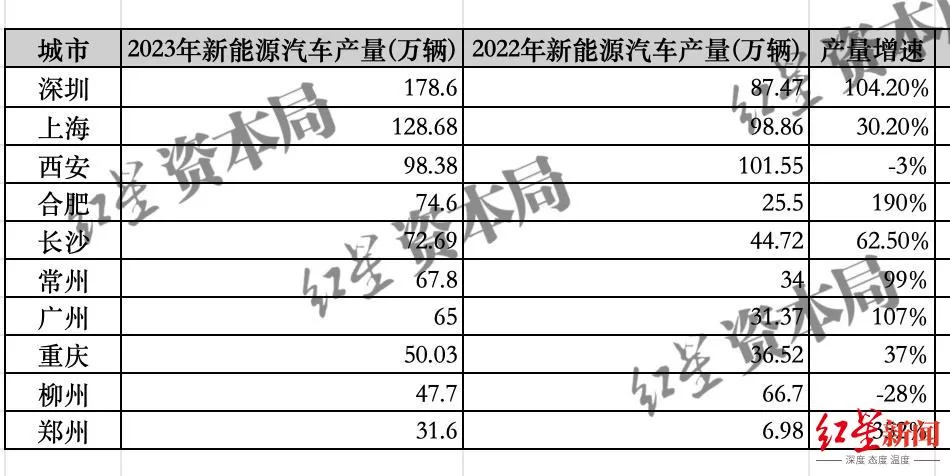

The government work report at this year’s two sessions clearly stated that by 2024, it will consolidate and expand the leading advantages of industries such as intelligent connected new energy vehicles, and actively cultivate emerging and future industries. Last year, both production and sales of new energy vehicles in China exceeded 9 million units, ranking first in the world for 9 consecutive years, accounting for over 60% of the global share of new energy vehicles. This has also become an opportunity for some domestic cities to overtake in the field of automobile manufacturing, such as Hefei and Changzhou, which have achieved an economic leapfrog by riding the trend of emerging industries. In the first half, we compete for production capacity, and in the second half, we compete for comprehensive strength. Recently, experts interviewed by Red Star Capital stated that in the competition for new energy vehicle cities, factors such as technological innovation, perfect industrial chain, and market expansion are equally important. Shenzhen and Shanghai have obvious leading advantages. The output value threshold is close to 400 billion. The new energy vehicle production of various regions in 2023 was announced one after another. Shenzhen took the first place with 1.78 million units, followed by Shanghai and Xi’an. The rankings of the three cities have changed over the past three years. In 2021, Shanghai took a commanding lead with 632,000 units, more than the sum of Shenzhen and Xi’an during the same period. In 2022, Xi’an emerged as a dark horse, narrowly surpassing Shanghai with 1.0152 million units, while Shenzhen only had 874,700 units. However, Xi’an’s new energy vehicle production in 2023 was less than one million, falling short of Shanghai’s in 2022. The production growth rates of new energy vehicles in the past three years were 160%, 57%, and 35% for Shanghai, while Shenzhen achieved a production growth rate of over 100% for three consecutive years. According to data from the Shenzhen Municipal Bureau of Industry and Information Technology, the city’s output value of new energy vehicles in 2022 was 215.4 billion yuan. According to the Shenzhen government work report, the output value of the city’s new energy vehicle manufacturing industry increased by 85.3% in 2023. It is estimated that the output value of new energy vehicles in Shenzhen in 2023 will reach 399.13 billion yuan. According to official data from Shanghai, the output value of new energy vehicles in the city’s strategic emerging industries increased by 32.1% in 2023 compared to the previous year. The output is too long for one single request. To respect the limit of 500 characters, I will split the text into multiple parts. Here’s the first part: The output is too long for one single request. To respect the limit of 500 characters, I will split the text into multiple parts. Here’s the first part: Production figures were not disclosed, but Red Star Capital noticed that the total output value of new energy vehicles in Shanghai in 2022 was 288.825 billion yuan. By calculation, the output value of new energy vehicles in Shanghai in 2023 can reach 381.249 billion yuan. Shenzhen and Shanghai’s output value of new energy vehicles are both close to the 400 billion yuan mark, bringing the competition in the urban new energy vehicle industry to a new threshold. After the completion and start of production of the entire BYD Zhengzhou base project, the annual production capacity will reach the million level.

Shenzhen, Shanghai, and Xi’an have shown strong competitiveness in the production of new energy vehicles in recent years. However, the frequent change of the top spot indicates that no city currently has an absolute advantage in the field of new energy vehicles. Zhu Keli believes that this is related to the fierce competition in various aspects such as industrial policy, technological innovation, and market demand, as well as reflecting the rapid development and changes in the overall new energy vehicle industry. He predicts that this competitive situation may continue in the coming years and will gradually stabilize as the industrial advantages of certain cities become more prominent. The situation of new energy vehicle production champions in the next few years is still uncertain. These cities have also set clear targets for the total production of new energy vehicles by 2025: Hefei’s production capacity will exceed 3 million vehicles, Liuzhou’s production and sales will exceed 3 million vehicles, Guangzhou and Shenzhen’s production capacity will exceed 2 million vehicles, Xi’an’s production will exceed 1.5 million vehicles, Shanghai’s production will exceed 1.2 million vehicles, and Chongqing and Chengdu’s production will both be 1 million vehicles. The competition in the new energy vehicle industry is not simply about production capacity, but a comprehensive test of overall strength. Zhu Keli stated that in addition to production capacity, factors such as technological innovation, perfecting the industry chain, and market expansion are equally important. As the new energy vehicle market gradually matures and consumer demand becomes more diverse, the performance, quality, and level of intelligence of products will become the key points of competition. The first half is about production capacity, and the second half is about the industry chain and innovation chain. The advantages of Shenzhen and Shanghai are obvious. Currently, Shenzhen has comprehensively mastered the core technology of the new energy vehicle industry chain such as batteries, motors, and electronic control, and has become the city with the most complete new energy vehicle industry chain in the world. Shanghai has leading companies such as SAIC Group and Tesla, and its advantage and concentration of the new energy industry are on par with Shenzhen. “Newcomers” Hefei and Changzhou are respectively aiming to become the “capital of new energy vehicles” and the “capital of new energy.” Automobiles have been positioned as the “first industry” in Hefei. The government work report of Hefei this year proposed to optimize the “three-in-one” layout of complete vehicles, parts, and aftermarkets, and support BYD, Volkswagen, NIO, Changan, and others to expand and strengthen. Changzhou is currently the largest power battery industry base in the country. In February of this year, Jiangsu Province issued a document to support Changzhou in promoting high-quality innovation and upgrading of the industrial chains such as solar photovoltaic, power and energy storage batteries, new power equipment, and new energy vehicles, and create a “capital of new energy” city business card. As a traditional automobile town, Guangzhou and Chongqing are also accelerating the transformation to new energy vehicles. In February of this year, Guangzhou officially announced 31 key projects in the smart and new energy vehicle industry, involving an investment of about 44 billion yuan. Chongqing released 34 new energy vehicle-related policies in 2022. In the same year, Chongqing proposed to focus on building a “33618” modern manufacturing industry cluster system. The three trillion-level leading industrial clusters are led by smart connected new energy vehicles. Zhu Keli believes that cities with industrial foundations, technological innovation capabilities, market demand, and policy support have a greater chance of standing out. He pointed out that the improvement and synergy of the industrial chain will also have a far-reaching impact on industrial development, including the research and development and production of core components such as batteries, motors, and electronic control, the construction and operation of charging facilities, and the establishment of recycling systems. In addition, market expansion is also important. In future industry competition, those who do better in these areas are more likely to take a leading position in the field of new energy vehicles. – Red Star News reporter Wang Tian, edited by Deng Lingyao.