu FREE is currently only 266,900 yuan (37110$). Entering 2024, there is no sign of the “price war” stopping, and many industry insiders even believe that this year’s car company price war will enter a “life and death battle”.

This is no empty talk. Even the “infinitely beautiful” ideal car announced a 30,000 yuan (4170$) price reduction for all its models in mid-January, with the starting price of the Ideal L7 dropping to 286,900 yuan (39890$) for the first time since its launch. It is worth noting that car companies cannot consider the 300,000-yuan market as a permanent “umbrella” of protection. First of all, it is clear that low prices are by no means easy. Behind the lower prices of complete vehicles, there is the contradiction of high sales and high losses for car companies, as well as the difficult-to-say hidden effort of car companies to reduce costs to alleviate the contradiction. Secondly, there are many competitors in the 200,000-300,000 yuan (41710$) price range, and the competition is fierce. According to relevant statistics, in the fourth quarter of 2023 alone, there are nearly 10 new cars with a guide price range of 200,000-300,000 yuan (41710$), including the Jiyue 01, Zhiji LS6, Zhijie S7, Jike 007, and Xingjiyuan ES. Looking ahead to the distribution of product price segments, Ideal CEO Li Xiang also stated that the upcoming Ideal L6 and Ideal L5 will adhere to the 200,000-300,000 yuan (41710$) price range. China Association of Automobile Manufacturers data shows that the sales volume of passenger cars in the 200,000-300,000 yuan (41710$) price range has been continuously increasing since 2018, from 1.93 million vehicles per year to 3.54 million vehicles in 2022. In addition, the market share of traditional fuel vehicles in the 200,000-300,000 yuan (41710$) price range has dropped from 99% in 2017 to 48% this year, breaking through 50% for the first time. However, this also means that the market space that new energy electric vehicles can cannibalize in the 200,000-300,000 yuan (41710$) price range is gradually diminishing. Therefore, looking at the new car price positioning gradually released by car companies in the fourth quarter of 2023, some car companies are beginning to “selectively avoid” the fierce competition in the 200,000-300,000 yuan (41710$) market and are beginning to plan and layout the high-end market.

Li Bin once made his judgment: “From 2024 to 2025, the market demand for high-end electric cars will explode,” while emphasizing: “Don’t compete with others in the 200,000 yuan (27810$) level, NIO always wants to maintain its high-end positioning.” However, it needs to be mentioned that positioning the entire vehicle price higher can help car companies improve the gross profit margin per vehicle, effectively alleviate the problem of car companies’ losses, but this does not mean that the pressure on car companies to reduce costs will no longer exist. After all, at present, most domestic new energy vehicle companies have not yet achieved profitability, and with the arrival of the second half of intelligentization, car companies’ research and development investment will only increase. In other words, whether car companies position their entire vehicle products as low-end, mid-range, or high-end, they still inevitably have to find ways to reduce costs. Tier 1 is at the forefront, car companies open both “swords.” Currently, the demand for cost reduction by car companies is increasing day by day. At present, car companies mainly have two ways to reduce costs: “cutting themselves” and “cutting suppliers.” On the car company side, most of them choose to reduce costs through technological innovation, for example, Tesla improves car design to make manufacturing processes as simple as possible. The company has saved about 10,000 to 20,000 yuan (2780$) per car through battery technology iteration. Although the initial investment in the integrated die-casting transformation of the body is large, the number of parts has been greatly reduced, the production process has been simplified, and the cost has significantly decreased under the conditions of large-scale production. In terms of suppliers, Dahai published an analysis report stating that Tesla requires upstream parts suppliers to reduce prices by up to 10%. It believes that Tesla’s price reduction and cost control actions will have a negative impact on the overall atmosphere of the Chinese automobile industry. In fact, Geely Automobile has learned that car companies require suppliers to undergo an “annual reduction” every year, with the magnitude generally around 3% to 5%, which has almost become an industry practice. According to the industry research data on “supply chain cost reduction” from Geely Automobile in March 2023, among nearly 3,000 industry users, 74% of users stated that the cost reduction requirements proposed by car companies in 2023 have significantly increased compared to previous years. In terms of the magnitude of cost reduction, more than half of the companies were required to reduce costs by 5-10% annually, and some companies stated that because of the epidemic, they had not reduced prices for three years and were required to reduce prices by more than 20% in 2023. In 2024, the pressure to reduce costs in the supply chain has become even heavier. Most of Tesla’s suppliers, including battery manufacturers Panasonic, LG Energy Solution, and CATL, as well as Italian die-casting machine maker IDRA Group, avoid discussing Tesla publicly due to confidentiality agreements.

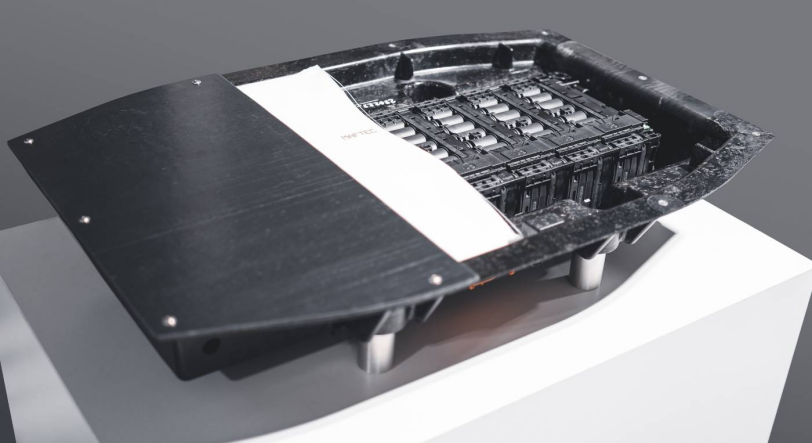

Bosch China CEO Chen Yudong clearly stated in a media interview that in the Chinese market, market share is far more important than profit. This also represents the voice of the majority of companies to some extent. It is reported that in order to maintain its market position, CATL is currently streamlining production line resources and proposing to reduce the price of power batteries starting in 2024. At the same time, BYD’s subsidiary, Fudi Battery, has also issued an internal notice urging the team to continue to reduce costs. As one of the key high-cost components of new energy vehicles, the cost reduction of power battery manufacturers is already significant. It is worth noting that in the process of car companies pursuing the ultimate low cost, the pressure has already been transmitted to various links and “nerve endings” of the entire supply chain. In any industry, the transmission effect of the industrial chain is inevitable. According to industry insiders, about 60% of the total cost of a car comes from purchased parts, making suppliers a key point for cost control by the automaker. The upstream of an automaker consists of hundreds of Tier 1 suppliers, with Tier 1 suppliers having Tier 2, Tier 3, and raw material suppliers upstream. For example, the seats in a car are supplied by Tier 1, while the seat rails that allow them to move back and forth come from Tier 2, the steel balls inside the rails come from Tier 3, and the steel needed to make the balls comes from raw material suppliers. As the pressure to reduce costs is passed down through the automotive industry supply chain, Tier 1 suppliers are forced to lower costs, causing Tier 2 suppliers to also become anxious. This is mainly due to the rapid penetration of new energy and intelligent electrification in the automotive industry, where the traditional “turnkey project” model is no longer suitable for the development requirements of “continuous iteration” in the context of software-defined hardware. Many automakers are calling for greater transparency in the supply chain, to “de-black-box” suppliers, improve safety control, and strengthen supply chain resilience. As a result, the automotive supply chain is undergoing a deep transformation. Previously, automakers had the closest relationship with Tier 1, with less connection to Tier 2, and minimal interaction with Tier 3 and beyond suppliers. Now, there has been a fundamental change in the relationship between automakers and suppliers at all levels. Chen Liming, president of Horizon, said, “Car companies have in-depth discussions with Tier1 to TierN on key components and functions, especially for system cost control and new technology introduction.” He believes the driving force for fundamental transformation of the automotive supply chain is the need to reduce costs. It is difficult for car manufacturers to control system costs if they do not have direct contact with major component and function suppliers. Similarly, Gasgoo interviewed Bao Leiwei, senior vice president of the BASF Performance Materials Business Division, who also admitted, “As a supplier to first-tier suppliers, we certainly face cost pressures in the process of providing materials.” He also admitted, “The Chinese electric vehicle industry has higher requirements for speed and agility, which will soon become a common requirement for all industries.” So, how can second-tier suppliers help first-tier suppliers and OEMs expand cost reduction space? In the field of power batteries, the traditional battery case is usually made of heavy metal profiles and molded parts, which will have a certain adverse effect on the overall weight and vehicle performance. For this reason, Adac, material supplier Mitsubishi Chemical Group, and battery system manufacturer Kreisel Electric have jointly designed a new concept. The result is an extremely light battery concept that can meet various requirements for the battery case of electric vehicles. Dr. Stefan Caba, head of safety travel in the innovation field of Adac Group, said, “This concept is light and powerful, especially suitable for medium-volume customers, such as high-performance vehicles such as electric sports cars and public transport vehicles.” Due to weight reduction and the potential for manufacturing battery boxes in a single process, a huge competitive advantage in the market has been created.

In terms of vehicle structure and materials, the new cost reduction trend in 2023 starts with the body materials, gradually replacing aluminum with steel. Gaise Automotive has learned that a certain second-tier automotive supplier has developed a new lightweight body technology, reducing the overall vehicle weight by 10% through the use of high-strength lightweight materials and optimized structural design. This technology enables car manufacturers to reduce material costs and fuel consumption, while improving fuel economy and driving performance. Similarly, to further assist upstream companies in cost reduction, BASF has chosen to gradually replace metal materials with TPU materials in the field of whole vehicles. According to Bao Leiwei, vehicle weight reduction has become a major concern for new energy electric vehicle manufacturers. “TPU materials can save 10% to 30%, 40% of the total weight. On one hand, it can increase mileage; on the other hand, it can free up more capacity to design the structure and function of other aspects of the vehicle body,” Bao Leiwei said. It is worth noting that in terms of cost, TPU materials are generally cheaper than steel structural materials. Bao Leiwei told Gaise Automotive that in terms of the production process of the vehicle itself, the cost of metal mold production for 100 units is definitely much higher, and the cost will be significantly reduced for one-time production of 5,000 units. “Some metal materials require rivets to be installed, which increases the total number of components and inevitably increases the cost. If parts made of materials such as TPU, polyurethane, and polyamide can be cast in one mold, many parts can be saved, which can also save a lot of costs,” Bao Leiwei said. In the field of intelligence, Heizhima is positioned as a second-tier supplier, and the company provides car manufacturers and first-tier suppliers with the best cost-effective products through chip design. For example, Huashan A1000 has developed a very competitive product solution with a very competitive price-performance ratio in terms of computing power, functional integration, and cost optimization. However, it is still worth mentioning that OEMs need to balance the relationship between the production cost and performance of the whole vehicle product. When OEMs do not require certain characteristics of the whole vehicle product to be very high, they can choose to reduce some costs. But when they choose to develop whole vehicle products with high-end performance, they cannot make any concessions to the characteristics, and they will inevitably have to sacrifice a certain amount of cost reduction space.