On NIO’s tenth anniversary, founder Li Bin issued an internal letter titled “Stay True to Our Original Intent, Focus on Action.” He outlined the company’s strategic plan for the next two years. Li Bin expressed confidence in NIO’s development despite tough market challenges. He set two key goals: double sales next year and achieve profitability by 2026. Li Bin’s commitments pose significant challenges for NIO today.

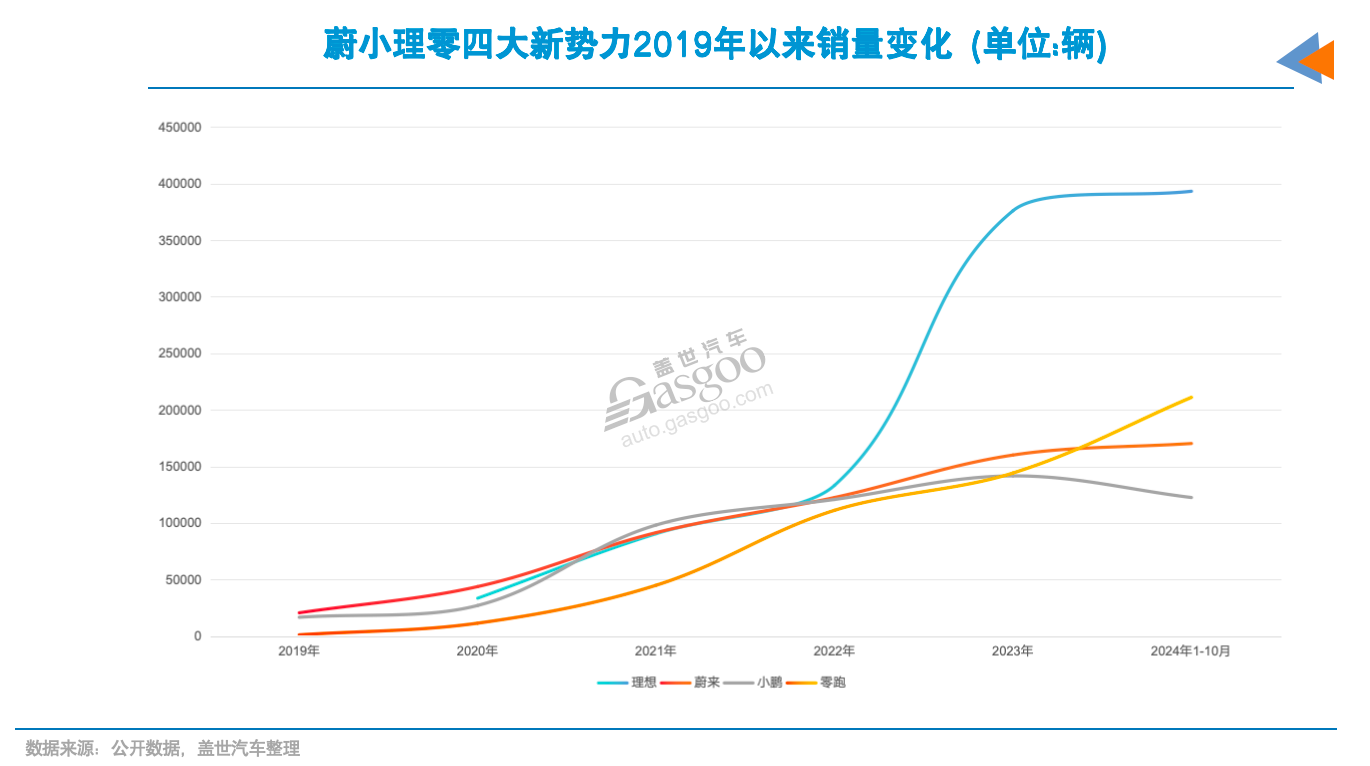

NIO faces a heavy task to double sales next year. This year, NIO set a sales target of 230,000 vehicles, similar to last year’s goal. By October, NIO delivered 170,000 vehicles, a 35% year-on-year increase, achieving 74% of its target. In October, NIO delivered 21,000 vehicles, with 4,300 being the ES6 model. This means NIO must deliver at least 60,000 vehicles in November and December. The fourth-quarter sales target ranges from 72,000 to 75,000 vehicles. Considering the fourth-quarter target and deliveries from the first ten months, NIO expects total annual deliveries to exceed 225,000 vehicles, nearing its sales goal.

The Global Automotive Research Institute predicts NIO will reach sales of 240,000 units this year, exceeding its target. Analysts attribute this increase mainly to models like the EC6, ES6, ET5, and L60. According to Lei Tiecheng, president of Lido Auto, the L60 will deliver over 10,000 units by December, boosting NIO’s monthly sales records. Next year, NIO aims to double its sales to at least 460,000 units. NIO’s confidence stems from large-scale deliveries of the Lido and Firefly brands. Li Bin stated that NIO will enter a new product cycle next year, with new offerings from both Lido and Firefly, leading to rapid growth for the group. NIO announced that Lido’s monthly deliveries will exceed 20,000 units starting in March. Combined with NIO’s monthly sales of around 10,000 units, total monthly deliveries could surpass 30,000. Next year, NIO will transition its models to a new generation platform and launch the ET9. Lido will introduce two family SUVs. Additionally, the Firefly sub-brand will launch in December and begin large-scale deliveries next year. Analysts at Kaiyuan Securities believe NIO will establish a complete product matrix with “NIO + Lido + Firefly,” covering the 150,000 to 800,000 yuan (110470$) price range. They note that the ET9, positioned as a luxury vehicle, may struggle to achieve high sales. The main brand’s sales momentum relies on updates to older models. Analysts expect Lido and Firefly to drive NIO’s overall sales growth by 2025. “As a growing car company, sales are crucial for us,” Li Bin said, expressing confidence in the 2025 market. However, institutions have low sales forecasts for NIO in 2025. Bank of China International raised its 2025 sales forecast for NIO to 350,000 units, significantly lower than NIO’s own target. Achieving profitability in 2026 poses even greater challenges. Compared to the goal of doubling sales in 2025, NIO faces immense pressure to become profitable in 2026. Currently, NIO’s quarterly losses exceed 5 billion yuan, making the path to profitability difficult.

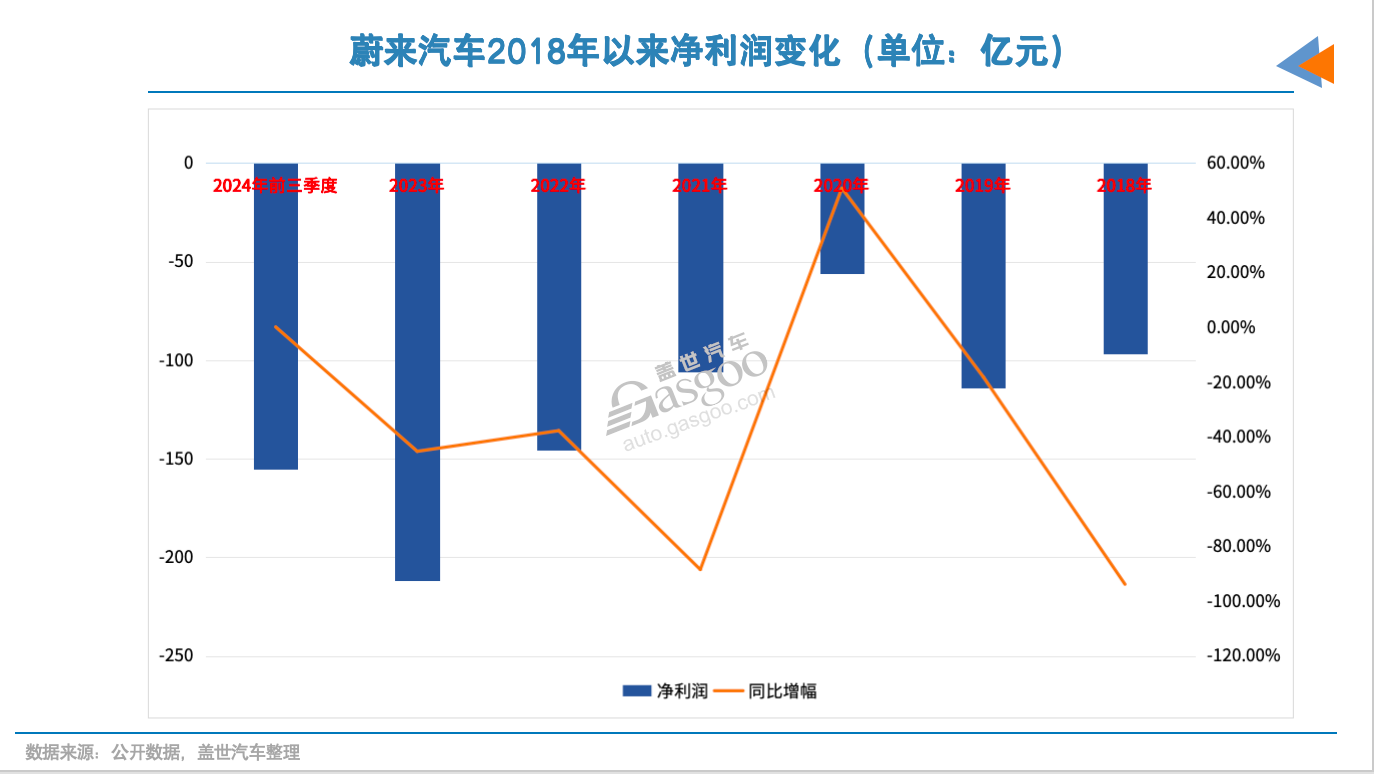

In the first three months of this year, NIO reported a net loss of 15.5 billion yuan, a slight increase of 0.18% year-on-year. Since its 2018 IPO, NIO’s total losses have approached 90 billion yuan. The gross margin stands at only 9.1%, significantly lower than the ideal 21%. NIO recognizes the urgency of improving its gross margin, even if it impacts sales. CEO Li Bin stated, “We realize the pressure on gross margin is high. Sustaining improvements in NIO’s brand margin is our core goal.” In October, NIO reduced some promotional spending, resulting in monthly sales just over 20,000 units, a decline from the previous month. NIO expected this outcome. By 2025, NIO plans to enhance its gross margin. The basic target for the Lido brand is 10%, with a gradual increase to 15%. NIO aims for a gross margin of 15%, striving for 20%. Citibank holds a cautiously optimistic view, predicting improved gross margins driven by operations and technology upgrades across all three brands. Achieving a 20% gross margin is challenging. Several institutions, including CMB International and KGI Securities, forecast lower than this target. KGI Securities predicts NIO’s overall gross margin may only reach 16.7% by 2026. Predictions for net profit are similarly bleak. KGI Securities expects NIO’s net loss in 2025 to narrow but still reach -15.82 billion yuan. By 2026, the net loss may exceed 10 billion yuan, at -14.49 billion yuan. CMB International believes NIO faces significant challenges in turning a profit in the short term. The main reasons include multiple constraints. NIO’s main brand struggles to achieve expected sales in the high-end market, still aiming for 200,000 annual units. While expanding sales through Lido and Firefly sub-brands is possible, affordable models contribute little to profit. The cost of charging infrastructure remains high and difficult to recoup in the short term. Sales management expenses exceed 20% of revenue, highlighting the need for improved operational efficiency. Amid these challenges, NIO’s goal of profitability by 2026 may exceed the company’s expectations.